Zimplats delivers a year-on-year growth

Zimplats Limited Holdings maintained stable production levels while achieving significant year-on-year growth. This quarter saw a 9% increase in mining output compared to the same period last year, driven by successful pillar reclamation efforts and continued development of the Mupani Mine. Metal production also showed a positive trend, with a 12% year-on-year improvement.

Patricia Rwafa

In a report released on 30 April 2024, Zimplats spent US$789 million during the quarter ending in March this year on major capital projects, including the development of the Mupani and Bimha mines upgrades as the platinum group metals miner expands operations.

Mining volumes remained unchanged from the prior quarter but increased by 9% year-on-year, benefiting from the pillar reclamation operations at Rukodzi Mine and the continued ramp-up of production from the Mupani Mine, which is under development.

Pillar reclamation activities also improved the 6E head grade, which was 2% higher year-on-year. The 1% reduction in grade from the prior quarter was due to the increased contribution of lower-grade Mupani Mine development ore and dilution from mining across geological structures.

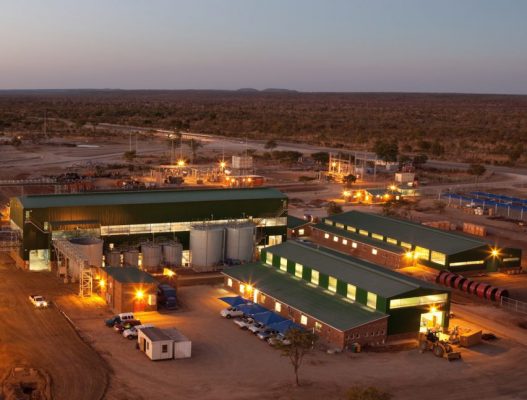

Milled volumes increased by 7% and 3% compared to the comparative and prior quarters, respectively. A scheduled reline of the mills at the Selous Metallurgical Complex (SMC) was deferred to the fourth quarter of FY2024, with volumes benefiting from improved milling rates and running time, in line with higher ore supply.

Concentrate recoveries were stable compared to the prior quarter and increased by 5% from the comparative quarter, resulting in a 2% quarter-on-quarter and 14% year-on-year increase in the volume of 6E in concentrate produced.

6E metal in the final product improved by 12% year-on-year and was 1% higher than the prior quarter.

Cost containment initiatives implemented in the prior quarter progressed in the period under review, resulting in a 2% reduction in total operating cash costs from the prior quarter. Operating cash costs increased by 7% year-on-year, primarily due to the 9% and 7% increase in mining and milling volumes respectively, benefiting from cost mitigation efforts that helped contain the impact of persistent input inflation.

Transfers from stocks to operating costs amounted to US$2.8 million during the period, in line with the movement in inventory across the value chain.

Cash costs of metal produced increased by 5% and 1% from the comparative and prior quarter, respectively. The operating cash unit cost of US$821 per 6E ounce was marginally below that of the prior quarter and declined by 6% year-on-year, benefiting from volume gains that offset inflationary pressures experienced on electricity.

In light of the softer metal pricing environment, management has implemented various cash preservation measures, including labor rationalization and capital project rescheduling within cash constraints. In April 2024, 67 employees, representing 1.6% of the total permanent workforce, were retrenched.

The Bimha and Mupani mine development and upgrade projects will replace production from Rukodzi Mine (depleted in FY2022), and Ngwarati and Mupfuti mines (depleting in FY2025 and FY2028, respectively).

Cumulatively, US$395 million has been spent on these projects as of 31 March 2024, against a total project budget of US$468 million.

A total of US$340 million has been spent to date on the smelter expansion and SO2 abatement plant against a total project budget of US$521 million.

US$27 million has been spent on the implementation of the 35MW solar plant project to date, against a budget of US$37 million.

A total of US$27 million has been spent to date on the execution of the Base Metal Refinery refurbishment project, against a total budget of US$190 million.