Positive project progressions in UK and EU lithium development will bode well for their respective battery supply chains and mission to reduce dependence on Chinese critical raw materials, market analyst Fitch Solutions asserts in its latest industry report.

Primary importing economies, such as the EU and the US have increasingly implemented policies to secure critical minerals sourcing and diversify away from China, following a multi-pronged approach. Domestic lithium extraction progress is needed to advance diversification of the battery value supply chain, Fitch asserts.

Zero-carbon lithium makes strides in EU

The EU offers the most promising, near-term development of lithium extraction with several projects in its pipeline likely beginning production around 2023, Fitch says. The European Commission added lithium to its list of critical raw materials for the first time in 2020, signifying its shift to the forefront of attention.

Also this month, Vulcan Resources released a pre-feasibility study for its much-anticipated Zero-Carbon lithium project in Germany, reporting its lithium resources to be the largest in Europe.

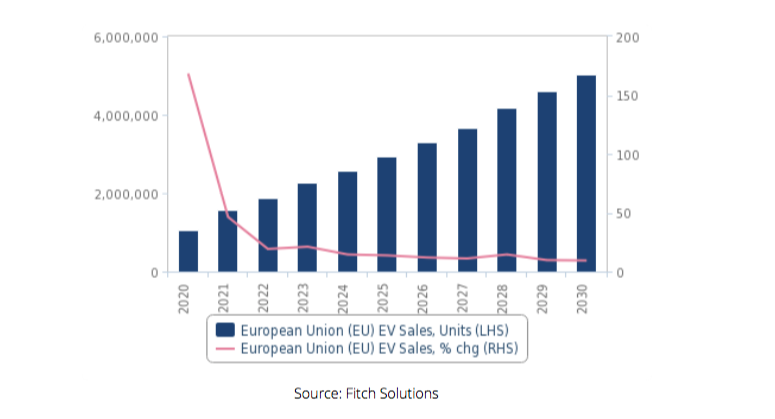

The company has pioneered a lithium extraction technique using geothermal power which it claims to emit no carbon dioxide (CO2), matching the EU stringent climate agenda, Fitch reports. The project is expected to produce enough lithium for 1mn EV batteries per annum, with possible production beginning in 2024, strengthening the EU’s capability to supply its domestic EV fleet.

Recent investment in Savannah Resources’ Mina do Barroso lithium project in Portugal will advance the project timeline by helping finance the definitive feasibility study, Fitch says. In January, Savannah reached a $6.4 million investment agreement with Galp Energia which will enable Galp to acquire a 10% maximum stake in Mina do Barroso.

Portugal is currently Europe’s largest lithium producer, accounting for 1.6% of global production in 2019, however Portuguese lithium is not marketed to the auto sector, but instead ceramics and glassware, Fitch points out. While Savannah Resources CEO David Archer says the lithium oxide at Mina do Barroso will be well-suited for implementation in EV batteries, initial lithium oxide spodumene will be exported to China.

Other key lithium projects in the development pipeline in the EU include CEZ Group and European Metals’ Cinovec project in the Czech Republic. European Metals announced that it has entered into a support and financial agreement with EIT InnoEnergy, the innovation engine of the European Battery Alliance initiated by the European Commission. European Metals said this partnership will facilitate the accelerated construction financing and commercialization of the largest hard rock lithium deposit in Europe.

In Austria, European Lithium’s Wolfsberg project is making progress, and operations could start around 2023. Keliber Oy’s eponymous project in Finland could also begin operations in 2023, as could Erris Resources and SolarWorld’s Zinnwald project in Germany. Infinity Lithium’s San Jose lithium project in Spain is making progress and could start operations around 2024-25 as it received in December a key exploration permit required to progress towards an exploitation concession.

Lithium Australia’s Sadisdorf project in Germany is on hold. The company did not renew the Sadisdorf license after it ran full term, relinquished the 133-square kilometre Eichight exploration license, and is yet to make a decision on the future of the Hegelshöhe license as covid-19 restrictions have limited Lithium Australia’s acitivities in the country.

Exore Resources and Preseus Resources’ Sepeda project in Portugal has made no recent progress.

Fitch emphasizes China’s maintained dominance in downstream activities will prove much more difficult for Europe to overcome.

