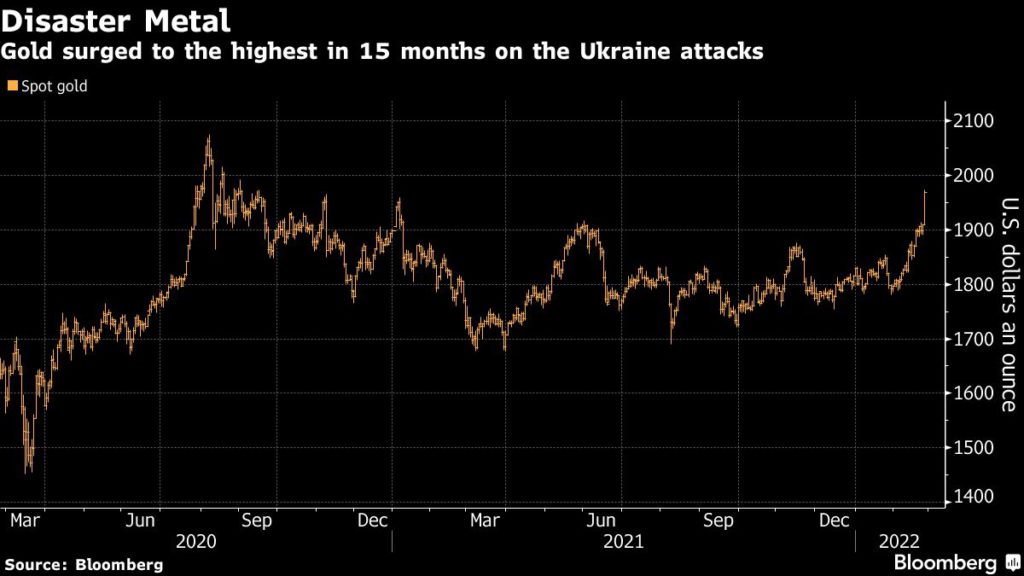

Gold blasted to its highest since 2020 after Russian forces attacked targets across Ukraine, triggering the worst security crisis in Europe since World War II and further crushing risk sentiment across the global markets.

On Wednesday evening, Russia President Vladimir Putin vowed to “demilitarize” Ukraine and replace its leaders, while the West threatened additional sanctions in response. In response, US President Joe Biden announced he would impose “further consequences” on Russia after what he called an “unprovoked and unjustified attack.”

“The Russian invasion of Ukraine puts the markets in panic mode,” Alexander Zumpfe, senior trader at refiner Heraeus Metals Germany GmbH & Co., told Bloomberg. “Investors are throwing shares out of their portfolios and fleeing to safe havens.”

Evidently, US futures and European stocks both tumbled, while Treasuries rallied. Gold jumped the most in almost two years, even as the dollar strengthened. Bullion priced in euros even hit an all-time high.

Gold has been trending up in recent weeks as Moscow’s standoff with the West intensified, helping to offset other headwinds like the US Federal Reserve’s policy tightening, which was expected to weigh on the metal.

Analysts will now be forced to look carefully at their price forecasts for the year. “It’s more than what the market was anticipating,” said RJO Futures senior market strategist Bob Haberkorn, in a Reuters report.

We “expect that gold prices break through $2,000/oz in the coming days if the conflict further escalates,” Bernard Dahdah, senior commodities analyst at Natixis SA, wrote in a Bloomberg note. “A quick correction will ensue once the conflict’s intensity winds down.”

“If Russia in fact does take Kiev and the international community has an aggressive response, gold will trade up over $2,000 fairly quickly,” RJO Futures’ Haberkorn predicted.

Mining (With files from Bloomberg and Reuters)