Despite being exempted from operating throughout the Covid-19 pandemic period, the mining sector faced several challenges that saw the chrome industry grinding to a halt. Unki Mines, Hwange Colliery Company Limited and How mine confirmed some of their staff tested positive for Covid 19.

By Shantell Chisango

According to 2020, Survey Data, miners pointed out that their operations were significantly impacted by the pandemic which resulted in higher output costs and the expense of unplanned spending for covid19 on protective materials.

“All respondents (100%) indicated that their cost of production increased due to unplanned expenditures on preventive material including face masks, hand sanitisers and testing kits. All respondents (100%) also highlighted increased importation logistical costs due to increased insurance and transportation costs as some transit areas were closed.” Source: Survey Data 2020

Moreso, another obstacle brought by Covid19 was sluggish commodity demand and market shutdown which harmed mineral demand, survey findings indicate that the most affected were base metals and ferrochrome producers.

Covid19 resulted in a decline in mineral output due to depressed mineral prices, with the majority of miners suspending their operations except for gold miners who registered an increase in gold prices amid the covid19.

Survey findings show that 40% of respondents indicated that their performance was weighed down by depressed mineral prices, with most ferrochrome smelters suspending their operations. On the contrary, gold producers reported that gold prices surged during the covid-19 pandemic and therefore were little affected.

Furthermore, the mining industry had the challenge of importing explosives and fuses needed for drilling and blasting processes due to travel restrictions resulting in the reduction of production capacity.

Speaking to Mining Zimbabwe, a small-scale miner in Mashonaland Central complained about the explosives shortage, saying, “Mining business currently is low, we have had challenges of acquiring explosives and fuses thus it has reduced the production capacity and in some cases leading to downtime of tools and equipment.”

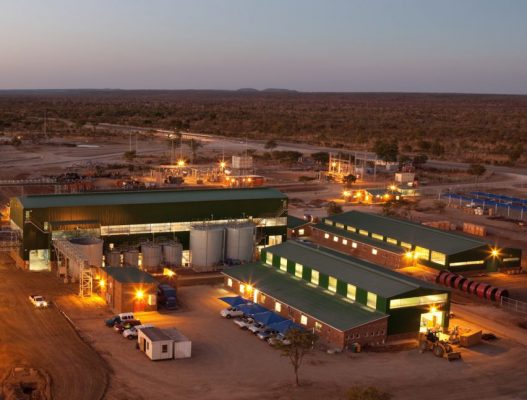

ZIMPLATS

However, despite the negative effect brought by Covid19 to the mining industry, some mining companies like Zimplats (leading Platinum mining company in Zimbabwe) recorded positive results.

Commenting on the performance of the company, Zimplats Chairman Fholisani Mufamadi said the company performed exceptionally well regardless of Covid19.

“I am excited to be writing to you, our valued stakeholders, as your Company posted excellent results despite the challenging environment in which the COVID-19 pandemic wreaked havoc the world over,” he said.

The Company recorded a profit of US$261.8 million for the year, an improvement of 81 per cent from US$144.9 million in the previous year due to the rise in revenue from improved metal prices and the decline in exchange losses from US$20.2 million in FY2019 to US$4.8 million (US$868.9 million in FY2020 as opposed to US$631 million in FY2019).

Furthermore, the company managed to pay the final instalment of US$42.5million on the Revolving Credit Facility with Standard Bank of South Africa.

“I am happy to report that your Company paid the final instalment of US$42.5 million on the Revolving Credit Facility with Standard Bank of South Africa. In addition, the Group generated enough cash to pay dividends amounting to US$45 million,” said Mr Mufamadi.

Zimplats is progressing with all its major projects which include the US$264 million Mupani Mine development project and completion of the US$101 million Bimha redevelopment project.

Currently, US$99.5 million has been invested in the construction of the Mupani Mine and US$98.8 million has been invested in the redevelopment of the Bimha Mine.

CALEDONIA

Zimplats is not the only company that managed to produce positive results during the Covid19 era, Caledonia Mining Corporation, a gold producer, which operates Blanket Mine in Gwanda has also succeeded in defying the impact of Covid19 by recording enormous production.

Chief Executive Officer (CEO) Steve Curtis applauded the wonderful work the company managed to produce despite the Covid19 impact on business.

Mr Curtis said “The production of 13,499 ounces in the second quarter is an outstanding achievement given the challenges faced during the quarter as a result of the COVID-19 Pandemic. To have achieved a 6.2% increase in the comparable quarter of 2019 during a period where our workforce and supply chains were disrupted is a performance of which every employee should be justifiably proud. Thankfully the virus has not affected our operations or the broader Zimbabwean gold mining sector too seriously although we remain vigilant.”

Currently, the company is working on the production guidance for 2021 which is 61 000 ounces to 67 000 ounces while guidance for 2022 is about 80 000 ounces.

On a positive note, surveys in the mining sector 2020 State of the Mining Industry Survey Report 27 has shown that employment in the mining sector was not that much affected for 80% of miners indicated that their employees were only affected by 0-10%, while the remainder were affected by 10-20%.

The government continues to ensure that the Covid19 initiatives are practised by all business sectors as a way to curb the spread of the pandemic and also to avoid the closure of industries if the pandemic continues to rise.

ZIMASCO and Afrochine

On the 25th March 2020, Portnex shut down its Zimasco ferrochrome plant in Kwekwe after prices of the alloy fell to four-year lows on weak demand caused by the coronavirus outbreak. Afrochine downgraded and started operating below 50% of installed capacity. Production at the miners has since increased.

ZCDC

COVID 19 pandemic struck affecting China which accounts for 15% of the global diamond market. The lockdown in China not only meant that diamond sellers had to close shop for at least 2 months but buyers could also not get out and shop for jewellery. The development hit the diamond producer hard to the point that ZCDC failed to pay salaries.

ZCDC spokesperson said “We had problems paying our salary arrears to workers and we have been updating them on the challenges that we had which were emanating from Covid 19 challenges. These challenges are not peculiar to ZCDC but have been felt across the whole sector, it’s a situation that we are addressing actively. We have been optimistic in our outlook and we have resumed diamond sales so we are actively addressing those constraints, we can safely say we are finally navigating out of the woods,” Chagonda concluded.

This article first appeared in the December 2020 issue of Mining Zimbabwe Magazine