Barrick gold reports $1.2 billion quarterly loss

Canada’s Barrick Gold TSX:ABX)(NYSE:GOLD), which completed its $5.4 billion merger with Africa-focused Randgold Resources at the start of the year, reported Wednesday a loss for its fourth quarter, due partly to issues at two mines in South America.

The world’s top gold producer by volume, which keeps its books in U.S. dollars, lost $1.2 billion, or $1.02 per share, for the quarter ended Dec. 31 compared with a loss of $314 million, or 27 cents per share, in the same period of 2017.

The loss included $900 million in net impairment charges related to the Lagunas Notre mine in Peru, where Barrick saw lower throughput, and the Veladero mine in Argentina, where it dealt with higher government taxes.

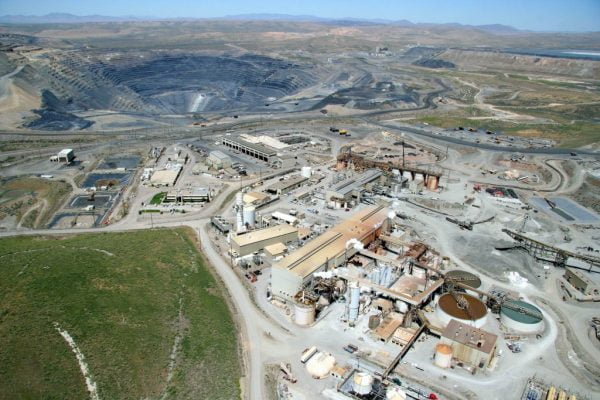

The company pinned the cost increases partly on mining ending at its low-cost Cortez Hills open pit in Nevada in the first half of the year.

Revenue for the quarter totalled $1.9 billion, down from $2.2 billion.

Barrick predicted cost to increase at least 7.9% this year in the $870 to $920 an ounce margin, up from $806 an ounce in 2018 for Barrick as a stand-alone company.

The guidance “primarily reflects the planned completion of mining at the comparatively high-grade, low-cost Cortez Hills open pit in the first half of the year,” the miner said, referring to one of its operations in Nevada.

The company is in the midst of implementing a regional management structure its chief executive Mark Bristow introduced at Randgold for better oversight of local operations. As a result, Barrick is cutting about 100 jobs at the headquarters in Toronto and has already overhauled the senior management team.

“In the short time that we’ve been together, the combined team has already made great progress in applying Randgold’s proven strategy to a new global group,” Bristow said in the statement.

Waiting game on assets sale

The company has previously announced it intends to offload some assets to improve its portfolio, but when asked, Bristow declined to say whether those transactions will take place this year.

Analysts believe that as the merger between Newmont Mining and Goldcorp proceeds, it might make more sense for Barrick to put mines and projects on the market one at a time to keep prices high.

The merged miner also expects to produce less gold in 2019 than Barrick and Randgold’s combined total last year.

For the year ahead, it forecasts an output of between 5.1 and 5.6 million ounces of gold and between 375 and 430 million pounds of copper.

Bloomberg News.