Aluminum price jumps again as Guinea coup adds to supply worries

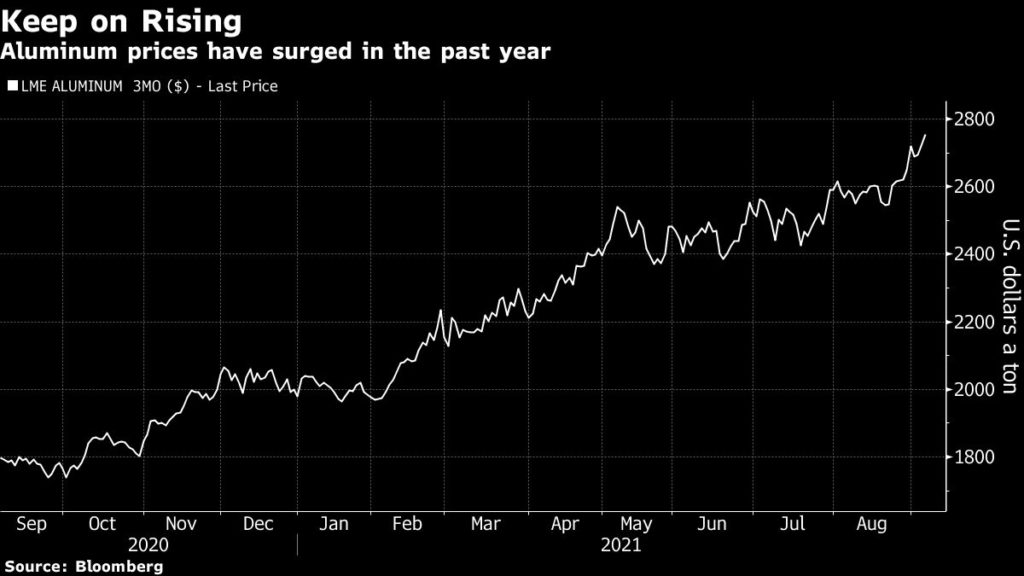

Aluminum climbed to the highest in more than a decade after a coup in Guinea fueled concerns over raw material supplies, with futures holding gains even after the head of the junta urged miners to keep operations running.