Thacker Pass approval in US

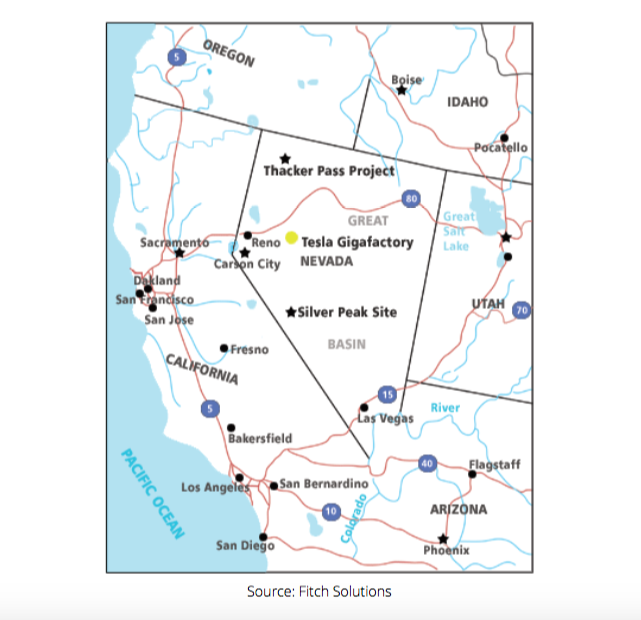

On January 15, the US Bureau of Land Management issued the Record of Decision for Lithium Americas Corp’s Thacker Pass lithium project, signaling a successful leap in the US reshoring of lithium extraction.

The project, located in Humboldt County, Nevada, is the largest known lithium resource in the country with 6mnt of lithium carbonate equivalent (LCE). According to Lithium Americas, US battery production capacity will require more than 250kt of LCE by 2030, with Thacker Pass well-positioned to contribute at a competitive cost of $4,088/tonne of lithium. Thacker Pass is expected to begin producing by 2023, making it one of the most advance-staged lithium developments in the US.

Meanwhile, Albemarle, owner of the only producing lithium mine in the US, Silver Peak, announced in January 2021 that it plans to double production capacity by 2025.

US homegrown lithium developments well-positioned near Tesla battery factory

UK needs more domestic investment

The recent successful achievement of lithium carbonate production in the United Kingdom will boost the country’s potential to provide for its domestic supply chain in the longer term, Fitch forecasts. On January 18, Li4UK (Securing a Domestic Lithium Supply Chain for the UK) reported positive lithium production from two projects within the UK, including Cornish Lithium (CLL)’s Trelavour project in Cornwall.

Li4UK is a project commissioned by the UK government to evaluate the viability of producing battery-grade lithium from domestic sources. The initiative was carried out by a consortium that includes Wardell Armstrong International (WAI), The Natural History Museum (NHM) and CLL. Cornish Lithium is also trialing a pilot plant using a zero-carbon, direct lithium extraction technology (DLE), similar to Vulcan Resources in Germany.

Fitch‘s autos team forecasts EV sales in the UK to surpass 296,000 units in 2021, representing y-o-y growth of 70.6%, and placing the UK as the third largest European EV market by sales volume.

Australia still dominates

Australia will maintain its position as the number one global lithium producer in the short term, underpinned by strong government support and a robust project pipeline, Fitch asserts. According to the USGS, Australia accounted for 54.4% of global lithium production in 2019, more than double the output of the world’s second-largest producer, Chile.

Core Lithium’s Finniss lithium project remains on track for targeted construction in H221 and commercial production in 2022. Located in the Northern Territory, it is expected to produce 175kt of high-quality lithium spodumene concentrate annually.

Core Lithium’s largest offtake partner, Yahua Industrial Group, has signed a supply agreement with Tesla to provide the auto manufacturer lithium hydroxide for battery use, sustaining demand for Australian lithium.

Other significant domestic lithium projects underway include Wesfarmer’s Mount Holland project and Liontown Resources’ Kathleen Valley project. The Mount Holland project is expected to produce 45kt of battery-grade lithium hydroxide per year (post ramp-up), and the firm plans to reach an investment decision during the first quarter of 2021, Fitch says.

In January, Liontown Resources reportedly proceeded to the next stage of project development, with a definitive feasibility study (DFS) for Kathleen Valley scheduled to be complete by Q42021. The project has an annual expected production of 295kt of lithium oxide spodumene concentrate_Mining.com

.png)