AFRICAN lithium developer, Prospect Resources, says a sample of its Arcadia mine premium grade lithium has passed the second qualification stage with one of the largest glass manufacturers in Europe.

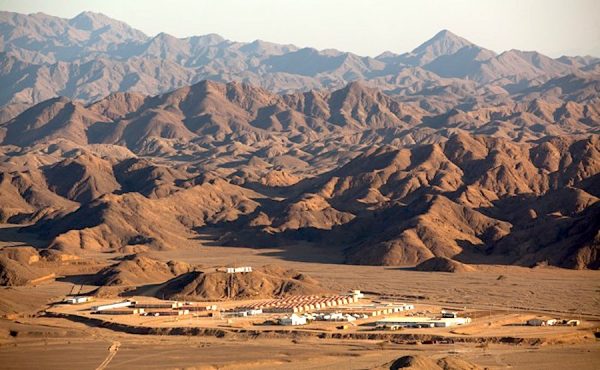

The Australian company operates the Arcadia lithium mine project 38 kilometres east of Harare, which will produce chemical grade (electric vehicle batteries) and technical grade (glass and ceramics) lithium.

Lithium is an integral component of Government ’s plans to build a US$12 billion mining industry by 2020 and the mineral is expected by that time to contribute at least US$500 million annually.

Prospect provided a sample for larger-scale laboratory testing and analysis and the outcome is that the ultra-low iron petalite surpasses the glass ceramic market’s stringent ultra low iron and alkali technical specifications.

If the product passes the final stage, Prospect will secure a potential lucrative market with one of the largest European-based consumers of the premium technical grade petalite.

To pass the final step in the qualification process, the product needs a full test in the production kiln, which will be undertaken this year, once the pilot plant is constructed and larger volume of product is available.

Prospect is also in discussions with another industry leading glass ceramic producer based in Europe with a view to enter into a Memorandum of Understanding, where both parties seek to develop a commercial relationship.

The Australia Stock Exchange listed firm is currently engaging with glass and ceramics customers across Europe, Asia and Africa who collectively, consume over 130 000 tonnes per annum of ultra-low iron petalite.

Prospect’s ability to consistently produce approximately 100 000 tonnes per annum of ultra-low iron petalite product from the Arcadia mine, over its 15,5 year Life-of-Mine, is a key attraction for customers.

“Prospect anticipates being one of only two mines in the world capable of producing ultra low iron petalite and we expect to be the largest player in this natural oligopoly – none of which are based in Australia.

“Demand for Prospect’s ultra low iron petalite is expected to be spread equally between Europe and Asia, with a considerable supply deficit for the foreseeable future,” the ASX listed firm said in a statement this week.

Prospect Resources has already appointed the African Export and Import Bank (Afreximbank) as lead arranger for a US$143 million syndicated loan facility it needs to finance the lithium mining project.

The open-pit lithium mining project, regarded as one of the world’s biggest hard rock lithium resources, was granted National Project and Special Economic Zone status by the Government back in October 2017.

An initial capital outlay of about US$162 million is required to develop the Arcadia lithium-ion batteries, used for portable electronics and electric vehicles project, and petalite mine to production and it is expected this will take about 18 months from the date of financial closure of project finance.

Development of Arcadia is key to Government’s vision of growing mining to a US$12 billion by 2023 and a definitive feasibility study (DFS) proved the lithium project will earn Zimbabwe at least US$3,5 billion over its life of mine.

Arcadia is Africa’s most advanced lithium-ion batteries project, which will raise world 5th largest producer, Zimbabwe’s ranking when it comes into production.

Zimbabwe has one producing lithium mine — Bikita Minerals.