Burkina Faso has moved to reassure mining investors that its revised mining stake framework is designed to build confidence and encourage long-term investment, not to discourage foreign capital, Mining Zimbabwe can report.

By Rudairo Mapuranga

Speaking at a recent mining conference, Mamadou Sagnon, Director-General of the Mining Registry, clarified that the government’s intention to acquire equity in mining projects such as West African Resources’ Kiaka gold mine is grounded in a strategic approach that promotes partnership and stability in the sector.

Under the new Mining Code introduced in July 2024, the state automatically holds a 15% free-carried interest in mining projects. In addition, the government may opt to acquire up to 30% paid interest, calculated on exploration and feasibility costs rather than the mine’s overall market valuation.

Sagnon stressed that this model is not coercive. “The goal is to give the state a meaningful role in projects while ensuring investors retain operational control. This strengthens trust and shows that Burkina Faso is committed to a stable, transparent investment environment,” he said.

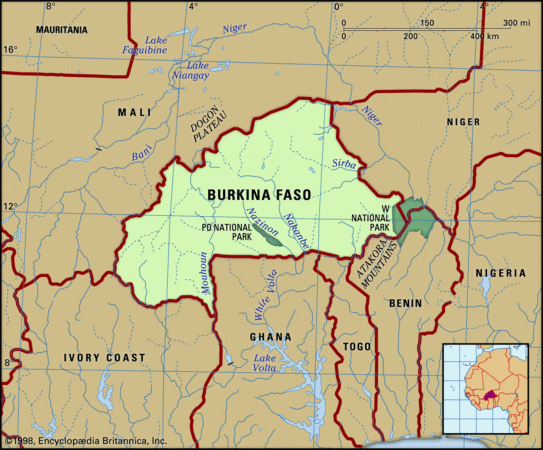

Burkina Faso, Africa’s fourth-largest gold producer, has been recalibrating its mining policies to increase local participation without undermining investor confidence. The creation of SOPAMIB, a state-owned holding company for mineral assets, reflects the government’s desire to structure its equity interests in a way that enhances governance and provides clarity to partners.

For the Kiaka gold project, where production began in June 2025 with an expected output of 234,000 ounces annually over 20 years, the state requested the option to increase its stake to 35%. Authorities clarified that this move is project-specific and not a blanket approach across all operations.

Mining companies have welcomed the clarification. West African Resources has confirmed that operations at Kiaka, Sanbrado, and Toega remain unaffected, while other miners, such as Orezone Gold, have reported no similar requests from the government regarding their assets.

Analysts note that the government’s messaging is intended to ensure that mining companies feel secure in continuing to commit capital, expand exploration, and develop new mines in Burkina Faso.

By positioning equity participation as a confidence-building measure, Burkina Faso is signaling that it values foreign investment and views partnership as the key to growing its resource sector.

President Ibrahim Traoré’s administration has made mineral resource governance a cornerstone of its economic policy, balancing the need for sovereignty and national benefit with a clear commitment to investor security.