BNC Revenue Down US$3.3 Million Amid Sales Volume Decline

BINDURA Nickel Corporation (BNC) revenue has gone down by US$3.3 million on the backdrop of reduced sales volumes owing to internal strategic arrangements.

In a recent update for the half year period ended September 30 2020, BNC board chairperson, Muchadeyi Masunda attributed the decline to temporary stoppage in dispatches to the market and new marketing arrangements which were put in place following the termination of the Glencore Off-take Agreement.

“The turnover for the period of US$25.0 million was 12% lower than the US$28.3 million realised in the comparative period last year. The London Metal Exchange (LME) nickel price averaged US$13 214 per tonne, compared to US$13 927 per tonne achieved in the prior year,” he said.

During the period under review, gross profit decreased by 31% to US$8.1 million half-year on half-year.

The decrease in profitability was mainly attributable to the decline in sales and net foreign exchange gains recognised in the prior period amounting to US$4.1 million, versus a net exchange loss of US$1.6 million.

Ore mined during the period was 207 747 tonnes versus 215 338 tonnes mined in the comparative period in 2019.

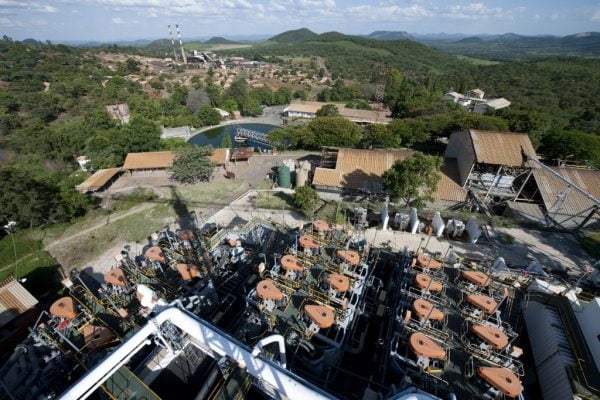

Trojan Nickel Mine is the only operating mine within BNC on average producing +/-440 000 tonnes of ore and produces +/- 6 000 tonnes of nickel in concentrate per annum, translating to approximately 44% of capacity.

The reduced capacity has largely been driven by a mining strategy anchored on a high-grade/ low-volume ratio of 1 part massives to 2 parts disseminated ore.

BNC has nickel resources across Zimbabwe under mining, processing and exploration assets.

These are Trojan Mine, Shangani Mine, the BSR (formerly Bindura Smelter and Refinery) facility, Hunter’s Road Project, Damba-Silwane and the Trojan Hill and Kingstone Hill Prospects.

Recently BNC was taken over by Sotic International Ltd, a Mauritius-based firm which is now the major shareholder.

Sotic owns Zimbabwe’s Landela Mining Venture Ltd and is suspected to be linked to Kuda Tagwireyi, one of President Emmerson Mnangagwa’s close allies and adviser who also has investments in chrome mining, fuel, agriculture and banking sectors of the country.