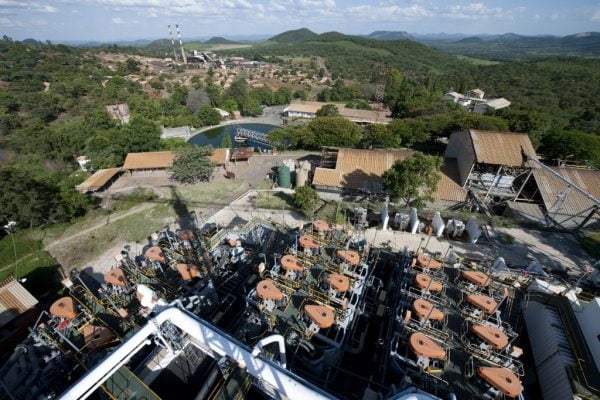

The country’s biggest nickel producer Bindura Nickel Corporation (BNC) has recorded a decline in production during the first half ended 30 September 2022 compared to the same period last year.

Rudairo Mapuranga

The Kuvimba Mining House-owned nickel producer in its Interim Condensed Financial Results for the half year ended 30 September 2022 said ore recovery during the period was also 35 per cent lower compared to the comparable half of 2021 due to lower head grade.

“Nickel in concentrate production for the half year to 30 September 2022 was 1,918 tonnes, which was 25% lower than the 2,553 tonnes produced in the same period last year. The decline was mainly due to the head grade of 1.03% which was 18% lower than for the 6 months to September 2021. Recovery at 81% was 35% lower than in the previous year, in sympathy with the lower head grade,” BNC said.

The nickel producer also said that during the quarter, ore milled was 5 per cent lower compared to the same period of 2021 due to lower mined volumes.

“Ore milled was 230,248 tonnes, which was 5% lower than the 241,325 tonnes milled in the same period last year due to lower mined volumes. The Company’s production performance has been negatively impacted by a decline in the footprint of the high-grade massive resource which necessitated a rapid transition in the mining model from a low-volume, high-grade strategy to a low-grade, high-volume strategy. Unfortunately, the transition is behind schedule due to a delay in the delivery of new underground mining mobile equipment which is a prerequisite to the realization of the new mining strategy. The delay in the delivery of equipment was due to disruptions in the global supply chains, as a result of the protracted effects of the COVID-19 pandemic and the ongoing geopolitical tensions related to the RussoUkrane conflict.

“In line with its new mining strategy, the business continued with its capital expenditure/reinvestment program, with specific emphasis on replacing the dilapidated and obsolete underground mining mobile equipment. The Company is expecting delivery of most of the acquired mining mobile equipment before the end of the calendar year 2022. The new equipment will enable the transition into the new mining strategy, leading to an anticipated upswing in ore volumes and a return to profitability in the second half of FY2023,” said the mining group.

BNC also said that sales volumes during the half year ended 30 September 2022 were lower than the previous sales, selling 1 146 tonnes compared to 2 549 tonnes during the previous half year ended 30 September 2021.

“Nickel sales volume was 2,146 tonnes, which was lower than last year’s sales of 2,549 tonnes. The average LME Nickel price of US$25,542 per tonne was 40% higher than the previous year’s price of US$18,233 per tonne, reflecting the global Increase in Nickel prices.

“The C1 cash cost of US$14,078 per tonne was 56% higher than the previous period’s US$9,045 per tonne, while the C3 All In sustaining cost of US$16913 per tonne was 63% higher than last year’s unit cost of US$10364 per tonne. The increase was attributable to low production arising from the lower tonnage of ore milled and head grade resulting from poor equipment availabilities and the unexpected reduction of higher-grade ore sources. Costs were also affected by the adverse impact on local operating costs arising out of the disparity between the auction rates and unofficial foreign exchange rates that suppliers use in their pricing models, coupled with the high cost of maintaining the old and obsolete mining equipment,” BNC said.