Large scale mining operations in Zimbabwe…

Zimbabwe’s mining industry has become the leading horse towards the resuscitation of the economy.

Rudairo Mapuranga

The mining industry has of late become the country’s largest foreign currency earner with nickel, gold and platinum groups of metals leading in fetching the country the much-needed forex.

The government through the Ministry of Mines and Mining Development has a vision for the mining industry to earn the country US$12 BILLION annually by 2023 an achievement that will have the capacity to transform the country’s economy to yester-year’s heights.

The country has many mid-tier and large-scale Mines which are well geared and oiled and are actively playing a critical role in helping achieve President E.D Mnangagwa’s vision for the mining sector to achieve a US$12 BILLION industry by 2023.

The following are some of the country’s operating mid-tier and large-scale mining operations in Zimbabwe 2020.

Zimplats

Zimplats specializes in platinum group metals such as platinum, palladium, gold, rhodium, iridium, ruthenium and osmium.

Zimplats is 87 percent owned by Implats, a leading South African platinum producer. Its Ngezi operation is located on the Hartley Geological Complex on the Zimbabwean Great Dyke approximately 150 kilometres southwest of Harare.

The Hartley Geological complex is the largest of the PGM-bearing complexes containing 80% of the known PGM resources in Zimbabwe. In FY2018 the operation produced 270 800 ounces of platinum in matte (including concentrate sold).

Zimplats operates four shallow mechanized underground mines, one open-pit and two concentrators at Ngezi. The Selous Metallurgical Complex (SMC), located some 77 kilometres north of the underground operations, comprises a concentrator and a smelter.

The company’s Half-year revenue for the half-ended 31 December 2020 increased by 79 percent to US$674.9 million compared to the same period last year, largely driven by increases in average metal prices and volumes of metal sold.

RioZim

RioZim separated from Rio Tinto plc in 2004 and became a wholly-owned Zimbabwean company that produces gold, coal, toll refines nickel and copper, it is listed on the Zimbabwe Stock Exchange. The group is divided into five distinct business units; RioGold, RioBase Metals, RioChrome, RioDiamonds, and RioEnergy. RioZim currently operates the Dalny mine, One step mines, Renco Gold mine in the south-east of Zimbabwe, the Cam & Motor gold mine in Kadoma, the Maranatha ferrochrome refinery in Kadoma, and the Empress Nickel Refinery near the city of Kadoma in Mashonalandwest. The group also owns 50 per cent of Sengwa Colliery Pty Ltd in Gokwe North.

The Renco Mine is 100 per cent owned by RioZim Limited. The mining rights are held through mining claims, a mining lease, and a special grant covering a total area of 2 736 hectares. The mine is located in the South-East of Zimbabwe in Nyajena communal lands, approximately 75km southeast of Masvingo.

Rio’s flagship mine is Cam and Motor Mine located 130km southwest of Harare, 10km to the east of Kadoma, at Eiffel Flats on the site of the former Cam and Motor Mine. The mine was once the largest producer of gold in Zimbabwe and produced in excess of 150 tonnes of gold in its entire life.

Rio currently has several exploration projects across the country.

Premier Africa Minerals

The Company has exposure to a wide range of commodities, including tungsten, lithium and tantalum, and rare earth elements as well as potash and limestone.

In Zimbabwe, Premier is building a mining operation at RHA tungsten and conduction exploration programmes on its Zulu Lithium and Tantalum project as well as at exploration for Rare Earth Elements at Katete and Lubimbi projects.

Murowa Diamonds

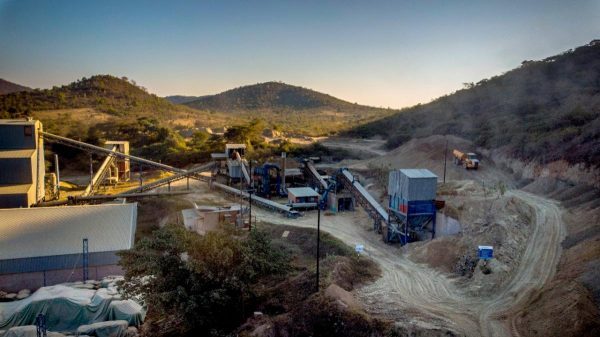

ZIMBABWE CONSOLIDATED DIAMOND COMPANY (ZCDC)

The Company has mining operations in Manicaland in Mutare’s Chiadzwa area and Chimanimani. The Company is conducting exploration and resource evaluation programs across Zimbabwe and expects to open new mines in other parts of the country soon.

