Caledonia Mining Corp secures Connemara

CALEDONIA Mining Corporation Plc has secured exclusive rights to explore and acquire the mining claims in the gold-rich Connemara North area in Gweru as part of efforts to expand its operations.

This comes after the company announced a similar arrangement at Glen Hume in the same district where airborne geophysics indicates attractive exploration targets.

In October, the company signed a memorandum of understanding with the government to boost investment, including the possible takeover of StaWWWWWte mining assets. Previously, the company indicated it was eying a number of brownfield gold mines in the country, but faced challenges in concluding deals.

In terms of the multimillion-dollar Connemara North agreement, Caledonia has the right to explore the area for a period of up to 18 months and if exploration is successful and at its sole discretion acquire the mining claims in the area.

The total consideration is an initial payment of US$300 000, followed by a further payment of US$5 million in cash or shares at the discretion of the vendor which would be payable should Caledonia decides to exercise its right to acquire the mining claims, Caledonia said.

“Caledonia has also agreed to the payment of a one percent net smelter royalty to the vendor on the gold it produces from Connemara North,” the company said in a statement.

Connemara North is the northern section of the closed Connemara mine which was previously owned by First Quantum Minerals (“First Quantum”). It was placed on care and maintenance in 2001 and subsequently disposed of in 2003.

Caledonia said the area had not been commercially mined since that time but before being placed on care and maintenance Connemara mine produced approximately 20 000 ounces of gold per annum from an open-pit heap leach operation. Public disclosures made by First Quantum in 2001 indicated that they had plans to expand the existing open pit operations at Connemara mine when gold prices were approximately US0/oz.

“At this stage, it is not possible for Caledonia to verify any of the work performed by previous owners or to ascertain what proportion of any purported resource lie within the boundaries of the Connemara North property over which Caledonia has secured the option,” the company added.

The new property is approximately 30km from Glen Hume with good road access between them offering the potential of operating synergies should Caledonia decide to develop both areas.

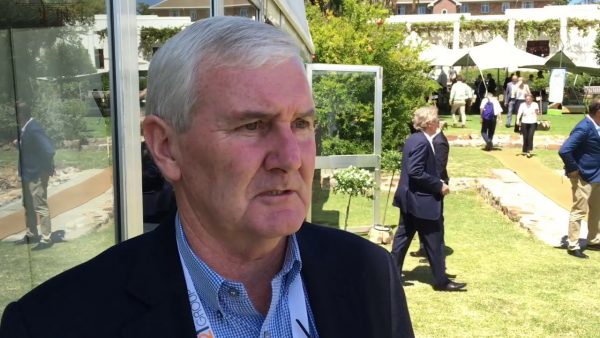

Caledonia chief executive Steve Curtis said the property was part of a wider area that contained a previously operational mine which showed great potential and has been lying untapped for 20 years.

“Connemara North is also in close proximity to the Glen Hume property over which we have already acquired an option. We are excited at the prospectivity of these two properties and if evaluation work proves successful and our exploration programmes deliver favourable results, Caledonia will have a great opportunity to establish a footprint in the highly prospective Zimbabwe Midlands which could deliver operating synergies between the two sites,” Curtis said.

“This has been a busy year for Caledonia and with the completion of the central shaft in sight I am pleased that we are now able to start delivering on the other components of our corporate strategy.”

Caledonia recently announced the completion of its US$60 million central shaft project which is expected to see the company ramp up production significantly.

Caledonia said the phase of fully equipping the central shaft from its base to the surface collar was complete and it was on track to be commissioned in the first quarter of 2021.

Key features of the central shaft project, which was started in August 2015, include increased exploration by providing access for further deep-level examination which, if successful, may extend Blanket mines, life to beyond 2034. Caledonia recently said the shaft allowed the company to build another mine below the existing one.

Production is expected to be increased by around 45% from approximately 55 000 ounces of gold in 2019 to the target rate of 80 000 ounces from 2022, while economies of scale and operational efficiencies arising from the new feature are expected to reduce the all-in sustaining cost per ounce of gold from US$8 551 in 2019 to between US$700 and US$800 per ounce.

The scope of the central shaft project was extended from an initial target depth of 1 089 metres to a final depth of 1 204 metres. NewsDay