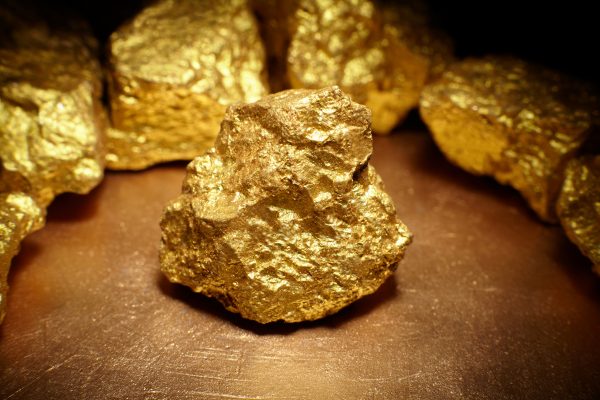

Gold exports hit record high

Zimbabwe’s gold exports hit a record high of US$184.2m in July, mirroring the favourable Reserve Bank of Zimbabwe (RBZ)’s policies and improved commodity prices on the international markets.

The export receipts reflected a 132% increase from US$79.3m reported in the same month in 2020.

The central bank recently introduced favourable policies that include a 5% incentive, scrapped taxes for small scale miners and is now timeously paying miners for gold deliveries in line with the international gold prices.

Before the July haul, June had the highest export receipts after Zimbabwe reported US$141.5m.

“Our July gold export receipts increased 132% courtesy of the new policies which saw miners clocking 500 kilogrammes weekly,” RBZ governor John Mangudya told Business Times.

Overall, Mangudya said gold export receipts rose 42% to US$648.4m for the seven months to July from US$457.2m.

Smugglers were believed to be taking about 2.5 tonnes to alternative markets every month.

But, with new policies in place, the majority of them are now delivering to Fidelity Printers and Refiners (FPR), the country’s sole buyer and marketer of gold.

Mangudya said the increase in gold export receipts show that most miners were delivering the yellow metal to FPR as it is offering competitive prices.

An industry official, who preferred anonymity, told Business Times that some gold buyers visited Treasury offices and RBZ, seeking the loosening of gold policies.

“Recently a group of buyers visited the RBZ building asking for a more level playing field in the gold sector but we knew that these were smugglers who were capitalising on high royalties and the cost of importing cash…” said the official.

“We just told them that we will look into the matter as to how best we can address the issue but in actual fact we know that we have done well to plug holes.”

Small scale miners also confirmed selling their gold to FPR with the Zimbabwe Miners Federation chief executive Wellington Takavarasha saying: “This time FPR is the best place to be as it is paying timeously and at the prevailing international gold market rate with some incentives for those who deliver 20kg and above. Small scale miners are delivering above 300 kg weekly and more is expected.”

As a result, the June 2021 gold deliveries clocked 2.92 tonnes against 1.4 tonnes same period last year due to a reviewed Fidelity’s buying price of gold for the artisanal and small scale miners.

Small scale miners delivered around 1.7 tonnes against large scale miners’ 1.1 tonnes.

The government has moved to provide equipment in gold centres to move towards helping the attainment of US$4bn gold export revenue.

In her post-Cabinet briefing this week, Information, Publicity and Broadcasting Services minister Monica Mutsvangwa said the government was targeting to establish gold centres across the country, a move which will help the country achieve a US$12bn mining industry by 2023.

“Gold centres are expected to provide basic equipment such as compressors and jackhammers as well as working capital to facilitate optimal production by small-scale miners who supply gold ore. The RBZ shall maintain presence, directly or through approved buying agencies, at all gold centres so as to buy all the gold produced,” she said.

Mutsvangwa said the gold centres will also provide technical services to miners who supply the ore.

“Cabinet approved proposals for the establishment of over20 Gold Centres by mid-2022. Accordingly, memoranda of understanding will be signed with four investors who have been identified for the purpose of setting up the Gold Centres.

The investors will own 100% equity in the centres, while those who operate joint ventures with the Ministry of Mines and Mining Development will fully fund the operations of the centres in return for a 90% equity stake,” Mutsvangwa said.

Business Times