ZCDC was issued with Special Grants 6026 and 6460 which vests mineral rights to carry out mining operations for diamonds in Chiadzwa and Chimanimani respectively.

The company has a 30 per cent stake in Alrosa Zimbabwe diamond exploration.

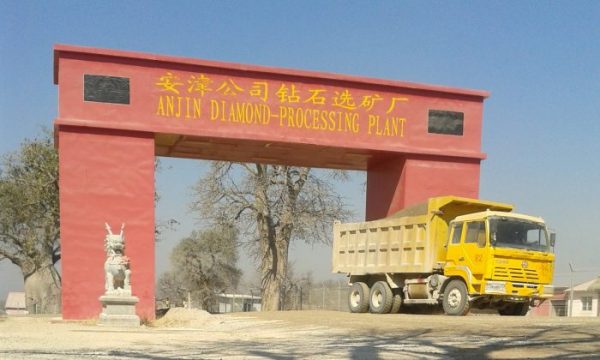

Anjin Investments

Controversial Chinese mining company, Anjin operates diamond mining in Zimbabwe at the Chiadzwa mining fields in Marange. Anjin had to shut operations back in 2015 after the Mugabe administration forced the closure of seven mining companies and the subsequent merger of their assets into the Zimbabwe Consolidated Diamond Company (ZCDC).

The company is reported to be selling diamonds without the involvement of the Mineral Marketing Corporation of Zimbabwe (MMCZ) allegations the company has disputed.

Caledonia Mining

Caledonia is committed to evaluating investment opportunities in Zimbabwe and has entered into two option agreements to acquire the mining claims over Glen Hume and Connemara North in the Midlands province.

Falcon Gold

Falcon Gold Zimbabwe Limited is a gold mining and exploration company in Zimbabwe.

Falcon Gold Zimbabwe Limited is a gold mining and exploration company in Zimbabwe.

The company owns Golden Quarry mine in Shurugwi. Founded in 1991, Falcon Gold Zimbabwe is a subsidiary of New Dawn Mining Group. New Dawn Mining Corp. is involved in the exploration, development, extraction, processing and reclamation of precious metal deposits in Zimbabwe.

It primarily explores for gold, base metals and precious metals. Falcon Gold Zimbabwe Limited also has an operational processing plant and ancillary infrastructure which supports a central processing plant that treats ore from Pickstone.

In 2016, Falgold sold one of its investment vehicles, Palatial Gold Investment (Private) Limited, which owns the Dalny Mine Complex (DMC), to RioZim.

Duration Gold Mine

Dallaglio Investments

Bilboes Gold

Bilboes Gold Ltd, a subsidiary of Bilboes Holdings. Bilboes Holdings (Pvt) Ltd (Bilboes) owns and operates the Isabella-McCay’s-Bubi Oxide Complex, which comprises three existing gold mining operations. The company also owns When, Bubi and McCays gold mines in the southern region of the country.

Unki Mine (Anglo American)

Unki Mine is owned by Amplats and is located in the southern half of Zimbabwe’s Great Dyke geological formation–widely recognised as the second-largest resource of PGMs in the world. The Midlands-based miner is currently Zimbabwe’s second-largest PGM producer after Zimplats.

Venice Mine

Venice Mine Complex (VMC) is a complex of mines in Zimbabwe that holds 106 mining blocks covering an area of approximately 2,664 hectares. It has extensive underground and surface infrastructure and over 100 years of recorded production. VMC was closed down in 2002 whilst under the management of Falcon Gold Zimbabwe Limited citing a lack of adequate exploration and development on the mine, the deteriorating economic climate in Zimbabwe and a low gold price.

VMC was acquired by Maris in 2015, with a plan for reinvigoration in a phased approach. In 2013, in partnership with managing director David May, Maris invested in a group of 32 mining blocks covering 5 mines, which had laid dormant since the 1980s: Bee Mine, Bee Eater Mine, Pamela Mine, Commoner Mine and Welcome Back Mine in Zimbabwe.

VMC is an investee company of the Maris Group, an Africa-focused holding company that has been managing investments since 2006.

Golden Valley

Golden Valley mine is a gold-producing mine located in Patchway, approximately 18km from the City of Kadoma. It is currently owned by John Mack company with Head office located in Harare. The mine is one of the biggest producers of gold in Mashonaland West province.

Mimosa

The Mimosa mine is situated in the Wedza subchamber of the Great Dyke of Zimbabwe.

At Mimosa, the focus is being given to developing the Mtshingwe Shaft and further evaluating the Mtshingwe Block, extending the life of mine, stabilizing production profiles at current performance levels, and fast-tracking the conversion of mineral resources to mineral reserves.

