THERE are plenty opportunities available in Zimbabwe’s mining sector that could be exploited by both local and foreign investors.

By Keith Sungiso

Zimbabwe has about 60 mineral occurrences, the major ones being diamond, platinum, gold, nickel, lithium, chrome ore, iron ore, tantalite, asbestos, coal, granite, zinc and silver among others.

Research also shows that Zimbabwe has six out of 10 of the world’s most valuable minerals.

This massive resource base creates lucrative opportunities for investors in exploration, mining, and beneficiation, among others.

Here are 10 Mining opportunities currently available in Zimbabwe right now and many years to come

Mining exploration

While addressing delegates at the 2018 Mining, Engineering and Transport expo held in Bulawayo in October, Mines and Mining Development Minister Winston Chitando admitted that the country has no record of its untapped mineral resources because there has not been any exploration work for the past decades.

This means Zimbabwe has been boasting of its vast mineral wealth without knowing exactly what is underground.

So, exploration is a very big opportunity which arises in the mining industry, which those with financial muscle can take advantage of.

But this type of investment would require high amount of capital. In other words, it is not ideal for small scale miners.

2. Mining

Investors would also want to invest in mining activities in the country. As said earlier, Zimbabwe boasts of a huge and highly diversified mineral resource base dominated by prominent geological features, namely, an expansive craton, widespread greenstone belts (also known as gold belts), the famous Great Dyke, Precambrian and Karoo basins and metamorphic belts, according to government records.

Investment opportunities exist in the mining of gold, diamond, platinum, nickel, lithium, chrome ore, iron ore, tantalite, asbestos, coal, granite, zinc and silver, among others.

This could be done through joint ventures with Zimbabwe Mining Development Corporation, small-scale miners and other miners facing financial constraints. For instance, according to the Zimbabwe Mining Potential Booklet, there are over 4,000 recorded gold deposits, nearly all of them located on ancient workings. The same document identifies the country as having chrome reserves on the Great Dyke of approximate 10 billion tonnes. Deposits hosted outside the Great Dyke occur in some ultramafic rocks of the Shurugwi, Mashava and Belingwe greenstone belts, and ultramafic bodies in the Limpopo Mobile Belt.

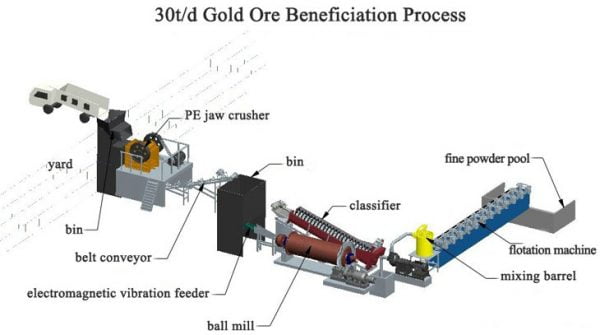

3. Mining beneficiation

As alluded above, Zimbabwe is richly endowed with bountiful mineral resources but the southern African nation has not been deriving meaningful benefit from its mineral reserves as the country has always been exporting its mineral wealth in raw form.

For years, the country has been exporting the majority of its minerals unprocessed.

There is a need for the country to derive meaningful benefit from its mineral resources by adding value into its minerals.

Given that the government is still grappling with the economic woes that have dogged the resource-rich nation over the past few decades, those with capital could chip in.

To date, about five pilot value chains have since been identified as energy, stainless steel, pigment production, auto catalyst and diesel particulate filters, diamond processing and jewellery making.

Other vast investment potential is in the areas of platinum refinery, chrome smelting, diamond cutting and polishing, platinum refinery among others.

So investors can set up local mineral beneficiation facilities.

The Mines and Minerals Bill draft requires a proportion of mineral output to be reserved for use in local value-adding activities and sold locally at a developmental price.

Zimbabwe Miners’ Federation (ZMF) President, Henrietta Rushwaya told Mining Zimbabwe that they were looking forward to more investment coming into the country especially with regards to chrome sector.

