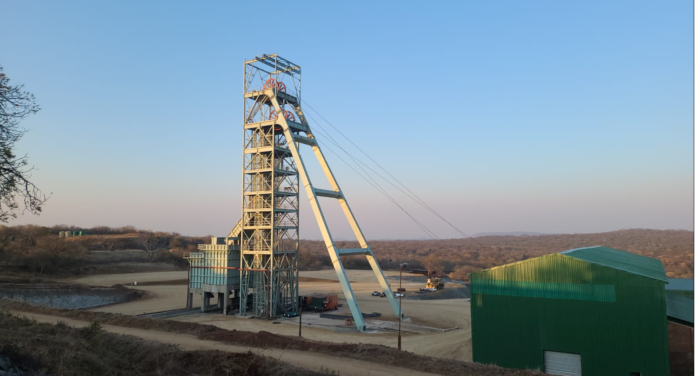

Victoria Falls Stock Exchange-listed gold producer Caledonia Mining Corporation plans to spend US$132 million in 2026 on the development of the Bilboes gold project, which, once operational, will become Zimbabwe’s largest gold mine, Mining Zimbabwe can report.

By Ryan Chigoche

This development comes as the company successfully met its production guidance for 2025, with Blanket Mine producing 76,213 ounces of gold, maintaining output in line with the previous two years.

The investment in Bilboes forms part of a broader US$162.5 million capital expenditure programme for 2026, which is subject to board approval and funding availability.

The project recently gained momentum after the government reversed proposals to double the gold royalty rate and change the tax treatment of capital expenditure, providing greater certainty for long-term investment.

Bilboes is expected to cost US$584 million in total, with production scheduled to begin in late 2028. The mine is forecast to reach a steady annual output of 200,000 ounces from 2029 for an initial period of 10 years.

Caledonia intends to fund the project through a combination of non-recourse senior debt, contributions from existing operations, and specialised financing methods such as metal streaming, where investors provide upfront cash in exchange for future metal supply.

Commenting on the company’s performance and future plans, CEO Mark Learmonth said:

“Blanket has once again delivered production in line with guidance, demonstrating the resilience and operational excellence of our team. Our 2026 budget reflects our commitment to sustaining Blanket’s operations while advancing growth projects at Bilboes and Motapa. These investments support long-term value, safety, and operational consistency for all our stakeholders.”

Alongside Bilboes, the remainder of the 2026 capital programme will support Blanket Mine and growth initiatives at Motapa, ensuring that current operations remain stable while the company pursues long-term expansion.

Sustaining capital of US$26.6 million is earmarked for Blanket, covering underground development, milling upgrades, infrastructure, safety initiatives, and business improvement projects. Growth capital of US$3.8 million is allocated to exploration at Motapa, while an additional US$11 million may be invested to address long-term power reliability issues that have affected Blanket’s operations.

By allocating capital to both growth projects such as Bilboes and sustaining investments at Blanket, Caledonia is ensuring that its existing operations remain stable while preparing for future expansion.

Meanwhile, Blanket Mine continues to serve as the backbone of the company’s production, producing 76,213 ounces of gold in 2025.

This met guidance and maintained output in line with the previous two years.

However, production in the fourth quarter was slightly lower at 17,367 ounces, compared with 19,841 ounces in Q4 2024, as reduced tonnages from higher-grade areas and electricity interruptions affected output.

Strong milling throughput, however, helped mitigate some of the pressure from the lower grades.

Looking ahead, Blanket’s 2026 production guidance is 72,000 to 76,500 ounces, with higher output expected in the second half of the year as additional high-grade zones come online.

On-mine cash costs are projected at US$1,500 to US$1,700 per ounce, while all-in sustaining costs are expected to range from US$2,100 to US$2,300 per ounce. The increase reflects inflation, higher labour and consumable costs, and ongoing investments in operational reliability, safety, and risk management.

Caledonia’s 2026 plans highlight a clear strategy of maintaining reliable production at Blanket while building future growth through Bilboes and Motapa, reinforcing Zimbabwe’s position as a leading gold producer in Southern Africa.