Precious gemstones miner Gemfields (LON: GEM) is stepping up efforts to market its emeralds and rubies in China after a report highlighted the “huge potential” for ethically sourced gems in the Chinese market.

Based on extensive qualitative and quantitative research among gemstone owners across China’s different regions, city tiers and levels of affluence, Gemstone concluded that now is the time to seize the opportunity of meeting Chinese consumers’ expectations of corporate responsibility and sustainability.

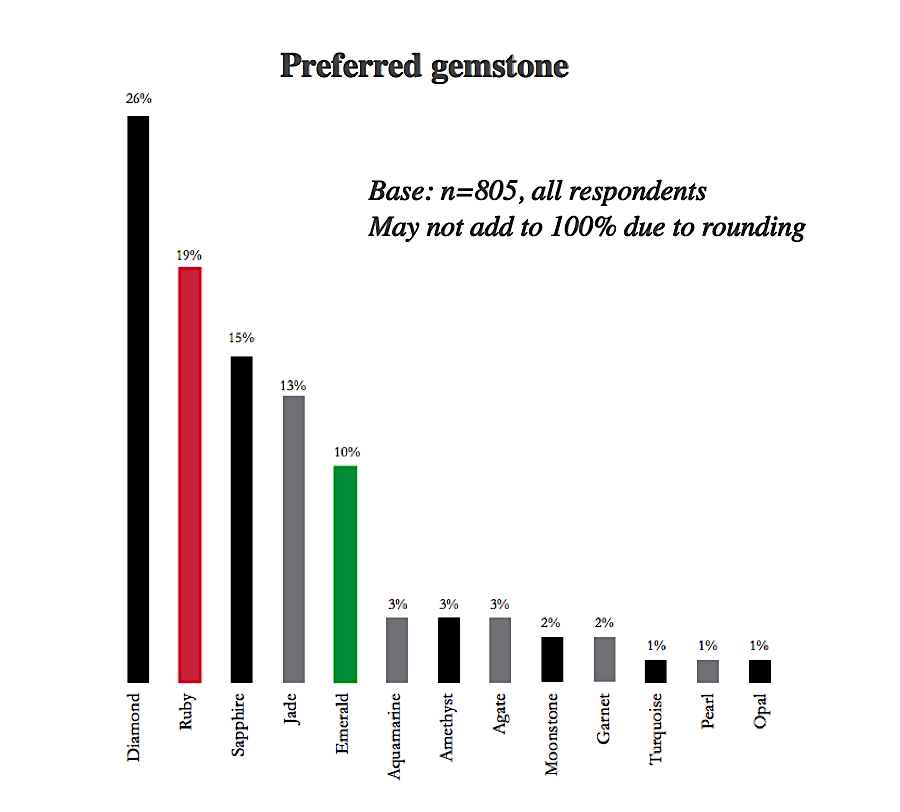

The document, titled “Sustainability: The Future of Coloured Gemstones in China” also shows that up to 35% of Chinese jewellery owners plan to acquire rubies, and 25% expect to buy emeralds in the near future. The findings point to an opportunity for the coloured gemstone industry, if pieces are marketed correctly.

The study also discovered that Chinese jewellery owners rank clarity, carat, colour and cut in this order when it comes to selecting a gemstone. Consumers reportedly care more about the gemstone itself than they do about its price.

“It is highly positive that 97% of jewellery owners are willing to pay a premium for responsibly mined gemstones,” chief executive Sean Gilbertson said. “We expect responsible sourcing will continue to receive ever-increasing attention, and become progressively more important to Chinese jewellery buyers.”

Gemfields owns and operates the Montepuez mine in Mozambique, which is the world’s richest known ruby deposit. It also has the Kagem emerald mine, in Zambia, which provides more than one-fifth of the world’s green gemstones.

The company, which owns Kagem in partnership with the Zambian government’s Industrial Development Corporation, currently repatriates all proceeds from the sale of Kagem’s emeralds back to Zambia. This strategy, says Gemfields, generates tax revenue for the government, as well as employment and associated economic growth.

First signs

Gemfields saw its first Chinese customer successfully win a schedule at an auction in Lusaka, Zambia, last year.

The buyer, Lok Chen of Cai Bao Cheng, bought 117,500 carats of large emeralds – greater than 31mm in size – which the company will cut and polish at their factory in Shenzhen.

The finished pieces are destined for the Chinese domestic market, either via a wholesaler or a jewellery company, Gemfields said at the time.

Cai Bao Cheng was the first company to signal an increasing interest in Zambian emeralds coming from Asian consumers, according to the company.

Gemfields’ growth strategies in China for the rest of 2020 includes undertaking marketing launches and ruby masterclasses, as well as participating in gem and jewellery fairs to maximize awareness on responsible sourcing.

Mining.com