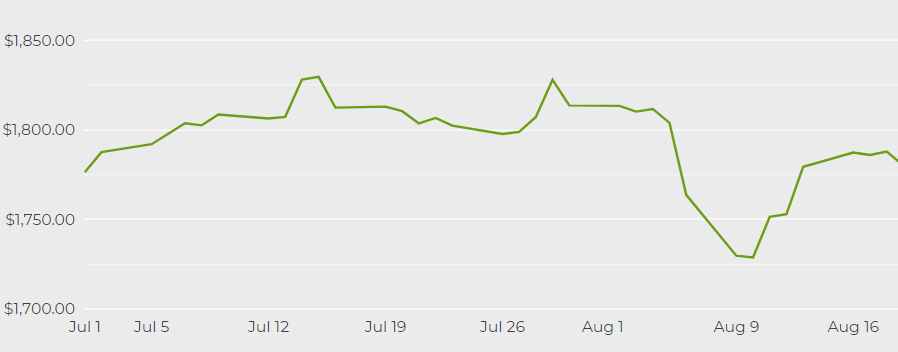

Gold prices rose above $1,800 per ounce on Monday after the US dollar retreated from multi-month highs, while investor concerns that the Delta coronavirus variant could dampen the pace of global economic recovery also lifted bullion’s safe-haven appeal.

Spot gold rose 0.5% to $1,801.63 per ounce by 11:30 a.m. EDT, the highest in over two weeks. US gold futures jumped 1.2%, trading at $1,805.30 per ounce in New York.

Meanwhile, the dollar index was down 0.4%, easing off the 9-1/2-month high hit last week, bolstering gold’s allure for holders of other currencies.

“The Delta variant is throwing sort of a spanner into the works on how likely and how soon we could see a tapering announcement,” ING analyst Warren Patterson told Reuters on Monday.

Dallas Federal Reserve President Robert Kaplan, a strong supporter for tapering stimulus, said on Friday he might need to adjust that view if the Delta variant slows economic growth materially.

In the clearest sign yet of the impact of the Delta variant on the Fed’s plans, covid-19 restrictions have prompted the US central bank to schedule its annual economic symposium in Jackson Hole, Wyoming on August 27 virtually and not in person as planned.

Chair Jerome Powell is expected to give a speech at the event on the economic outlook.

“I don’t think Powell will give a clear timeline for stimulus withdrawals. So the dollar will fall and gold could rise beyond $1,800,” predicted Jigar Trivedi, commodities analyst at Mumbai-based broker Anand Rathi Shares.

Highlighting the toll from the recent surge in infections, Japan’s factory activity growth slowed in August, while that of the services sector shrank at the fastest pace since May last year.

(With files from Reuters)