Caledonia Mining Corporation has entered into a zero cost contract to hedge approximately a quarter of its 2022 gold production target at Blanket as it seeks to protect its balance sheet during its phase of higher capital investments.

The Victoria Stock Exchange-listed miner has entered into a cap and collar hedging contract for 20,000 ounces of gold in the period March to July.

The contract has a cap of US$1,940 and a collar of US$1,825 which means that for 4,000 ounces of gold per month for the period, Caledonia will receive an effective gold price per ounce of not less than US$1,825 or greater than US$1,940. It will receive an effective spot gold price between these two levels.

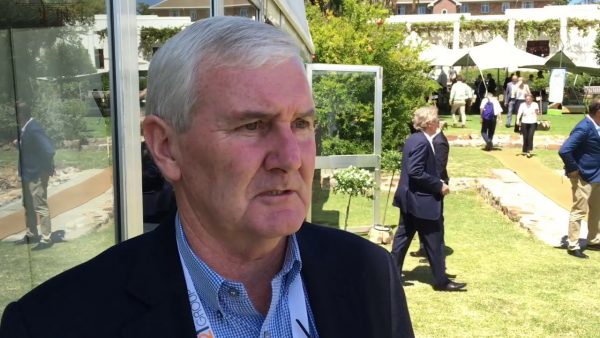

CEO Steve Curtis said the resources firm decided to hedge production so as to take advantage of the current strong gold prices to protect the balance.

He said hedging gold production is not an easy decision for a gold miner as investors usually wish to maximise exposure to gold price upside.

“However, given the fact that our capital expenditure phasing is heavily weighted towards the first half of 2022 as we ramp up gold production, the board considered it prudent to take advantage of the current strong gold price to protect the balance sheet during this phase of higher capital investment with a five-month hedging arrangement over a portion of our production,” Curtis said.

Hedging is a risk management strategy employed to offset losses in investments by taking an opposite position in a related asset.

The reduction in risk provided by hedging also results in a reduction in potential profits. Hedging strategies typically involve derivatives, such as options and futures contracts.

Meanwhile the company is targeting an annual gold output of 80 000 ounces in 2022 and they are also top acquire more assets in the country.