Copper is trading more than $800 per tonne below the near-decade high hit in February, and some of the ardour of copper price bulls has cooled decidedly since then.

Snowdon doubled down on the investment bank’s view that the mining sector is at the start of a supercycle, citing three factors driving the boom in the broader commodity market:

Long-running structural underinvestment in the “old economy”, including mining, infrastructure and industrial production, new redistribution policies ushered in by covid that target commodity-intensive social needs rather than financial stability and thirdly, a massive rise in government spending, particularly in the US.

Green has copper core

Snowdon says environmental policies will drive a capex boom on par with the 1970s and 2000s over the course of the next decade and copper is the core of the green energy transition:

“We estimate nearly $16 trillion would have to go into green-focused infrastructure to achieve decarbonisation targets, compared to just $10 trillion in China during the last supercycle.”

Another factor supporting higher raw material prices is the vulnerability of global supply chains exposed by covid and the subsequent destocking in Western countries – notably in the copper trade, where Chinese imports have continued to set records.

Ex-China growing faster

Snowdon says while the market is only now entering a period of deficits, by the second half of next year the copper market would be at its tightest point since the mid-2000s with very low inventories leading to concerns about scarcity.

“We are in a supercharged, synchronised global demand surge. Chinese demand remains very strong, growing at 4% this year, underpinned by strength in infrastructure investment, strong completion phase in the property sector, and also strong recovery in consumer led sectors.”

But what is particularly unusual of the current copper market is the pace of demand recovery in ex-China economies, says Snowdon:

“We forecast demand growth in developed economies at a faster rate than China – close to 7% growth rate this year.”

Supply gap becomes a chasm

On the supply side, Snowdon points to the collapse in treatment and refining charges (paid by miners to smelters) which reflects underperforming mine supply as evidenced by exports from Chile and Peru, which have not recovered as expected this year.

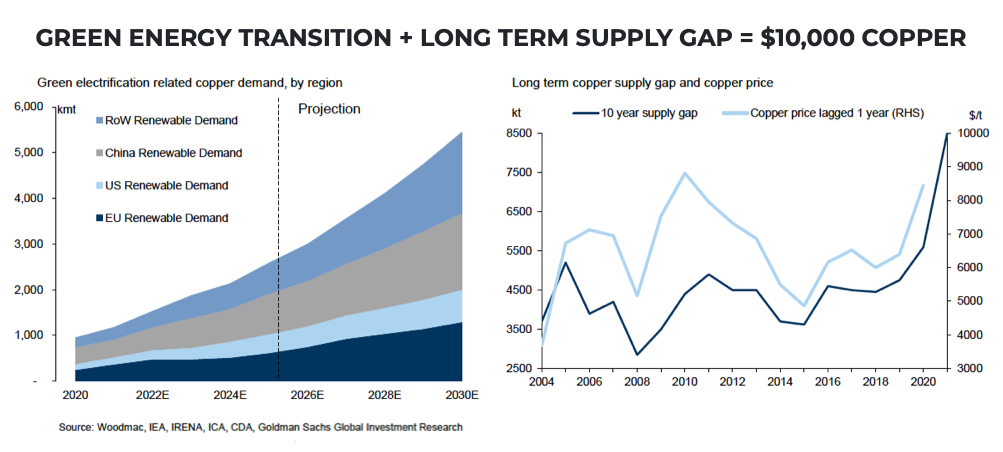

Green-related demand will gather pace in the second half of this decade, ultimately generating nearly 5 million tonnes of additional demand, according to the Goldman forecast.

Set against a peak in global mine supply from 2024 onwards, Snowdon says these fundamentals will generate “a record long term supply gap by the end of the decade that has to be solved by investment in new mine capacity.”

The long-term supply gap has really opened up in the last few years and at the current 8 million tonnes is close to double the supply gap during the last bull market in the 2000s and early 2010s.

“This can only be resolved by higher prices stimulating investment in new supply,” says Snowdon.

Mining,com