Chinese diamond mining company Anjin Investments, operating in Zimbabwe’s Chiadzwa diamond fields, has set an ambitious target of producing 1 million carats in 2025, Mining Zimbabwe can report.

By Rudairo Mapuranga

This target comes after a challenging year in 2024, during which the company is expected to fall short of its original target of 720,000 carats, achieving only 45% to 50% of that goal. This shortfall was revealed in a Ministry of Mines and Mining Development report based on monitoring visits conducted from September 29 to October 12, 2024.

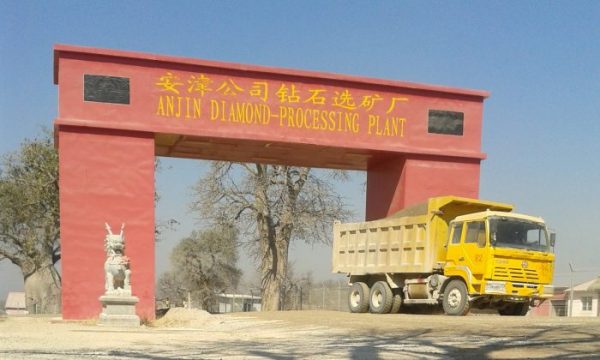

Anjin, which first operated in Chiadzwa from 2010 to 2016 before being shut down and reopening in 2020, has faced numerous challenges affecting its production capacity. Upon reopening, the company invested $28 million to recapitalize and repair vandalized equipment. However, much of the machinery has since outlived its lifespan, with current operations running at only 50% of full capacity.

Production Challenges

As of the time of the report (September to October 2024), Anjin had produced 260,000 carats—well below the anticipated annual output. The shortfall is attributed to an outdated fleet of equipment, including excavators and dump trucks, which now operates at only half the capacity it had during the company’s initial operational period (2010–2016).

In response, Anjin plans to acquire new excavators and dump trucks in 2025 to enhance production. The company is currently mining in Portal D, with ongoing exploration in Portal C, aiming to commence operations there next year. Exploration in Portal B has already been completed, revealing a proven reserve of 9.8 million tonnes of ore. This reserve is expected to sustain a 10-year mine life, with an annual production capacity of 1 million tonnes of ore.

Strategic Expansion

Despite the challenges, Anjin remains optimistic about its future. The company has outlined a strategy to establish additional mining sites, a move deemed critical to increasing revenues and mitigating the negative effects of falling diamond prices and the high mining costs associated with deeper operations in Portal D.

One significant hurdle is the impact of low diamond prices on the company’s operations. An auction for the sale of 10% of production reserved for the local market failed, as bidders were unable to meet reserve prices. This reflects broader market challenges facing Zimbabwe’s diamond sector.

Additional Challenges

Other obstacles include outdated equipment, frequent power cuts caused by load shedding, and the proliferation of illegal mining activities. The proximity of homesteads to mining zones has exacerbated the issue, making it easier for illegal miners to encroach on operational sites and further complicate Anjin’s work.

Optimism for the Future

Despite these difficulties, Anjin remains committed to achieving its target of 1 million carats in 2025. The company is banking on new equipment acquisitions, increased exploration efforts, and the development of additional mining sites to meet its goal.

With a proven ore reserve and a clear strategic plan, Anjin aims to position itself as a key player in Zimbabwe’s diamond industry, contributing to the country’s long-term economic goals, including the Vision 2030 goal of achieving upper-middle-income status. However, the company must address its operational and market challenges to unlock its full potential.

The diamond sector remains one of Zimbabwe’s critical industries, and Anjin’s ability to ramp up production will play a crucial role in sustaining growth in this sector, despite the difficulties currently facing mining companies across the country.