Gold prices have trended lower since the start of 2021, amidst rising US treasury yields and an increasingly positive outlook for the economic recovery.

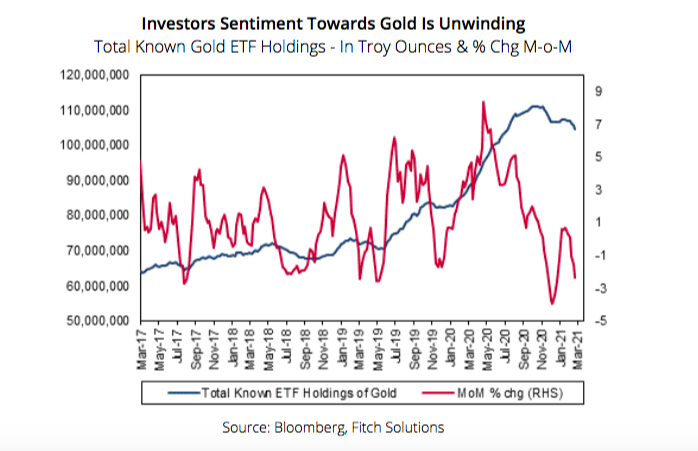

Investor sentiment towards gold has also continued to ease significantly in recent months following the rally recorded in H120 and the peak in prices reached in August last year.

Gold prices could remain supported over March-April as inflation will likely pick-up and could rise faster than bond yields sending real bond yields even in more negative territory, market analyst Fitch Solutions predicts in its latest industry report, adding that this will likely push real interest rates lower in the near term, temporarily boosting the appeal for gold.

Fitch forecasts gold prices could see some volatility in the coming weeks as financial markets assess incoming inflation readings.

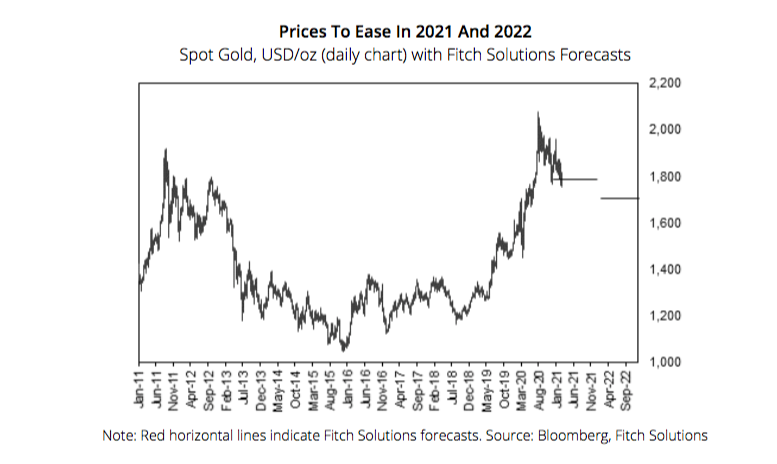

However, the analyst believes gold prices will trend lower on a six-to-twelve-month horizon given its expectations for bond yields to rise this year and as macroeconomic uncertainty eases.

As such, Fitch is revising down its 2021 gold price forecast, to an average of $1,780/oz from $1,850/oz previously.

A key gold driver to monitor in the coming weeks will be rising inflationary pressures. Fitch’s Macro team expects inflation to pick up over the coming months but believes that it will only be temporary as base effects will start to wear off around Q321 and that significant slack in the economy exists.

This helps to underpin the analyst’s view for gold prices to remain supported in the near term, before they ease later in the year as inflation pressures fade and as bond yields continue to rise. However, Fitch notes that a stronger-than-anticipated rise in inflation readings or inflation expectations could provide significant a temporary tailwind to gold as it is traditionally seen as a hedge against inflation.

Prices will be driven by both upside and downside pressures in 2021, but Fitch believes the balance weighted to the downside. The analyst’s forecast implies prices will trend lower overall this year and in 2021, the average price will be similar to the $1,773/oz average in 2020.

Fitch maintains its forecasts for 2022 and beyond, expecting gold to trend lower in the coming years as monetary policy continues to normalise, and as the US Fed raises interest rates and winds down its balance sheet.

Fitch continues to hold a below-consensus view on gold prices, in 2021 and beyond.

Mining.com