Zimbabwe Stock Exchange (ZSE) listed major nickel mining concern, Bindura Nickel Corporation (BNC), has a long history almost linked with the very history of nickel mining in Zimbabwe.

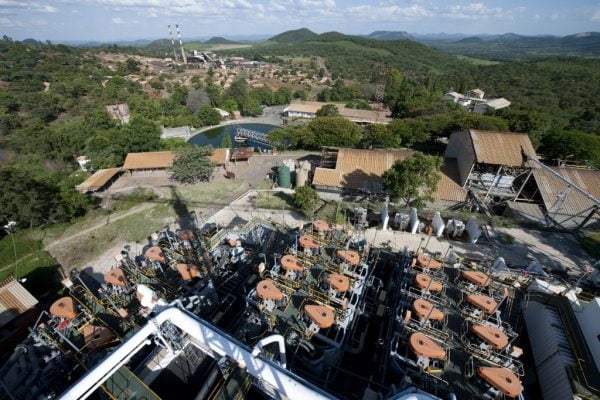

The company operates nickel mines and a smelter complex in Bindura in Zimbabwe’s Mashonaland Central Province. Scope of operations entail the extraction of nickel and the production of nickel by-products like copper and cobalt.

These are the main activities in the company’s two main divisions, namely, the Mining Division and Bindura Smelter & Refinery (BSR) Division.

The mining division is constituted by Trojan Nickel Mine Limited (TNM) and Hunters Road Nickel Mine (Private) Limited. Assets and liabilities for all the operations, however, is the prerogative of Trojan Nickel Mine.

Trojan Nickel deposits were the first to be discovered in Bindura in 1956 with the first concentrate having been produced in 1964. BNC was then established in 1966 by the Anglo American Corporation Group in Zimbabwe. Madziwa Nickle Mine near Shamva was first mined during the year.

The smelter and refinery was commissioned in 1968, with the first nickel cathode having been produced the very year using two blast furnaces that treated concentrates from the two main suppliers of nickel ore then, Trojan and Madziwa Mines.

The two blast furnaces were decommissioned in 1976 and replaced with an ultra-modern electric furnace.

Epoch Nickel Mine was established in Filabusi in 1969. Epoch and Shangani mine’s introduction had, in fact, necessitated the replacement of old blast furnaces.

In 1971 Bindura Nickel Corporation got listed on the ZSE.

Shangani Mine was closed for two months in 1995 pursuant to a mine accident.

Two years later in 1997 proposals were made to close Madziwa and Epoch mines and develop Hunters Road nickel property.

Epoch Nickel Mine and Madziwa Nickel Mine were closed in 1998 and 2001 respectively due to a decline in nickel prices and poor ground conditions.

As another scourge, toll treatment of matte from Botswana and Australia Bindura’s smelter exceeded nickel production from locally sourced concentrates.

In 2003 the Anglo American Corporation sold its 52,9 percent stake in BNC to Mwana Africa Holdings for US$8 million. BNC was the first of Mwana Africa’s acquisitions before the Anmercosa base metal and gold prospects in the Katanga copper belt in 2004, and the Freda Rebecca gold mine in Bindura in 2005. Freda Rebecca was closed in 2007.

The Shangani and Trojan mines and the Bindura smelter and refinery complex were placed on care and maintenance in 2008 citing depressed performances.

In 2009 RBZ relinquished its role as gold sales agent to allow firms to sell the metal and keep all the proceeds. Mwana Africa, the new holding company, then announced an intention to restart gold production at the Freda Rebecca mine the same year.

In 2012 US$23million was raised through a renounceable rights offer to necessitate the reopening of Trojan Mine.

The mine subsequently restarted operations in October 2012 after nearly four years of care and maintenance.

By March 2014, Mwana Africa PLC’s shareholding in BNC was 74,82 percent. Exactly a year later, the group raised US$20 million for the Smelter Restart Project which by 2017 was 83 percent complete.

In 2015, a Chinese mining and exploration group, ASA Resources, acquired control of BNC by taking over Mwana Africa’s 74,73 percent shareholding.

In tandem with the acquisition, Mwana Africa shareholders approved a name change to ASA Resources.

In 2017 BNC concluded feasibility studies of converting the Smelter into a plant that processes Platinum Group Metals (PGMs). However, results indicated this was impossible, due to a limited supply of platinum concentrates.

ASA Resources disposed of its 74,73 percent stake in BNC in 2019.

Its assets in Zimbabwe include the disposed Bindura Nickel Corporation, Freda Rebecca Gold Mine and an agribusiness venture.

The Smelter enhancing project had reportedly been temporarily shelved as the group pivots towards shaft deepening to boost production on the back of an anticipated improvement in the global nickel price. Prices are projected at US$18 000 per tonne of nickel.

Market Capitalisation as updated November 27, 2019, stood at $185 948 492 with a share price of 15,00 cents.

Business Weekly