ZIMBABWE’S biggest car battery maker, Chloride Zimbabwe, says plans to draft lithium battery production technology into its operations have kicked off to prepare the firm for a future without petroleum-powered cars.

General manager Kudzai Pasipanodya told businessdigest this week that for now, Chloride, a unit of the Zimbabwe Stock Exchange-listed ART Corporation, was planning for the long-term when lithium-battery-powered electric vehicles (EVs) swamp the domestic market.

There has been a huge global push to eliminate air-polluting, fossil-fuel-powered motor vehicles, the biggest consumers of Chroride’s batteries.

Pasipanodya spoke as traditional car battery makers continued to be confronted by market changes demanding strategic planning.

To underline the gravity of challenges that confront traditional car battery producers, lithium battery car maker Northvolt last week raised US$2,75 billion in fresh equity to expand a factory under construction in Sweden to match surging demand for EVs.

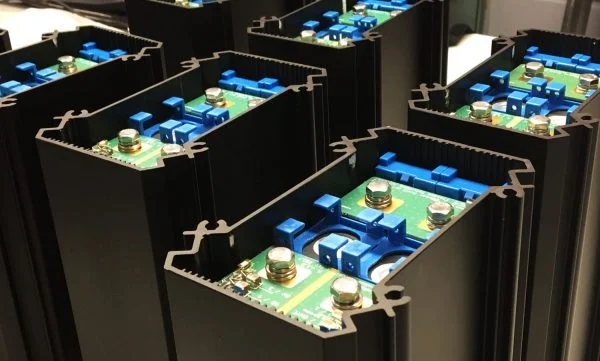

“Work on exploring how best we can migrate to lithium technology has started,” Pasipanodya said, speaking exclusively to businessdigest. “This is a long-term project which we think by the time there is general use of the electric vehicles in our market, it would be economical to produce the lithium battery locally.

“We will start by assembling the battery before going into full-time manufacturing. We do not have the capacity as of now, but certainly we are watching market developments whilst looking at what is required to cease the opportunity when it becomes economical to produce locally.

Analysts have cautioned African producers of lithium, including Zimbabwe, not to wait until EVs increase their presence and then make moves to shift their product lines.

There were already indications that EVs would make inroads into the domestic markets earlier than expected after Agilitee Africa, a South African EVs maker, acquired 90% shareholding in a Zimbabwean dealership in May.

The deal is set to create about 700 jobs when a plant is established in Harare.

But should it enter the lithium market in future, Chloride would leverage on its strategic positioning close to some of Africa’s most promising lithium mines including Prospect Resources’ Arcadia near Harare.

The Australia Stock Exchange-listed miner said last week its pilot plant was over 90% complete, as work on kick starting production at Arcadia progressed.

London-headquartered Premium has also been developing a lithium operation near Bulawayo, while significant finds have been made on dump sites at the mothballed Kamativi Tin Mine near Hwange.

The state-run Zimbabwe Mining Development Corporation has indicated that it would scout for partners to develop the asset.

Meanwhile, Pasipanodya said Chloride would be ramping up production at its operation to 600 000 units per annum, from the current 450 000.

“Annual production stands at 450 000 units and we are already upgrading the plant to produce 600 000 units annually. Since we embarked on improving production capacity, the market has responded well. The market share has grown from 55% 10 years ago to the current 80%,” he said.

“We export 40% of our production capacity into regional markets, that is Zambia, Malawi and Mozambique to be more specific. The Exide brand is already dominant in the Zambian and Malawian markets and we are currently developing the Mozambican market. Emphasis has been on manufacturing a quality product that competes with any global brand. We have invested in communicating the benefits of using our product to the market.

“Chloride Zimbabwe introduced solar batteries in 2014 and the product has been doing well in the targeted market segment. However, there is a market segment which prefers Gel batteries. During the first month of lockdown, we lost 90% of local sales volume, but we recovered after we were declared an essential service. The sales volume recovered to around 80 % of normal sales.”