Alrosa (Russian: АЛРОСА)

Hwange Colliery

Hwange Colliery Company Limited is the leading coal producer in Zimbabwe and supplies the nation’s requirements, including low phosphorus coal and coke.

Hwange’s mining operations are predominately open pit. The company owns, the Hwange Coalfield and Chaba Mine located in the north-western region of Zimbabwe; its head office is in the capital city, Harare.

Makomo Resources

Makomo Resources is the largest privately owned coal producer in Zimbabwe.

The coal miner is located in Matabeleland. The company is 60 percent owned by a group of Zimbabweans, while British and South African investors hold the rest. In July 2014 the company said it has plans to spend US$1.5 billion on a 600-megawatt power plant in Hwange. Construction was planned to start in 2018. Makomo would finance the plant together with Chinese investors. Makomo would mine the fuel for the power station; it also supplies the nearby state-owned Hwange power station.

Zambezi Gas

Zambezi Gas Zimbabwe (Pvt) Ltd is a wholly-owned Zimbabwean private limited company operating in the coal mining and coalbed methane exploration industry since its incorporation on August 1st, 2002. Zambezi Gas explores mine, process, and market coal, coke, and their associated by-products. The company has in its portfolio an operating mine with a mining license expiring in 2042 as well as an on-going CBM exploration project both of which are situated in the Entuba Coalfields in Hwange Matabeleland North Province. The Entuba Rail Siding is located just 2km from the Company’s mining operation which is approximately 12km from Hwange town.

Chilota Colliery

Chilota Colliery began operations late last year and is now producing 30,000 tonnes of coking coal per month used to produce coke; the high-quality fuel needed by smelters. Chilota colliery is producing 30,000 tonnes of coking coal and about 30,000 tonnes of thermal coal for Zimbabwe Power Company (ZPC), which they are producing at Chaba Mines under a contract mining arrangement with Hwange Colliery.

The colliery has also deployed some of its equipment to Hwange Colliery Company, the country’s oldest coal mine where it is producing thermal coal under a mining contract.

Zimasco

ZIMASCO owns Mutorashanga, Valley Mine, Ironton Mine, Railway Block Mine and Peak Mine

The Kwekwe-based ferrochrome smelting company has six operational furnaces and each has the capacity to produce 200 tonnes of ferrochrome a day.

Bikita Minerals

The Bikita mine is the largest lithium mine in Zimbabwe. Bikita is owned by Southern Africa Metals and Minerals Limited chaired by investor Mr. Wilfred Pabst. The mine holds the world’s largest-known deposit of lithium at approximately 11 million tonnes. The mine is located in southern Zimbabwe in Masvingo Province.

How Mine

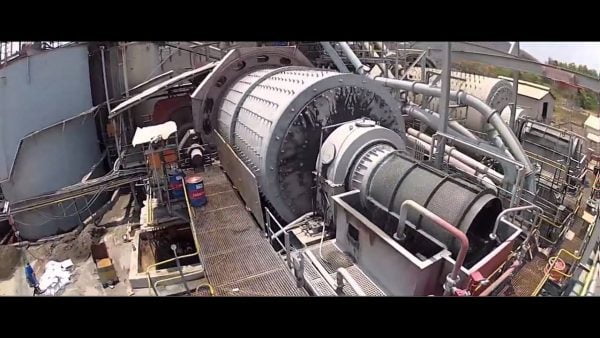

How mine is owned by Metallon Corporation. How Mine has been in operation since 1942 and has produced over a million ounces of gold to date. It comprises a single underground operation, where ore is processed at a central processing facility, using a combination of conventional milling and a carbon-in-leach process.

How mine is owned by Metallon Corporation. How Mine has been in operation since 1942 and has produced over a million ounces of gold to date. It comprises a single underground operation, where ore is processed at a central processing facility, using a combination of conventional milling and a carbon-in-leach process.

Redwing mine

Redwing Mine is owned and operated by Metallon’s King’s Daughter Mining Company Limited. Redwing Mine resumed production in 2015 following dewatering. The mine is located in Manicaland province in the east of Zimbabwe, about 20 kilometres northeast of the city of Mutare and 265 kilometres southeast of Harare.

Freda Rebecca

Bindura based Freda Rebecca gold mine was previously owned by Freda Rebecca Holdings (Pvt) Limited and ASA Gold Limited (formerly Mwana Africa Ltd). The mine is one of the country’s leading gold and silver producer.

The mine is situated on the Mazowe-Bindura greenstone belt. The belt’s surrounding area is characterised by shamvaian sediments, diorite and granodiorite that are traversed by dolerite dykes. Ore bodies are located within two major mineralised envelopes.

