Gold had a monumental 2020 as bullion soared to multiple record highs throughout the year amid the economic uncertainties brought by the covid-19 pandemic, which helped to cap off its best annual performance in a decade.

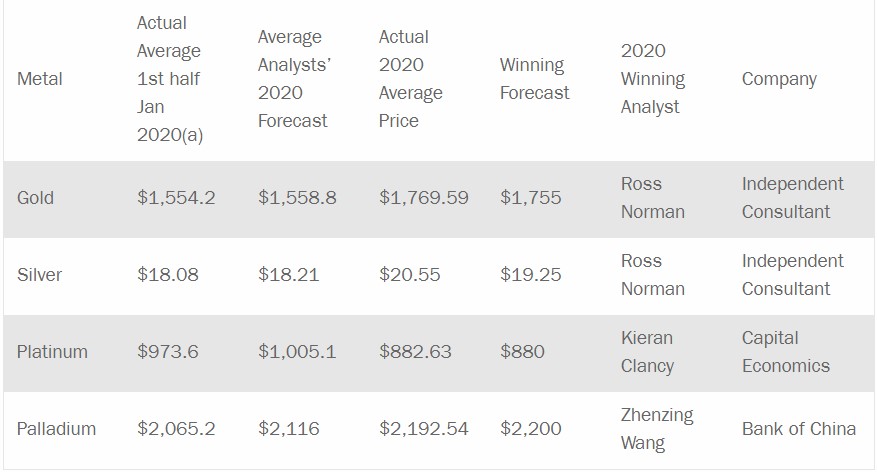

According to the London Bullion Market Association’s (LBMA) annual precious metals forecast competition, analysts were forecasting the gold price to be $1,558.8/oz on average, an increase of 12% from the average price in 2019, but still short of the actual average price by over $200/oz.

DURING THE PAST CALENDAR YEAR, GOLD PRICES TRADED AT AN AVERAGE OF $1,769.59/OZ, WELL EXCEEDING WHAT MOST ANALYSTS WERE FORECASTING

Therefore, only the most bullish analysts came close to the actual figures, with Sharps Pixley’s Ross Norman taking home the first place prize with his forecast of $1,755/oz, just $14 shy of the actual price.

Taking second place was Rene Hochreiter (Noah Capital Markets/Sieberana Research Pty Ltd) with his forecast of $1,670/oz, followed in third place by Frederic Panizzutti (MKS PAMP GROUP) with his forecast of $1,636/oz.

All three analysts secured first place finishes in the 2019 survey, which saw participants under-predict gold prices by about $80.

In other precious metals, Ross Norman also snatched first place in the silver category with his forecast of $19.25/oz, close to the actual price of $20.55/oz in 2020. This was Norman’s ninth first-place finish since the survey began.

Kieran Clancy of Capital Economics took first place in platinum with his forecast of $880, which was less than $3 from the actual average.

Lastly, Bank of China’s Zhenzing Wang won the first prize in palladium by virtue of his low/high ranges of $1,610-$2,500, which were closest to the actual low/high range of $1,557-$2,781.

The four winners would each receive a 1 oz gold bar donated by MKS PAMP.

Mining.com