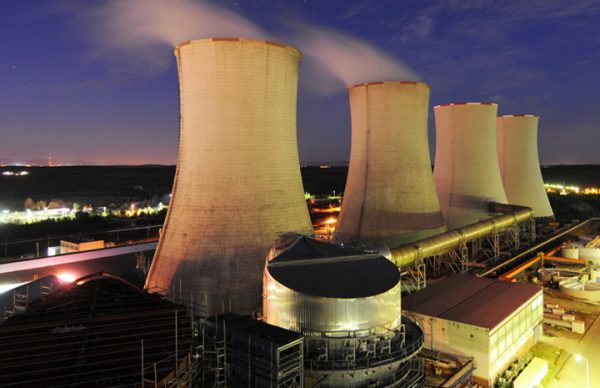

Hwange Power Station under threat

THE skewed pricing structure and the acute foreign currency shortages in the market have crippled the operations of coal miners, lowered production and could lead to a shut down of operations, businessdigest has learnt.

The developments could also severely reduce the power output at Hwange Power Station.

This comes at a time the mining sector has been hard hit by a number of challenges which include foreign currency shortages, power outages and inadequate capital.

Makomo Resources director and Coal Producers Association chairperson Raymond Mutokonyi warned that if the issue is not addressed, it could result in Hwange Power Station failing to generate electricity.

“The coal mining sector is definitely under threat due to the capacity constraints. It is only a matter of time. We risk having Hwange shutting down because of the inadequate stock they have,” Mutokonyi said.

As of Tuesday this week, he said, Hwange Power Station had only 94 000 tonnes out of a required minimum stock of 200 000 tonnes in stocks, representing only 20 days cover. He said if Hwange put its Unit 5 into operation, then that cover could be reduced to less than 10 days.

“Unless some of these issues are looked at properly, there is a real possibility of a blackout,” Mutokonyi warned.

He said there has been a decline in the production of coal due to various challenges such as the ineffective pricing model at which producers sell their coal to the Zimbabwe Power Company, a subsidiary of Zesa Holdings.

“Over time, we have seen the decline in production capacity at the coal mines because of obviously the challenges in the economy, but primarily because of the payment structure of coal,” Mutokonyi said. “The running price of coal at the moment was last set in 2011 and has not been reviewed since then. The position of the Zimbabwe Power Company is that they cannot review the price without an increase in the power tariff which unfortunately has not been awarded.”

He said they are currently being paid the equivalent of US$16 per tonne which falls far short of the price of between US$33 to US$35 per tonne it needs to remain viable.

Mutokonyi said the three coal mining companies namely Hwange Colliery, Zambezi Gas and Makomo Resources are hard hit by the fuel shortages in the country. He said the three mining companies need about 1,5 million litres of diesel a month for its operations mainly for its earth moving machinery.

He said the situation is aggravated by the shortage of foreign currency which is needed to buy spares and explosives as well as AN fertilizer. He pointed out that while the fertilizer is available, it can only be made available from bonded warehouses and can only be accessed by paying for the commodity in foreign currency. As a result, the association has requested that ZPC pays partly in foreign currency for the coal it produces to capacitate them and acquire equipment.

Mutokonyi bemoaned the foreign currency retention threshold set by the Reserve Bank of Zimbabwe which currently stands at 50%. He said they need a foreign currency threshold of at least 80%.

He said his company has now resorted to the pre-payment system in order to remain viable given the volatile nature of the economy. Source: Zimbabwe Independent