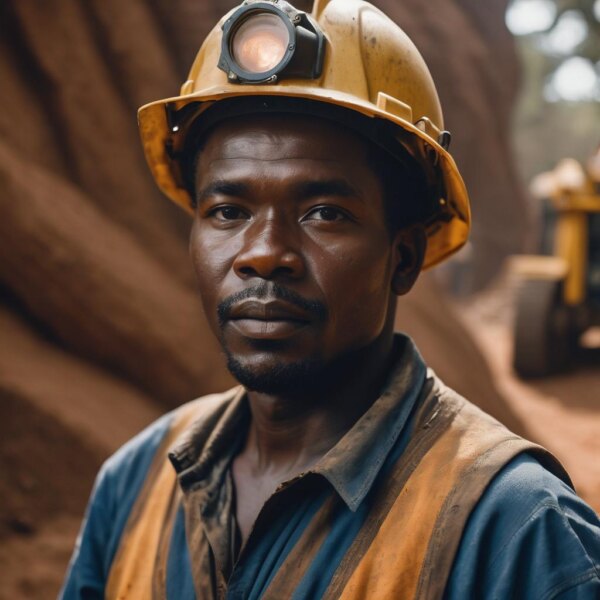

The global platinum mining industry is facing significant challenges amidst a period of declining prices, leading to widespread job losses across various critical roles within mining operations.

The effects of these job losses extend beyond the individuals directly affected, impacting families and the broader economies.

According to Zimplats’ Directors’ Report and Condensed Consolidated Interim Financial Statements (Reviewed) for the half-year ended 31 December 2023, the company made a post-tax loss of US$8.8 million, down from a profit of US$159.6 million, marking a 105% loss in earnings.

Zimplats’ pre-tax profit also decreased by 94% from US$221.5 million to US$14.2 million.

Of the six platinum group minerals that Zimplats produces, the biggest price losses were in palladium, which fell 42%, and rhodium, down 70%. Platinum suffered a 1% decline, while ruthenium decreased by 11%. Gold and Iridium were positive, with Iridium posting a 24% increase, while gold increased by 13%.

Jobs loses at ZIMPLATS

ZIMPLATS has now resorted to cutting jobs after initially offering voluntary retrenchment packages in a bid to protect the miner from the impact of a sharp fall in platinum group metal (PGM) prices.

Some of those who have lost their Jobs include Projects, Transport, Contracts Managers, SHEQ (Safety, Health, Environment, and Quality), Geologists, Resource Evaluation Specialists, Training Instructors, Development and Training Officers, HRD (Human Resources Development) Managers, and Materials Managers Departments among others.

Job losses in South Africa and Zimbabwe

Amplats

Anglo-American Platinum (Amplats) plans to cut 3,700 jobs in South Africa. This is in a bid to reduce costs and turn around fortunes for one of the company’s most troubled divisions.

Recently, the company said it would reduce its workforce by almost a fifth, after a 71% fall in annual profitability following a sharp drop in platinum group metal prices. The company also said it was planning to review contracts with 620 service providers, which could mean an even larger number of cuts which will affect the entire value chain.

Amplats CEO Craig Miller said the job cuts would have a “socio-economic impact”, adding that it was “important to understand that this has been a decision taken as a last resort for the company.

The group’s earnings fell to R14bn, from R48.8bn in 2022.

Anglo owns Unki mine. So far no price slump-related jobs have been cut at the Shurugwi mine.

Sibanye-Stillwater

Sibanye said that it could restructure lossmaking PGM mines including potentially shutting them down which will cost more than 4,000 jobs. Sibanye owns 50% of Zvishavane-based Mimosa Mine with the other 50% belonging to Implats which owns ZIMPLATS.

Mimosa recently undertook a significant workforce reduction, retrenching 33 managers and supervisors due to a persistent 35% decline in metal prices since April 2023. In response to the challenging market conditions, nine of the affected employees opted for early retirement, while 24 chose voluntary separation packages, as detailed in a company statement released on the 5th of February 2024.

“In response to these challenging market conditions, we have implemented several measures to ensure the viability of our business in the low-price metal environment. These proactive steps include capital expenditure curtailment, cost reduction initiatives, and cash conservation efforts,” the company said.

Implats

ZIMPLATS’ parent company Impala Platinum earlier this year said profit plunged 88% in the first half of its current financial year, and reported much lower earnings because of softening prices in the PGMs.

The miner announced that basic earnings dropped to R1.6 billion in the six months through December.

CEO Nico Muller joined a chorus of mining CEOs warning that more job cuts are imminent as reducing costs becomes a strict requirement to keep the industry afloat. This has now become a reality at its Zimbabwean unit, ZIMPLATS. Muller told eNCA that if Implats cannot reduce its costs, the miner risks undergoing significant restructuring or absolute closure.