After years of remarkable growth, 2024 proved to be a disappointing year for the global electric vehicle (EV) industry, resulting in a significant slowdown in global lithium demand. However, projections for 2025 suggest a recovery is on the horizon, driven largely by renewed interest in EVs, particularly in China. Yet, as the world prepares for a rebound in lithium demand, Zimbabwe’s role as a critical supplier remains under scrutiny, with the benefits to the local economy still in question.

By Rudairo Mapuranga

Globally, lithium prices experienced a dramatic fall in 2024, declining by as much as 80% from their peak. Oversupply, particularly from Australia and China, exacerbated the issue, forcing some higher-cost miners to reduce output. Looking ahead, demand is expected to increase by 26% to 1.46 million tonnes of lithium carbonate equivalent (LCE) in 2025, spurred by growth in the EV sector, particularly in China, where EVs now represent more than half of all vehicle sales. The rise in energy storage systems (ESS) is also anticipated to play a significant role in driving demand for lithium.

For Zimbabwe, one of the world’s emerging lithium producers, this global recovery presents both an opportunity and a challenge. While the country boasts significant lithium reserves, it continues to struggle with ensuring that its lithium industry generates tangible benefits for the local economy. Although Zimbabwe has attracted substantial foreign investment, particularly from Chinese companies, concerns persist about the lack of local participation in the sector.

The Problem of External Benefits

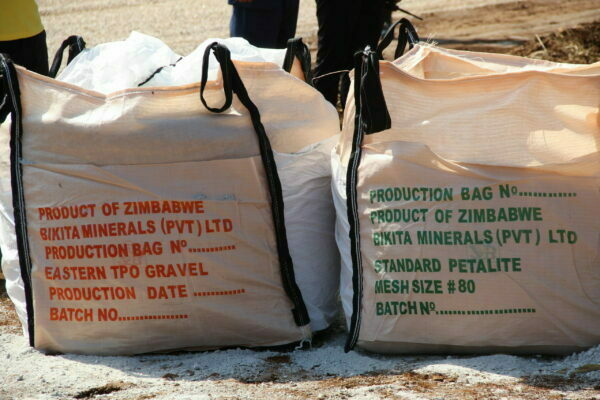

Many lithium mining operations in Zimbabwe, such as Bikita Minerals, have faced criticism for benefiting foreign entities rather than the local economy. Bikita Minerals, one of the country’s most significant lithium producers, has been accused of relying heavily on contractors from Mozambique. The frequent sight of Mozambique-registered trucks transporting lithium out of Zimbabwe underscores a broader issue: the proceeds from Zimbabwe’s lithium are largely funneled to foreign companies, often based in Mozambique. Additionally, most contractors working at these mines are Chinese nationals, leaving limited opportunities for local employment and skills transfer.

Similarly, Prospect Lithium Zimbabwe (PLZ), owned by Huayou Cobalt, a Chinese battery manufacturing giant, is another example of foreign dominance in the sector. PLZ controls the entire value chain, from extraction to battery manufacturing, essentially selling the lithium it mines to itself. This vertical integration maximizes profits for Huayou while leaving Zimbabwean companies and the local economy with minimal benefits. The lack of local ownership in the industry hampers Zimbabwe’s ability to reap the full rewards of its lithium sector, even as global demand for the mineral rises.

One operation that stands out for its relatively neutral approach is Kamativi Mining Company. Unlike other lithium miners in Zimbabwe, Kamativi has avoided selling lithium to its own affiliated companies, instead working with external players such as Tesla to produce batteries. This approach has positioned Kamativi as a more transparent and independent player in Zimbabwe’s lithium industry. However, despite this neutrality, Kamativi still faces criticism for its reliance on Chinese workers, with the majority of skilled positions filled by foreigners. Skills transfer remains a significant challenge, as local Zimbabweans are often excluded from technical roles.

The Path Forward

Despite these challenges, there is optimism that Zimbabwe’s lithium sector will grow alongside global demand. As EV production ramps up, particularly in China, Zimbabwe is poised to play a critical role in supplying the lithium required for batteries. However, for this growth to truly benefit Zimbabwe, a concerted effort is needed to ensure that more of the value chain remains within the country. This includes increasing local employment, fostering skills transfer, and developing local lithium processing facilities.

The recovery of global lithium prices in 2025 could provide Zimbabwe with an opportunity to renegotiate terms with foreign investors and push for greater local involvement. As companies such as Tesla seek stable, long-term lithium suppliers, Zimbabwe could leverage its position to demand more from foreign companies operating within its borders.

As the global lithium market recovers in 2025, Zimbabwe’s potential to become a leading player in the sector is clear. However, the benefits to the local economy remain limited due to the dominance of foreign companies and a lack of local involvement in the industry. To truly capitalize on the lithium boom, Zimbabwe must focus on increasing local participation and ensuring that the wealth generated by its lithium reserves benefits the country and its people. The road ahead for Zimbabwe’s lithium industry is promising—but only if the necessary steps are taken to ensure that Zimbabweans are not left behind as the world shifts to greener energy solutions.