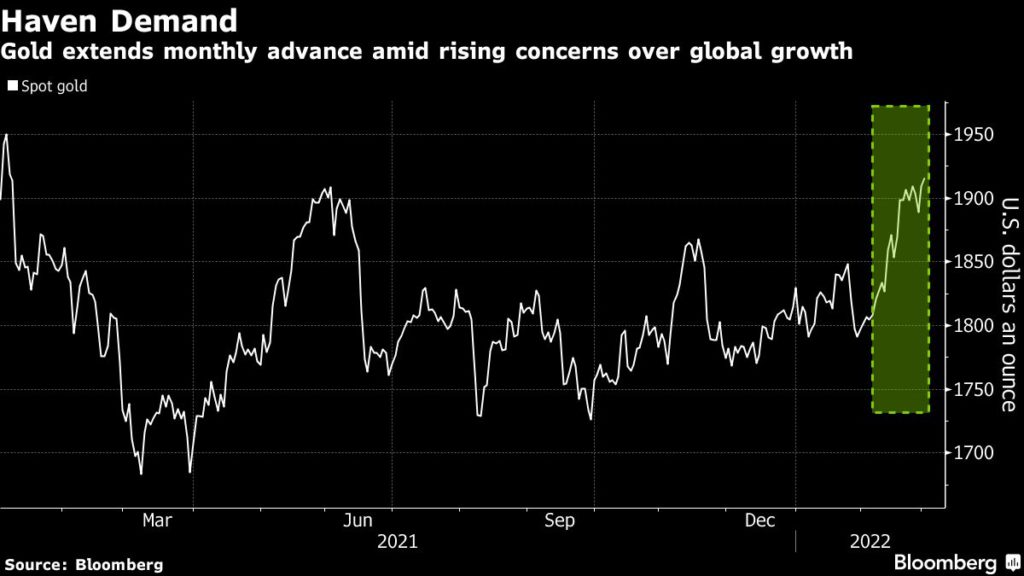

Gold extended gains on Tuesday as investors continue to assess the risks to global growth that may stem from the sanctions against Russia in the wake of its invasion of Ukraine.

Spot gold rose 1.0% to $1,927.76 per ounce by 11:30 a.m. ET, recovering from last week’s slight dip and reaching a new 15-month high. US gold futures were up 1.5% to $1,930.40 per ounce in New York.

Treasuries also climbed, and traders are abandoning bets on a half-point rate hike by the Federal Reserve this month amid concerns that an escalation of war could weigh on the growth outlook. US equities fell while the dollar advanced.

Earlier, Russia said it would press forward with its invasion of Ukraine as troops were seen moving in a large convoy toward the nation’s capital Kyiv. As penalties against the Kremlin mounted, the European Union identified seven Russian banks it’s considering excluding from the SWIFT payment system.

Bullion remains “largely supported amid haven flows due to the Ukraine situation,” Fawad Razaqzada, market analyst at ThinkMarkets, said in a Bloomberg interview.

“The metal also got additional support from falling bond yields, which are further weighing on real yields with inflation continuing to soar. Investors are reducing their expectations about aggressive tightening from central banks,” Razaqzada added.

According to Bloomberg data, gold-backed ETF holdings registered the biggest daily inflow in three weeks on Monday. “Gold ETF inflows is a clear sign generalist investors are sourcing war hedges and safe havens,” said Nicky Shiels, head of metals strategy at MKS PAMP SA.

Mining(With files from Bloomberg)