Global energy transition set to spark minerals boom

The global shift to clean energy is going to drive an unprecedented boom for critical minerals, according to the International Energy Agency (IEA), raising questions of supply and the overall environmental cost

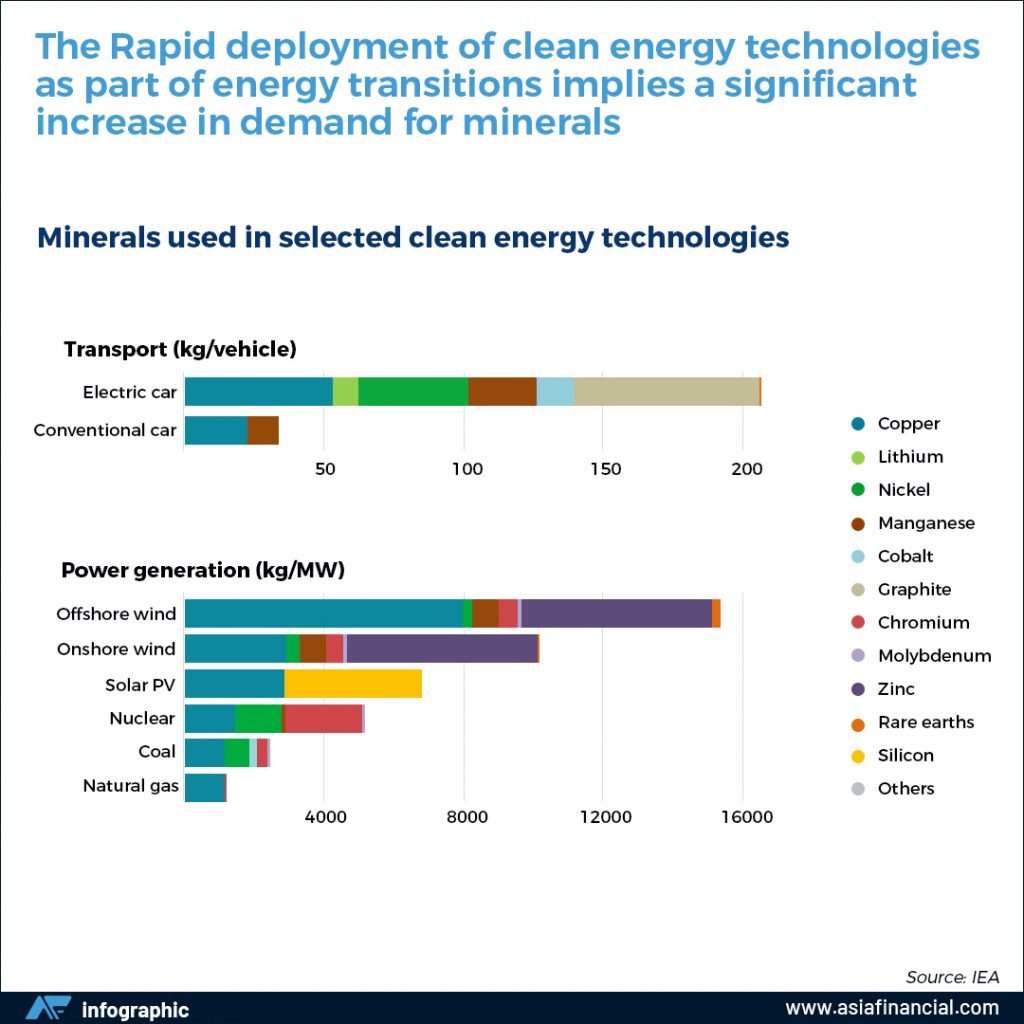

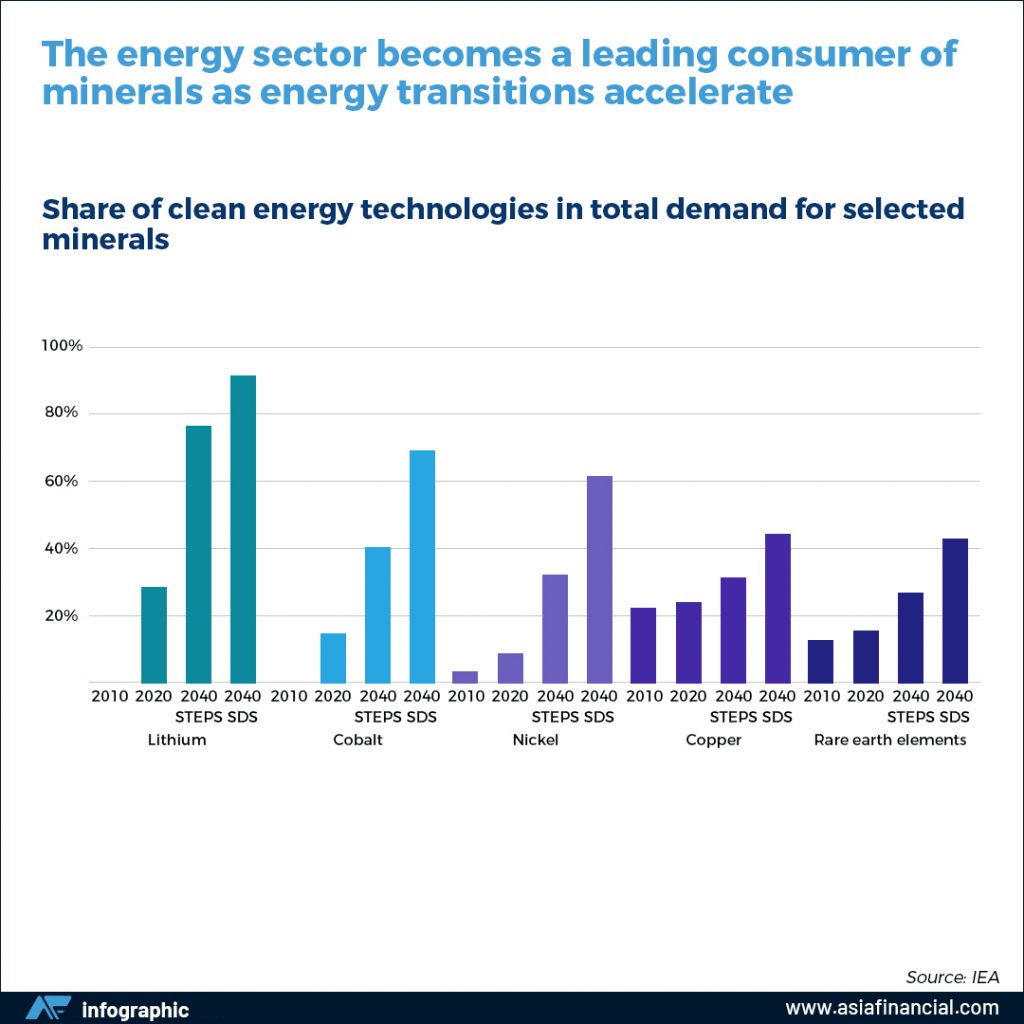

(AF) Until the mid-2010s, the energy sector represented a small part of total demand for most minerals, the IEA noted in a new report. However, as energy transitions gather pace, clean energy technologies are becoming the fastest-growing segment of demand. The rise of low-carbon power generation to meet climate goals would mean a tripling of mineral demand from this sector by 2040.

“The shift to a clean energy system is set to drive a huge increase in the requirements for these minerals, meaning that the energy sector is emerging as a major force in mineral markets,” the agency said in the report, “The Role of Critical Minerals in Clean Energy Transitions”.

In a scenario that meets the Paris Agreement goals, clean energy technologies’ share of total demand rises significantly over the next two decades to more than 40% for copper and rare earth elements, 60- 70% for nickel and cobalt, and almost 90% for lithium.

Electric vehicles (EVs) and battery storage have already displaced consumer electronics to become the largest consumer of lithium and are set to take over from stainless steel as the largest end user of nickel by 2040.

In climate-driven scenarios, mineral demand for use in EVs and battery storage is a major force, growing at least 30 times to 2040. Lithium sees the fastest growth, with demand growing by over 40 times in the SDS by 2040, followed by graphite, cobalt and nickel (around 20-25 times).

The expansion of electricity networks means that copper demand for power lines more than doubles over the same period.

SIX KEY TAKEAWAYS

The IEA report makes six major recommendations:

- Ensure adequate investment in diversified sources

- Promote technology innovation at all points along the value chain

- Scale up recycling; Policies can play a pivotal role in preparing

- Enhance supply chain resilience and market transparency

- Mainstream higher environmental, social and governance

- Strengthen international collaboration between producers

The prospect of a rapid increase in demand for critical minerals – well above anything seen previously in most cases – raises huge questions about the availability and reliability of supply. In the past, strains on the supply-demand balance for different minerals have prompted additional investment and measures to moderate or substitute demand.

