African countries, Zimbabwe included, continue to be haunted by the “resource curse” over failure to use their mineral wealth to transform their economies.

They are among resource-rich countries that have seemingly failed to leverage on mining through beneficiation and value addition.

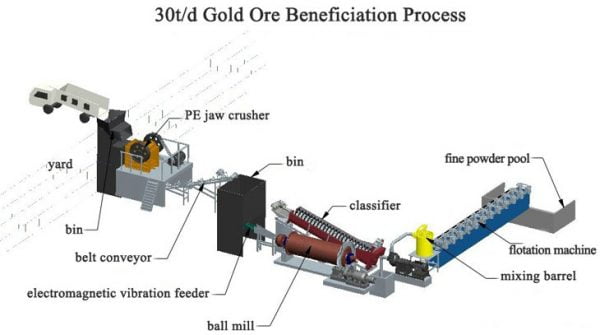

Value adding mineral resources involves processing them into semi-processed and processed form.

Despite having more than 40 mineral resources, the country still faces foreign currency shortages.

This has increasingly led to calls for beneficiation and value addition.

The country is home to the world’s second largest platinum group metals (PGMs) and chrome deposits after South Africa. It has a high gold yield per square kilometre, huge deposits of iron ore, nickel, copper, lithium and possibly oil and gas.

It also has a huge and highly diversified mineral resource base dominated by two prominent geological features, namely the Great Dyke and ancient Greenstone Belts also known as Gold Belts.

Mining already contributes 60 percent of the country’s total exports, accounts for 16 percent of the country’s gross domestic product (GDP) and an estimated 6 percent to 10 percent of total formal employment.

Government, however, believes the sector is still expected to drive growth in the short to medium term.

The African Union (AU) came up with a policy framework in 2009 — Africa Mining Vision — for the continent to optimally exploit and benefit from its minerals.

President Mnangagwa also recently challenged local mining firms to start pursuing strategies to beneficiate and value add minerals.

Addressing the Chamber of Mines of Zimbabwe annual general meeting (AGM) in Victoria Falls, the President said realising the full potential in mining could materially transform the economy and create the much-needed employment opportunities.

“Guided by the Africa Mining Vision and National Development Strategy 1 targets, the sector is challenged to ensure equitable and inclusive broad-based development through enhanced beneficiation of our mineral endowments,” he said.

Government plans to grow the sector to a US$12 billion industry by 2023.

“This would augment the industrial development focus on value addition and beneficiation, export-led industrialisation and job creation among other things. Execution of commitments for the establishment of beneficiation plants should be urgently pursued,” the President said, adding that he had noted efforts by players in platinum, chrome and lithium.

The AU’s Agenda 2063, which encapsulates Africa Mining Vision, advocates resource-based industrialisation.

Finance and Economic Development Minister Professor Mthuli Ncube believes mining companies should concentrate on adding value to minerals rather than ship predominantly raw exports.

Treasury estimates the sector would grow more than the targeted average growth of 5,2 percent over the course of NDS1, which runs for five years through 2025.

“Mining is the largest foreign-currency earner (circa US$3,2 billion), but we also want to make sure that it moves away convincingly from just extraction to value addition and that job creation and export growth are further enhanced,” said Prof Ncube.

It is believed that Government still needs a policy framework that uses the carrot-and-stick approach to ensure that value addition and beneficiation are expeditiously pursed.

A study by economic think tank the Zimbabwe Economic Policy Analysis and Research Unit (ZEPARU) showed that while a number of mines have responded, many others are still far behind.

Government’s policy position on mineral beneficiation and value addition, ZEPARU added, is aligned with the regional and continental initiatives.

“The Government of Zimbabwe prioritises beneficiation of diamonds, chrome, platinum group metals (PGMs), nickel and coal-bed methane (among others),” it said in its study.

“Zimbabwe has not fully exploited these mineral resources for growth and development, a case which is sometimes argued as resource curse.”

The country is still characterised by a high dependency on exports of unprocessed or semi-processed mineral products, which results in the country being a price-taker, ZEPARU said.

“The decline in commodity prices negatively affects revenue, which ultimately impacts on Government planning.

“However, it is common knowledge that the prices of value-added metal products such as jewellery, electronic products, etcetera, seldom fall in response to the drop in the prices of gold, platinum or related metals from which the products are made . . .

“The fact that 60 percent of world trade is in intermediate products strengthens the case for value addition and beneficiation in Zimbabwe, hence the need to move away from export of raw and semi-processed minerals.”