The envelopes are characterised by shears. The two shears unite in the southwest and flatten at a height of about 850m before extending into metasediments. They are defined by a number of anastomosing shears that are separated by under-formed rocks.

Sabi Gold

Sabi Gold mine is a gold mine owned by Anesu Gold and the State of Zimbabwe. Includes Sabi Extra, Canada, and White Sabi to the north and Monte Carlo and Hazard to the south, all located within the main shear. The mine is one of the country’s largest producers of the yellow metal.

Dorowa Minerals

Dorowa Minerals is wholly owned by Chemplex Corporation and is the only phosphate mine in Zimbabwe. Mining is by opencast method and involves ripping and dozing in soft rock and drilling and blasting in hard rock.

The Dorowa deposit is volcanic and exists within a horseshoe-shaped range of hills. It is very fortunate that the deposit is only 5 kilometres from the Save River from which water is extracted at the rate of five million litres per day for use on the flotation plant.

The beneficiation plant consists of milling and flotation processes to produce phosphate concentrates which are converted into superphosphates at ZimPhos, a sister company. Ore from the pit is at 6, 5% P2O5 and the concentrates being dried and sent to Zimbabwe Phosphate Industries (ZimPhos) are at 37% P2O5.

The dried concentrates are sent to the railhead at Nyazura along the Mutare highway, some 65km away, by road and 190km to Zimbabwe Phosphate Industries, in Harare by rail.

SAMREC VERMICULITE

The Shawa deposit is one of the largest vermiculite deposits in the world located within a 5.5 km radius alkali ring complex. The deposit was formed 209 million years ago, with the vermiculite being hosted within ijolite rocks.

Much is being talked about the mine’s contribution to the national fiscus but it, however, remains one of the largest vermiculite mines in the world.

Bindura Nickel Corporation (BNC)

ZSE listed BNC is operated and 73.64% owned by Kuvimba Mining House. The Mine is located, in Bindura Mashonaland East Zimbabwe. Its Smelter and Refinery Complex is located south of Bindura. The smelter

produces nickel cathodes, copper sulphide and cobalt hydroxide. BNC is the country’s largest nickel producer

Kuvimba Mining House

Kuvimba is also the majority owner of listed Bindura Nickel Corporation and is seeking to acquire chrome and more gold assets. The company is also linked to Darwendale platinum mine and owns Shamva, Jena, Golden Kopje, Elvington, ZimAlloys and Sandawana mines. Kuvimba already has interests in mining assets, including gold, chrome, nickel, gemstone, platinum group metals (PGMs) and chrome.

The company according to experts has the potential to become Zimbabwe’s biggest miner at the same time becoming the largest producer of gold, PGM and Chrome among other minerals. It is set to embark on exploration works at Golden Kopje and Elvington gold mines to establish their commercial viability and It wholly controls gold mines, Freda Rebecca.

TN Gold

TN gold is a mining company owned by Business mogul Tawanda Nyambira. The company owns Arcturus Gold Mine which previously belonged to Britain-based Metallon Gold. The Goromonzi based Arcturus mine is one of the oldest operating mines in Zimbabwe and has the potential to produce one tonne gold per annum.

Pretoria Portland Cement (PPC)

The company owns Colleen Bawn mine in Matebeleland South. PPC Has two plants in Bulawayo and Colleen Bawn. The two PPC Zimbabwe plants are among the most modern in southern Africa and well located to serve both the Zimbabwean and neighbouring export markets. Combined, they have an annual capacity of 760 000 tons of cement. The Bulawayo plant can produce another 300 000 tons of cement per annum with clinker supplied from PPC’s South African operations, while the installation of a new cooler and upgrade to the kiln at Colleen Bawn increased capacity by around 20% in 2010.

PAN AFRICAN MINING (PVT) LTD

The company owns Muriel Mine, Aryshire Mine and AMT 97 Mine.

Lafarge

Lafarge Cement Zimbabwe is one the leading cement and allied products producers in Zimbabwe.

The company has two mining operations where limestone is extracted. These include Mbubu in Mashonaland East Province and Sternblick quarry in Harare. Lafarge Cement Zimbabwe has an installed Plant Capacity of 500 000 tonnes per annum.

Conclusion

Despite facing economic challenges for over a decade, mining in Zimbabwe is still going strong. It is an undisputed fact that some mines and mining companies need to up their game to increase production which currently the national focus as companies move to achieve the 12billion Mining Industry by 2023. The government can also necessitate increased production by maintaining consistency and improving service delivery which is seriously lagging behind in the Mines and Mining Development Ministry (MMMD).