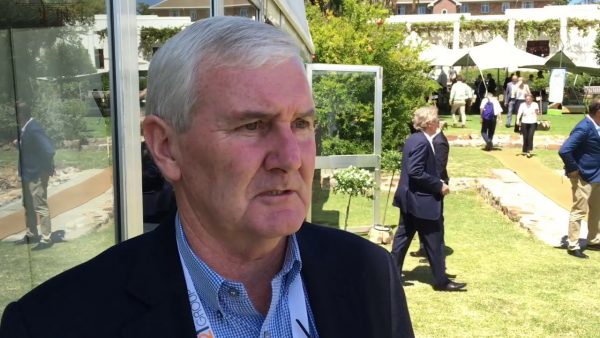

Caledonia’s Blanket Mine Chief Executive officer Steve Curtis blames unstable electricity supply and grade dilution for the mine’s failure to meet its production target for the first quarter of 2019.

According to the Mine’s statement, approximately 11,948 ounces of gold were produced during the Quarter, slightly below the firm’s target and also below the comparable first quarter in 2018 which produced 12,924 ounces.

“Production in the first quarter of 2019 was slightly below our target and below the comparable quarter

in 2018 (Q1 2018: 12,924)” said Steve Curtis

The statement also said that, Caledonia maintains its 2019 full year production guidance of 53,000 ounces to 56,000 ounces and remains on track with progress towards its target of 80,000 ounces by 2022.

According to the Mine statement, Curtis blames unstable electricity supply.

“Continued difficulties with unstable electricity supply and grade dilution which we experienced in 2018 had an adverse effect on production, but improved drilling and blasting practices have been put in place in pursuit of improved grade control and I am pleased to say that efforts to minimize dilution are proving successful” said Curtis.

The Mine’s Chief Executive Officer, said that efforts to address the electricity situation were underway.

“Our technical team has worked tirelessly to mitigate the effects of electricity supply interruptions and we continue to work closely with the Zimbabwean electricity supply authorities to address these challenges as well as investing internally to improve our resilience to this issue” said Steve Curtis.

“The sinking of the central shaft continues according to plan; we are now only months away from the

completion of the shaft sinking phase of the project and are set to commence shaft equipping from mid 2019. We look forward to commencing production from the central shaft from mid-2020 which is expected to deliver the Company’s growth plan to achieve 75,000 ounces in 2021 and 80,000 ounces by 2022.”

Caledonia’s primary asset is a 49 per cent interest in an operating gold mine in Zimbabwe, Blanket. In November 2018, Caledonia announced that it had signed a legally binding agreement to increase its shareholding in Blanket to 64%, subject to the receipt of, among other things, regulatory approvals. Caledonia’s shares are listed on the NYSE American (symbol: CMCL) and on the Toronto Stock Exchange (symbol: CAL) and depository interests representing the shares are traded on London’s AIM (symbol: CMCL).

As at December 31 2018, Caledonia had cash of approximately US$11.2 million. The Company plans for Blanket to increase gold production from 54,511 ounces in 2018 to approximately 75,000 ounces in 2021 and approximately 80,000 ounces by 2022, Blanket’s target production for 2019 is 53,000 to 56,000 ounces. Caledonia expects to publish its results for the quarter to March 31, 2019 on or around May 14, 2019.

.png)