“We are looking at more investment coming in, especially in the chrome sector,r which is a bit short-changed for now because of the high financial requirements that go with the machinery. If you are a chrome miner, you would need an excavator, a dump truck, but as long as you don’t have that within your reach, it is difficult for you to mine chrome at a large scale,” she said.

4. Long-term capital

Mining is capital intensive. According to Chamber of Mines of Zimbabwe (CoMZ) the mining sector needs fresh capital investment to ensure that positive growth and viability is maintained.

The mining body says mining companies need over US$7 billion to recapitalise their operations over the next five years, from 2018 to 2022.

But the challenge is that local financial institutions have not been offering long-term capital, making it difficult for mining companies to borrow for recapitalisation or to sustain output growth or undertake new projects.

Most of them need to replace antiquated equipment that has become inefficient and costly.

So there is an opportunity for mining investors to chip in and explore these massive opportunities available in the sector.

5. Machinery funding

Small-scale miners told Mining Zimbabwe that they needed machinery to carry out their activities.

“We need small machinery that carries the order of the day in the gold mining industry. For instance, with the rain season looming, you find that our miners lack small machinery like compressors, dewatering pumps, generators, explosives,” Rushwaya said.

“These are some of the small items where we are saying if people come up with organised-based mining within the communities where they operate, it’s easier for the government, for instance, to assist in their form of scheme. Our miners are not keen to receive funding in the form of cash. They are keen to receive funding in the form of the machinery. Let’s empower them with requisite machinery, and that way we won’t go wrong,” she said.

6. Employment opportunities: Women

For every direct mining job approximately three jobs are created in other sectors. Jobs are created in the industries that either supply goods and services to the mining sector, or use mining products for downstream value addition and so on. The mining sector is estimated to employ 45 000 people formally and about 200 000 people informally. Women can find employment at different stages of the mining value chain. The industry also offers employment to both skilled and non-skilled women.

For skilled women, the sector absorbs women trained in technical fields such as geologists, metallurgists, technicians and also those with soft skills, such as accountants, lawyers, and human resources practitioners.

As such, women and youth must take advantage of the employment opportunities that arise in other sectors through increased local content and enhanced linkages in the mining industry.

7. Training opportunities

Mining is a technical sector. Possession and utilisation of requisite skills are one of the key determinants of the viability of mining projects. Apart from free technical advice from the Ministry of Mines and Mining Development, small scale miners, including women should pursue other training options, particularly with the Zimbabwe School of Mines (ZSM).

ZSM offers short training courses and diplomas at affordable rates. So, ZSM and other institutions should take advantage of this and offer tailor-made courses for small-scale miners.

8. Goods and services

Mining sector in Zimbabwe has created more than 45,000 formal jobs and more than 500,000 artisanal miners. With such huge numbers, women and youth can supply goods and services such as catering, personal protective, financial services, drilling, metallurgical, geo-mechanics, to name just a few, throughout the mining value chain.

9. Gold buying agents

The government, through its gold buying unit, Fidelity Gold and Refinery, has issued about 21 gold buying licences for small-scale miners in a bid to stop illicit gold outflows.

Rushwaya said the move by the government has made their members gold buying agents.

“So our small-scale miners are now going to be gold buying agents in various gold mining districts where they operate. So if you are a member, for instance, Umzingwane Association, one of your association members would be a buyer. This has been necessitated by the fact that there are certain quantities Fidelity Gold does not buy,” she said.

“If you are producing less than 5 grams, Fidelity does not buy. So, all those who are producing less than the various stipulated quantities have been disadvantaged in the sense that they are now selling their gold in the black market. Now that Fidelity has accorded us the opportunity to acquire those buying licences.

She said they started with a number which they thought could be used for experimental purposes, “which is 105 agents.”

10. Electricity supply

One of the challenges faced by the mining sector is the cost of electricity, which has remained high, hampering the viability of mineral producers.

Current commercial tariffs from the Zimbabwe Electricity Transmission and Distribution Company on average range from $0,13/kWh for on-peak usage, $0,07/kWh for standard usage, to $0,04/kWh for off-peak usage.

This is the highest in the region.

Such challenges present a good opportunity for players in the energy sector to establish power generation plants in the country to cater for these miners.