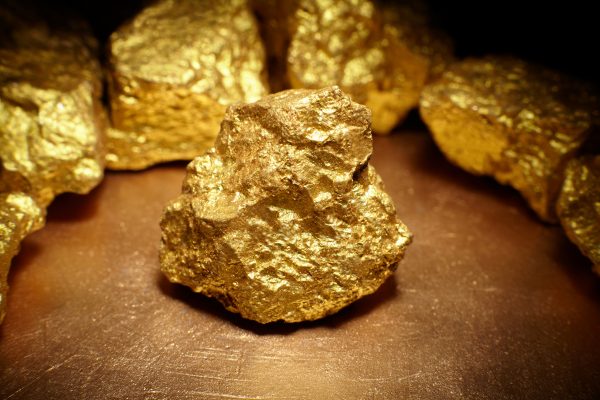

The most sort after special mineral, Gold has disappointed investors lately and is likely to continue doing so.

According to Forbes here’s what’s happening and why you should be happy about it.

Gold Prices Melting

The SPDR Gold Shares exchange-traded fund (Ticker: GLD), which closely tracks the price of bullion, has fallen 4.1% in the three months through Friday, compared to a gain of 7.3% for the SPDR S&P 500 (SPY) ETF, which tracks the S&P 500 stock index, according to data from Yahoo. The latter figure excludes dividends.

The bad news for anyone holding substantial quantities of bullion is that for the foreseeable future things aren’t likely to get better. In other words, gold prices will either languish where they are now, at around $1,465 a troy ounce or drop further.

Part of the reason that will likely happen is that investors are still overly bullish on gold.

“The specs (speculators)keep increasing longs, not decreasing them,” writes Rick Bensignor, author of the Bensignor Investment Strategies financial newsletter.

What he means here is that traders, or ‘specs’ in his vernacular, are placing more and more bets on the price of gold going up. He knows this because the Commodity Futures Trading Commission, which regulates futures markets, produces a weekly report detailing which way fund managers are betting.