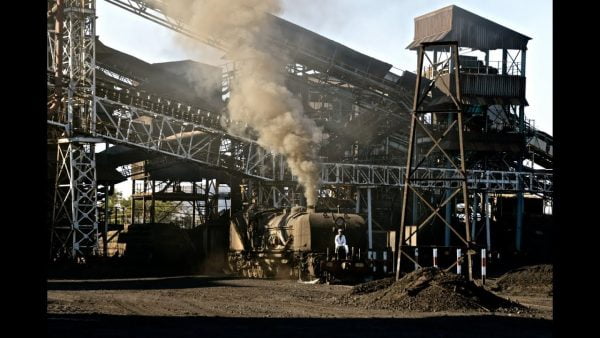

Ailing Hwange Colliery Company Limited (HCCL) has announced its voluntary suspension from the London Stock Exchange (LSE) with effect from Monday this week.

The temporary suspension of the company on the LSE comes after the colliery was suspended in 2018 from trading on the Zimbabwe Stock Exchange (ZSE) and the Johannesburg Stock Exchange (JSE) after it adopted a reconstruction path.

“Hwange wishes to advise shareholders that following the suspension of trade on the JSE that has been in force since November 2018, it has successfully requested that the FCA (Financial Conduct Authority) in the UK suspend its listing on the UK Official List, which suspension also suspends Hwange’s trading on the London Stock Exchange.

“The request for suspension was approved by the FCA on 10 February 2020, with the suspension effective from 10 February 2020. Shareholders will be updated in due course,” it said in a statement issued on behalf of the board by a JSE sponsor, Sasfin Capital, a division of Sasfin Bank Limited.

A statement released by RNS, the news service for LSE, also confirmed the development.

“The Financial Conduct Authority temporarily suspends the securities set out below from the official list effective from 10 February 2020 at the request of the company,” reads the statement.

The suspension from ZSE and JSE followed the placement of the coal miner under reconstruction by its major shareholder, the Government, to save it from liquidation.

The decision was done in terms of the Reconstruction of State-indebted Insolvent Companies Act.

According to the Reconstruction Act, every disposition of the property, including rights of action of the company and every transfer of shares or alteration in the status of its members made after the commencement of the reconstruction, shall unless the administrator otherwise orders, be void.

HCCL’s suspension on the ZSE is for the duration of the administration. The government has justified its decision to place the ailing coal producer under reconstruction, saying as a majority shareholder, it had noted that there was no sense in continuing with the business. One of the major reasons was that the company was operating on a gross loss with the cost of production alone, before factoring other overheads, outweighing sales revenue.

Further compounding to its placement under reconstruction at the time was a US$42 million debt to Mota Engil.

Meanwhile, HCCL in the first half year of 2019 posted a profit of $3,5 million recovering from a loss of $23 million recorded in the previous year.

The troubled firm had been in the red for successive years as it struggled with viability and corporate governance issues and constant changes in management has not helped the situation.

The Chronicle