But these responses have come with time lags and have been accompanied by considerable price volatility. Similar episodes in the future could delay clean energy transitions and push up their cost. Given the urgency of reducing emissions, this is a possibility that the world can ill afford.

In addition, concerns about price volatility and security of supply do not disappear in an electrified, renewables-rich energy system, the agency said.

“Today’s international energy security mechanisms are designed to provide insurance against the risks of disruptions or price spikes in supplies of hydrocarbons, particularly oil.”

PACE OF TRANSITION

The IEA estimates that the goals of the Paris Agreement (climate stabilisation at “well below 2°C global temperature rise”, as in the IEA Sustainable Development Scenario [SDS]) would mean a quadrupling of mineral requirements for clean energy technologies by 2040.

“An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today,” the IEA says.

While hydropower, biomass and nuclear make only minor contributions given their comparatively low mineral requirements, wind and solar require lots of inputs given their infrastructure-heavy design. The rapid growth of hydrogen as an energy carrier underpins major growth in demand for nickel and zirconium for electrolysers, and for platinum-group metals for fuel cells.

Future technologies remain unknown. Cobalt demand could be anything from 6 to 30 times higher than today’s levels depending on assumptions about the evolution of battery chemistry and climate policies. Likewise rare earth elements may see three to seven times higher demand in 2040 than today.

The prospect of mineral-driven energy transformation has already excited investors. Australian minerals explorers have raised the most cash in nearly a decade as investors rush into gold as well as lithium and copper explorers expected to boom in the global energy transition.

ENTHUSIASTIC INVESTORS

A recent report by BDO, the accounting and consulting group, showed that Australian-listed explorers raised A$2.37 billion ($1.81 billion) in the March 2021 quarter, the most since 2013, and almost double the figure in March 2020.

“There’s no doubt about where the money’s going and why it’s going there,” Sherif Andrawes, BDO’s head of global natural resources, says, noting that the flood of funding towards battery minerals and clean energy companies is in line with growing environment social and governance (ESG) initiatives, including rising EV adoption and lower carbon emission targets.

Among companies that raised more than $10 million over the quarter were 10 gold companies, nine lithium companies, four uranium companies, four rare earth metals companies and four graphite companies. The remaining companies covered 14 different sectors, most notably copper-gold, copper and oil and gas, BDO said.

Fossil fuel companies have been forced to join the transition, with the IEA expecting them to increase climate-friendly investments to at least 4% of their capital spending in 2021, up from just 1% last year. The figure underscores both the rapid pace that investment is tilting toward low-carbon sources as well as the scale of the challenge.

The IEA said earlier this year that the world needs to stop development of new oil and gas fields as well as coal mines to limit global temperature increases.

ONE SIDE OF THE COIN

“Much greater resources have to be mobilised and directed to clean energy technologies to put the world on track to reach net-zero emissions by 2050,” said Fatih Birol, IEA’s executive director. “The rebound in energy investment is a welcome sign, and I’m encouraged to see more of it flowing toward renewables.”

Some critics say the IEA’s goals are laudable but that new investment is not the complete answer.

“Generating clean energy is only one side of the coin, we must also reduce the energy we waste and use what we produce more efficiently,” Jonathan Maxwell, CEO of Sustainable Development Capital, a private equity group, says. “After all, the cleanest energy is always the energy we don’t use.”

In addition, many minerals operations carry a high environmental cost. “Production and processing of mineral resources gives rise to a variety of environmental and social issues that, if poorly managed, can harm local communities and disrupt supply,” the IEA notes.

Consumers and investors are increasingly calling for companies to source minerals that are sustainably and responsibly produced.

“Without broad and sustained efforts to improve environmental and social performance, it may be challenging for consumers to exclude minerals produced with poor standards as higher-performing supply chains may not be sufficient to meet demand,” the report says.

CLIMATE RISKS

Mining assets are exposed to growing climate risks, the IEA acknowledges.

More than 50% of today’s lithium and copper production is concentrated in areas with high water stress levels, while several major production regions such as Australia, China, and Africa are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supplies.

Higher prices as a result of tight supply could have a major impact on the level of grid investment, the IEA says. “Our analysis of the near-term outlook for supply presents a mixed picture.”

Some minerals such as mined lithium and cobalt are expected to be in surplus in the near term, while lithium chemical products, battery-grade nickel and key rare earth elements such as neodymium and dysprosium might face tight supply in the years ahead.

“However, today’s supply and investment plans are geared to a world of more gradual, insufficient action on climate change,” the IEA says. “They are not ready to support accelerated energy transitions.”