Canada’s Barrick Gold said on Thursday that continued exploration and the conversion of resources to reserves at its Tongon mine in the Ivory Coast have allowed it to extend the operation’s life to 2023.

The world’s second-largest gold miner, which considered selling Tongon in 2019, now counts it among its most valued assets and is pursuing further opportunities for replacing reserves.

The mine produced a total of 284,863 ounces of gold in 2020, at the top end of its guidance for the year, Barrick said.

TONGON PRODUCED A TOTAL OF 284,863 OUNCES OF GOLD IN 2020, AT THE TOP END OF ITS GUIDANCE FOR THE YEAR

Speaking to Ivory Coast media, Barrick president and chief executive Mark Bristow highlighted some of the obstacles Tongon has had to overcome to achieve its current performance.

The mine was built and commissioned in the midst of civil war and it has since operated in an unstable socio-political environment. It has also been impacted by a broad range of problems, including a mill fire, recurring technical issues, and an erratic grid power supply.

“Despite all these challenges, Tongon has been consistently profitable and in 2020 again paid a $150 million dividend to its shareholders,” Bristow said. “It provided $1.2 million to the government to support its campaign against covid-19 while implementing effective prevention measures at the mine to protect its people and the business.”

In line with Barrick’s policy of supporting local business, Tongon also spent $105 million — 66% of its total procurement budget — with Ivorian contractors and suppliers in 2020.

Best safety record

Bristow noted that Tongon had the best safety record among Barrick’s assets. Until it suffered one lost-time injury in October last year, the mine had recorded more than 15 million lost-time injury free work hours over 1,120 days.

Since pouring its first gold in 2010, Tongon has contributed more than $1.6 billion to the Ivory Coast’s economy in the form of taxes, infrastructure development, salaries and payments to local suppliers, Barrick said.

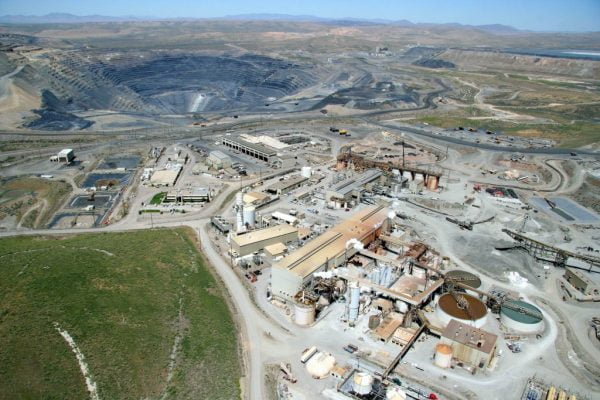

The company has a nearly 90% stake in the gold mine, which is located 682km (424 miles) north of the coastal city of Abidjan. The Ivorian government and local investors own the remainder interest.

Mining.com