The lithium market has entered a “new normal” period of stability, with sustained price surges now a thing of the past, according to analysts at Fitch Solutions BMI. Zimbabwe, one of the top lithium producers in the world, plays a significant role in this evolving landscape.

Falling lithium prices over the past year mean prices are expected to remain low for the next decade, Sabrin Chowdhury, head of BMI commodities analysis, said from Singapore. This outlook is reshaping the industry landscape, presenting opportunities and challenges for major producers and junior developers.

“This stabilization is primarily due to a rapidly expanding global supply, which has already pushed the market into surplus,” Chowdhury said. “We expect no return to previous highs for lithium. Prices will remain below the peaks of 2022 and 2023 for at least five to ten years.”

For this year, BMI forecasts mainland Chinese 99.5% lithium carbonate prices to average $15,500 per tonne, increasing to $20,000 per tonne in 2025. This starkly contrasts with the over $72,000 per tonne average in 2022. Similarly, BMI predicts lithium hydroxide monohydrate (56.5% grade) to average $14,000 per tonne this year and $20,500 in 2025, down from about $70,000 per tonne in 2022.

The extended period of low lithium prices could be a boon for cost-saving methods and industry M&A, the analysts said. Juniors and developers may have to incorporate new technology, such as direct lithium extraction for brine projects, while the industry’s numerous operators will likely face consolidation.

“Out of 164 total operations in our database, 126 individual companies own these projects,” BMI metals and mining analyst Amelia Haines said on the call. “This creates an optimal environment for mergers and acquisitions, with larger, well-funded miners looking to acquire promising lithium assets to meet growing demand.”

Competitive Edge

Technological advancements are poised to impact supply and demand and are fundamental in gaining a competitive edge for entrants to the cut-throat market, the analysts said.

“Relatively new direct lithium extraction technology can potentially reduce production times and environmental impact compared with traditional methods,” senior metals and mining analyst Olga Savina said.

Despite the price decline, many major producers continue to remain profitable. This is mainly owing to their ability to maintain low production costs. In Australia, for instance, the production cost of mining spodumene is significantly lower for projects like Tianqi Lithium and IGO’s (ASX: IGO) joint Greenbushes mine and Pilbara Minerals’ (ASX: PLS) Pilgangoora. Higher-cost producers Galaxy Resources, Altura Mining, and Nemaska Lithium had to curtail production or go bust. Lithium demand is set to continue its vigorous growth, driven mainly by the electric vehicle (EV) sector.

However, advancements in battery technologies, including the rise of lithium-iron-phosphate (LFP) batteries and potential breakthroughs in solid-state batteries, could influence needs, the analysts said.

Global lithium demand from EVs is expected to increase by about 14% in 2024 and 2025. The EV sector is expected to account for most of the lithium demand, with worldwide passenger EV sales forecast to reach 17.6 million units in 2024, representing a 21.3% year-on-year growth.

“We expect global lithium production to grow by 16.4% year over year in 2024 to 1.12 million tonnes lithium carbonate equivalent (LCE) and by 19.7% in 2025 to 1.35 million tonnes LCE,” Savina said. By 2028, global lithium mine production and demand are projected to reach an equilibrium at about 1.9 million tonnes, with demand set to overtake supply thereafter.

Australasia

Australia and mainland China will be the primary drivers of this growth. Australia, already a leading hard-rock lithium producer, will continue to dominate due to its strong project pipeline, BMI said. Mainland China will keep importing lithium for its battery industry while expanding its domestic production capacity and securing supplies by developing projects overseas.

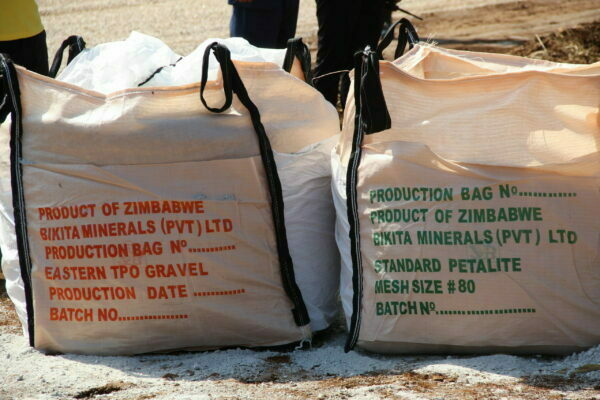

Emerging players like Argentina and Zimbabwe are also expected to contribute significantly to the global supply. “Argentina’s growth in the lithium sector looks promising as several major projects begin operation,” Savina said. Major economies are implementing several measures to achieve critical mineral supply chain resilience. These measures aim to reduce external risks and ensure a stable supply of lithium for the green energy transition, Haines said.

The United States Inflation Reduction Act provides tax credits for EVs that use critical minerals mined domestically or in markets with free-trade agreements with the US. This has spurred significant investment in lithium projects across North and Latin America, including Argentina, Canada, and the US. The European Union’s Critical Raw Materials Act aims to build onshore production capacity and promote import diversification. Europe has lithium resources across several countries including Portugal, the Czech Republic, and Finland.

“Onshoring mineral production and processing capacity, enhancing recycling capabilities, forming strategic partnerships, and diversifying supply chains are crucial strategies,” Haines said. “These measures aim to reduce external risks and ensure a stable lithium supply for the green energy transition.”