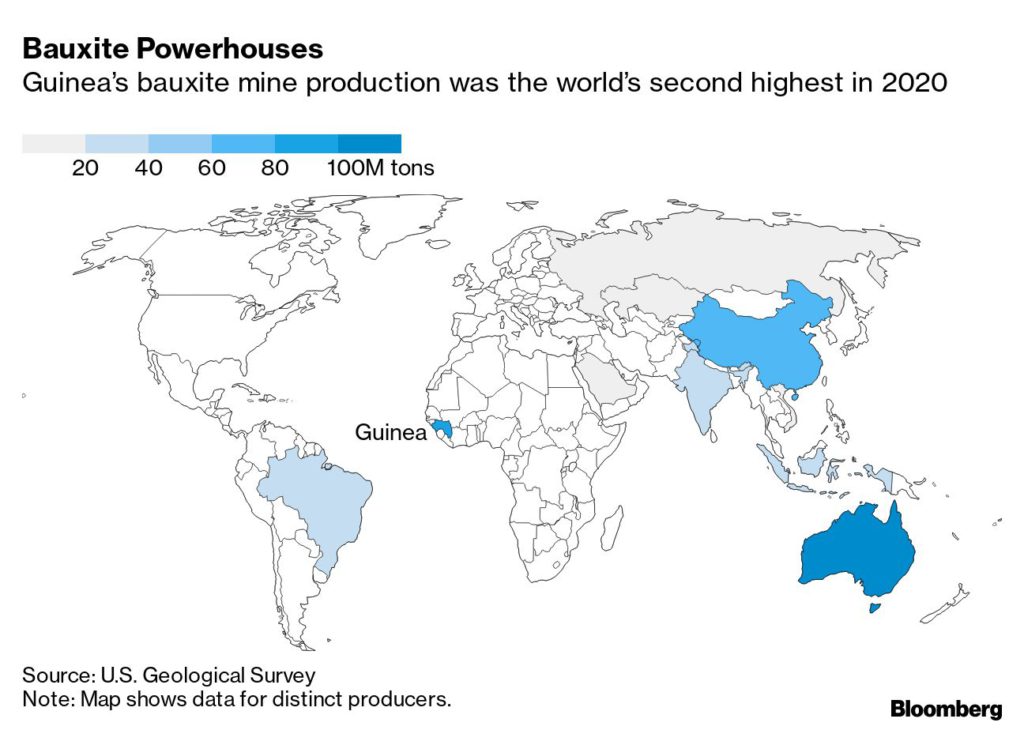

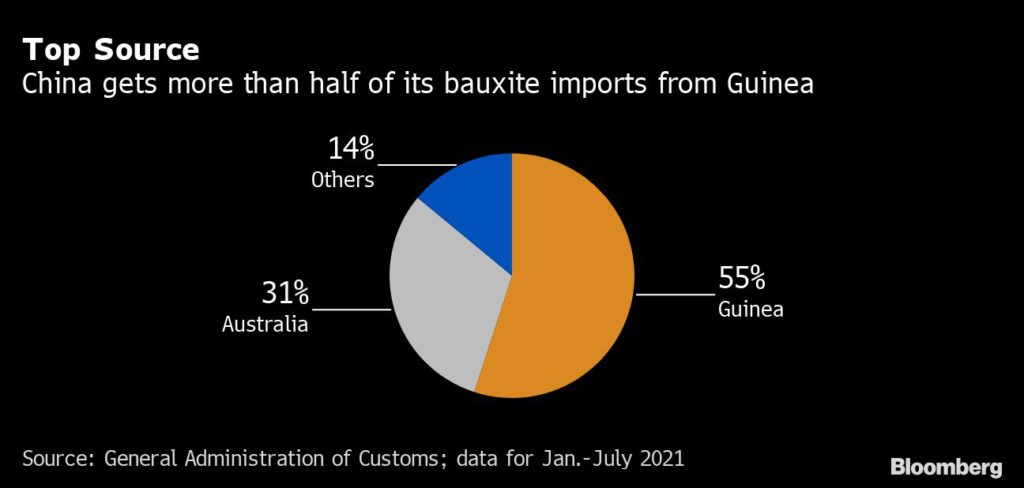

Metal prices extended gains and producer shares surged — industry leader Aluminum Corp. of China, or Chalco, jumped as much as 10%. Guinea is a major supplier of bauxite, the feedstock needed to make aluminum, and accounts for more than half of the imports by China.

Aluminum, which is used in everything from car parts to drinks cans and home appliances, had already climbed about 38% this year in London before the coup, as consumer demand and economic activity rebound. At the same time, smelters in China have struggled to maintain output during a seasonal power crunch and as Beijing seeks to rein in the country’s carbon emissions.

Aluminum held gains Monday even after Doumbouya said that maritime borders remain open to export mining products and a curfew on mining activities has been lifted. The junta is urging mining companies to keep operating, he said in a speech. Earlier, Chalco, which has a bauxite project in Guinea, said all of its operations are normal and it has ample bauxite inventories at its plants in China.

[Click here for interactive aluminum price chart]

While United Co. Rusal founder Oleg Deripaska warned that the market “can be seriously shaken” by the situation, traders were still waiting on Monday for further clues about potential supply cuts.

The bauxite market has been in surplus for years, and any disruption would need to be severe to alter that dynamic, according to Michael Widmer, head of metals research at Bank of America Merrill Lynch.

“I’m bullish aluminum, but for different reasons,” Widmer said by phone from London. “That said, if you do have issues in a country that supplies 20% of bauxite to the global market, then clearly that will be a problem.”Play Video

Prices on the London Metal Exchange rose as much as 2% to $2,782 a ton, the highest since May 2011, before closing at $2,773. In China, futures jumped as much as 3.4% to the highest since 2006, before paring gains. Other industrial metals were mixed on the LME, with copper and zinc up and nickel, lead and tin all down.

“Investors are quite concerned given China buys a big chunk of bauxite from Guinea,” though there haven’t been reports of disruptions yet and the extent of any impact will depend on how the situation evolves, said Xiong Hui, chief aluminum analyst with Beijing Antaike Information Development Co.

Investors are also looking at ongoing production cuts in China’s Guangxi province, which is further tightening the market, Hui said.

The energy-intensive aluminum industry has come under increased scrutiny as part of Beijing’s pollution crackdown. China produces around 60% of the world’s total, with concerns around output prompting some of its largest smelters to pledge to ensure supply, and metal to be released from state reserves to ease tightness. The country has become increasingly reliant on imports, a rare development that’s drained global supplies of the usually abundant metal.

Bloomberg