Zimplats delivers strong performance

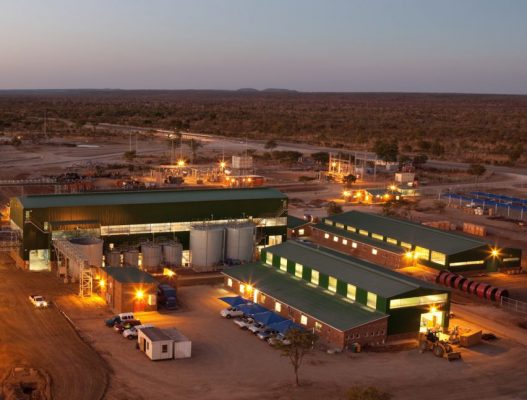

Zimplats, Zimbabwe’s biggest platinum group producer, delivered another strong performance in the full year to June 30, 2020, navigating challenges and threats to workers and operations from Covid-19 pandemic, to help drive positive group results for Impala.

The South African based platinum group metals (PGMs) producer, however, delivered marginally lower mine-to-market Six-Element concentrate volumes of 2,5 million ounces, a 5 percent decline from the comparable period, due to Covid-19.

But maiden contributions from Impala Canada and stable deliveries from Zimbabwean offset the impact of Covid-19 on South Africa where operations were suspended during a three week national lockdown initiated on March 25, 2020.

Restricted ramp up in South Africa commenced when the restrictions were eased from level 5 to 4 in April and, while material production losses were recorded in April/May, output was restored to approximately 90 percent capacity by end of June.

Mining was declared an essential service during the Zimbabwe national lockdown and the impact of the lockdown on Zimplats and Mimosa was minimal. Concentrate and matte exports temporarily suspended due to Impala Refinery Springs force majeure.

Another Zimbabwe operation, Mimosa suspended mining operations for 10 days to treat accumulated surface stockpiles. Zimplats is owned 87 percent and Mimosa 50 percent by the South African PGMs producer and refiner.

Tonnes milled from managed operations (Impala, Zimplats, Marula and Impala Canada) increased by 1 percent to 19,6 million tonnes (FY2019: 1,5 million tonnes), with the Covid-19 operating losses suffered at Impala and Marula offset by strong delivery at Zimplats and the maiden contribution from Impala Canada.

Total production losses of 151 000 ounces 6E in concentrate (12 percent lost) are directly attributed to the impact of Covid-19 during the second half of financial year 2020.

The group said milled throughput for the year declined by 14 percent or 1,6 million tonnes to 9,6 million tonnes, largely as a result of the Covid-19 pandemic.

Group revenue was 44 percent higher at R69,9 billion on higher dollar metal prices and a weaker rand, partially offset by lower PGM sales volumes.

Group recorded earnings before interest tax depreciation and amortisation (EBITDA) of R29,4 billion at an EBITDA margin of 42 percent (FY2019: R10,5 billion and 21,6 percent).

Implats achieved headline earnings of R16,1 billion and 2 075 cents per share were achieved, with positive contributions from all Group companies while Zimplats recorded headline profit of R3,4 billion, as operation unaffected by national lockdown

Zimplats has operated uninterrupted since the onset of the Covid-19 crisis, working closely with Government health departments to lend support and raise awareness in the communities surrounding its operations.

Tonnes milled were 4 percent higher at 6,8 million tonnes (FY2019: 6,5 million) while stable 6E grade of 3,48g per tonne resulted in a commensurate increase in 6E produced in concentrate of 597 000 ounces (FY2019: 572 000 ounces).

A furnace rebuild was completed in 2020 first half, with the unit recommissioned in October 2019, and scheduled mill relines at the Selous concentrator completed in the second half of financial year 2020.

Six-Element production in matte was stable at 580 000 ounces while 6E sales volumes of 555 000 ounces were impacted by the force majeure implemented by Impala Refineries Springs in late-March 2020.

Mimosa was exempted from the Zimbabwean lockdown implemented in response to Covid-19.

The presence of a significant run of mine surface ore stockpile afforded the mine the opportunity to suspend mining operations for 10 days in Q4 FY2020, with the production gap used to institute critical Covid-19 operational preparedness measures.

Milling constraints experienced in the first quarter of financial year 2020 were substantially offset by consistent operational delivery for the remainder of FY2020 and milled volumes declined by 4 percent to 2,7 million tonnes (FY2019: 2,8 million tonnes).

While the 6E mill grade of 3,85g/t was stable, sub-optimal concentrator residence time due to capacity constraints impacted recoveries and 6E in concentrate production of 247 800 ounces declined by 5 percent (FY2019: 260 600 ounces).

The Herald