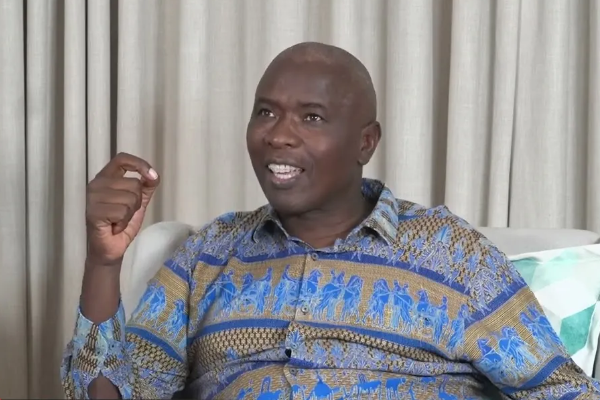

Economist and President Mnangagwa advisor Eddie Cross has said business mogul Kudakwashe Tagwirei left Zimbabwe’s biggest mining company Kuvimba Mining House (KMH).

In an interview with a local daily, Cross revealed that Kuda’s journey began with the fuel business, where he capitalized on sales and eventually secured a substantial share in the Zimbabwe-Mozambique fuel pipeline.

Cross said Tagwirei made considerable profits from these ventures, allowing him to diversify his portfolio into various properties and investments.

Cross said Tagwirei made a strategic decision to channel his wealth into Kuvimba, a burgeoning enterprise with seven mines on its portfolio. Investing heavily in Kuvimba, Kuda played a pivotal role in its development and success.

“Kuda was Kuvimba. He took all the money he got from the fuel business, disposing of the sales, putting the pipeline back to NOIC because he had 50 per cent shares of the pipeline and NOIC bought him out. He made a lot of money and bought a lot of properties and put it into Kuvimba. Now Kuvimba has been taken over by the National Wealth Fund (Mutapa Fund),” Eddie Cross said in the interview.

Kuvimba has since undergone a significant transformation, being taken over by the National Wealth Fund, also known as the Mutapa Fund.

Tagwirei’s investment into Kuvimba has seen the rise of the Shamva gold mine located 90km northeast of Harare.

However, the company now faces a daunting task at some of its mines namely Bindura Nickel, Sandawana (Lithium) and Great Dyke Investments (Platinum) due to plummeting commodity prices.

This has led to the company releasing hundreds of workers from its promising ventures such as Sandawana.

Lithium prices are down more than 80% from their 2022 peak, due to low demand, prices of palladium and platinum fell by 40% and 15% in 2023.

While many are sceptical of why commodity prices are falling, the simple explanation is Supply has outgrown demand.