Huo Investments (Pvt) Limited has deepened its commitment to Zimbabwe’s Muchesu coal project, reinforcing confidence in the mine’s long-term potential. Contango Holdings Plc confirmed that an entity controlled by a director of Huo Investments has acquired an additional 6.502% stake in Monaf Investments (Private) Limited (“Monaf”) from a local minority shareholder.

By Ryan Chigoche

However, this transaction does not affect Contango’s existing interest in Monaf; instead, it signals growing investor confidence in the project’s future.

This latest acquisition is part of a broader strategy as Huo Investments moves closer to securing a controlling 51% stake in Monaf, pending regulatory approvals.

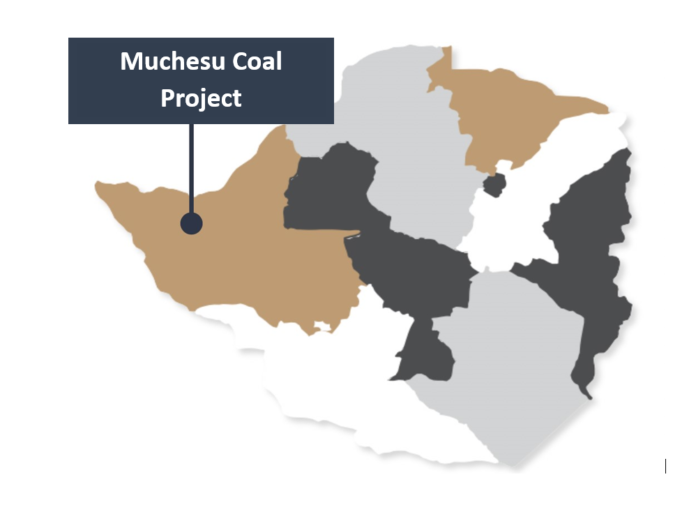

The Muchesu Project, which boasts over 2 billion tonnes of coal reserves, has been gaining traction as Zimbabwe positions itself as a key player in the global coal market. The shift marks a defining period for Contango, significantly reducing its previous risks as the sole operator at Muchesu and paving the way for a more sustainable and capital-efficient business model.

In a statement, Contango CEO Carl Esprey welcomed Huo Investments’ additional purchase, emphasizing the growing confidence in Muchesu’s potential.

“We note the investor’s purchase of additional shares in Monaf from another minority shareholder and the investor’s continued investment in the Muchesu Project. This should provide shareholders with further confidence in the investor’s focus on the development of the Muchesu Project and reinforce its inherent value.

“The investor has already made a material investment ‘into the ground’ at Muchesu, acquired a 20.42% holding, and become Contango’s largest shareholder. In addition to this, royalty payments to Contango have commenced. This further increased ownership interest in Monaf and the Muchesu Project, bodes well for the investor’s commitment to fully developing Muchesu.

“I look forward to updating shareholders on further progress and the completion of outstanding documentation with respect to the Definitive Agreements,” Esprey said.

Beyond increasing its stake, Huo Investments has demonstrated its commitment through tangible financial contributions. In July 2024, an initial $1 million was advanced as part of a future equity subscription, reflecting strong confidence in Muchesu’s potential. This was followed by another $1 million in January 2025, facilitating the successful closure of a planned $2 million equity placement.

As a result, Huo Investments has become Contango’s largest shareholder. At the same time, Contango has been streamlining its operations, resizing its cost base, and positioning itself for a leaner and more efficient financial future.

Additionally, the company’s recent transition to a royalty-focused business model marks a shift toward a more sustainable and risk-mitigated strategy. By focusing on royalties rather than direct mining operations, Contango is not only unlocking substantial growth potential for investors but also shielding shareholders from uncertainties related to future operational costs, capital expenditure, and working capital requirements.

As regulatory approvals near completion, Contango and Huo Investments are poised to accelerate the Muchesu Project’s development. With increased financial backing, a streamlined business model, and growing investor confidence, Muchesu is on track to become a major force in Zimbabwe’s coal industry.