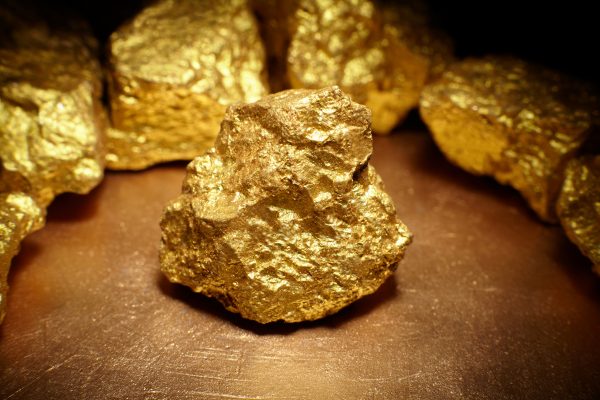

Listed diversified group, Padenga Holdings Limited’s revenue grew 10% to US$78.5m in the reviewed period from US$71.6m achieved in the previous year on the positive performance in the gold mining division.

The uptick in revenue comes when the crocodile and the alligator businesses faced reduced demand and changing market dynamics.

Padenga recently acquired a controlling stake in Dallaglio group, which contributed 66% to the total revenue while Zimbabwe crocodiles contributed 31%. Texas alligators contributed 3%.

“Solid group revenue performance was largely driven by exceptional contribution from the mining operations. This follows the on-line commissioning of the new Eureka Gold Mine in Guruve in October 2021. The

Eureka Gold Mine achieved its plant nameplate capacity seven weeks earlier than forecast on November 25, 2021,

” board chairman, Thembinkosi Sibanda said.

The mining division made an operating profit of US$8.4m. There was a 43% increase in operating costs and the mining business generated positive cash flows of US$10.1m from its operations that contributed to working capital relief.

“Gold volumes for the Dallaglio group are therefore anticipated to increase 25% during 2022 with a concomitant 20% reduction in the all in sustaining costs per ounce produced . This will increase margins and

enhance profitability. Eureka produced 976kgs which was an improvement from 722kgs in the prior year, ” Sibanda said.

He said the mining sector picked up its pace in the second half of the year as Eureka made its successful commercial production volume in September 2021 following its official opening on October 21, 2021 by President Emmerson Mnangagwa.

Despite growth in revenue, Padenga, however, plunged into a US$7.4m loss from a profit of US$3.2m achieved in the previous year.

Total assets stood at US$169.8m from US$151m in 2020.

.png)