Contango Holdings Plc has cleared a key regulatory hurdle at Zimbabwe’s Muchesu coal project. The Reserve Bank of Zimbabwe (RBZ) has approved a revised ownership and operating structure that brings in Pacific Goal Investments Private Limited (PGI) as project operator, Mining Zimbabwe can report.

By Ryan Chigoche

The approval formalises the transfer of majority control in Monaf Investments (Private) Limited, the company that holds the Muchesu coal asset.

It also brings to a close a restructuring phase aimed at moving the project closer to development.

For Contango, the decision marks a shift from corporate realignment to execution planning.

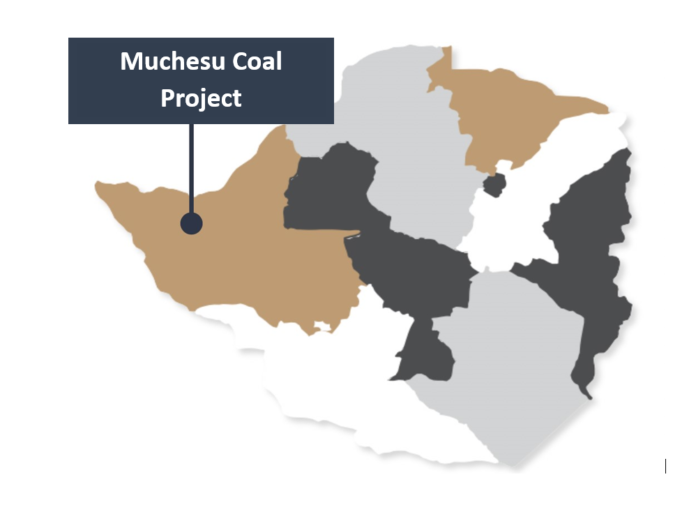

Located in Binga, Matabeleland North, the Muchesu project hosts a coal resource estimated at more than two billion tonnes.

This places it among Zimbabwe’s largest undeveloped energy assets.

The project is positioned as a long-term mine-to-energy opportunity with national significance.

Confirming completion of the process, Contango announced the Hong Kong firm as the registered executor of the project.

“Contango Holdings Plc, a company focused on unlocking value from the +2 billion tonne Muchesu coal project in Zimbabwe, is pleased to advise the completion of registration with the Reserve Bank of Zimbabwe for the transfer of 51 percent ownership of Monaf Investments (Private) Limited from Contango to Pacific Goal Investments Private Limited. PGI has also now been registered as the operator of the project.”

Under the revised structure, PGI now holds 51 per cent of Monaf Investments. Contango retains a 24 per cent interest. Lilyone Investments owns 6.5 per cent, while local minority shareholders hold the remaining 18.5 per cent.

Contango has previously indicated that separating ownership from operations was a deliberate move.

The scale of Muchesu requires significant capital and operational depth. Retaining equity while appointing an experienced operator allows the company to manage risk without giving up long-term value.

PGI forms part of the Pacific Goal Group, a Hong Kong-based industrial group with established mining and energy operations in Zimbabwe.

“As previously reported, PGI forms part of the Pacific Goal Group, a Hong Kong-based industrial group with extensive mining and energy operations in Zimbabwe, including a major mine-to-energy industrial park, incorporating two power stations, a graphite processing plant and a nickel smelter.

PGI is co-owned by Mr Wencai Huo, the company’s 20.42 per cent shareholder, and Mr Liu Jun.”

Beyond the ownership changes, Muchesu is increasingly seen as strategically important. This is true at both provincial and national levels. Large coal assets are again drawing attention as Zimbabwe looks to stabilise power supply and support industrial growth.

For Contango, RBZ approval provides regulatory certainty. It also creates a clearer pathway for the project to advance with a partner that has existing mine-to-energy experience in the country.

The Muchesu coal asset has long been regarded as a cornerstone resource in Matabeleland North.

Historical exploration has confirmed a substantial, long-life deposit. Its location places it within reach of regional power demand centres and infrastructure corridors.

If developed, the project could support power generation, industrial energy needs, and broader economic activity over several decades.