The $12 billion mining sector by 2023 target might have sounded to some like a mirage or mere wishful thinking by an exuberant Government, but as days and months unfold, this is slowly becoming a reality, a goal quite achievable going by the situation on the ground or is it underground!

Although there is still much that the picks, shovels and their heavy-duty compatriots need to excavate, the progress made is noted.

The mining sector has become quite active, breaching its own output and employment targets in some instances while laid out production strategies by firms in the sector demonstrate a growing sector, exuding great potential. Mining has become a giant straddling across Zimbabwe’s economy.

One of the projects that have made headway is the Kuvimba Mining House, which has just declared a $5,2 billion dividend, triggering implementation of a number of empowering projects that had been put in abeyance by some of its shareholders.

Freda Rebecca, one of its gold mines, recently broke a 20-year record, producing 300kg gold in one month. The previously dormant mine was resuscitated only last year.

The majority shareholding in Kuvimba Mining House is held by a broad spectrum of local institutions, including a 12,5 percent which is for the purpose of meeting obligations in respect of compensation for white former commercial farmers under the Global Compensation Agreement signed between the Government and former farmers, a 7,5 percent stake by the National Venture Fund, managed by the National Venture Capital Company of Zimbabwe (of this, 2,5 percent is held on behalf of youths whose projects will be supported under the Fund, 2,5 percent for supporting women while 2,5 percent is held for the account of Veterans of the Liberation Struggle).

The Insurance and Pensions Commission holds 5 percent and proceeds from the investment are set for compensation in respect of legacy pensions. Also, the Deposit Protection Corporation holds 5 percent shareholding and intends to expend some of the funds towards compensation for small depositors for loss of value on savings.

The Public Service Pension Management holds 7 percent of shares in Kuvimba while 6,5 percent shareholding is in the hands of the Sovereign Wealth Fund of Zimbabwe, a statutory fund which is now being fully implemented for the future benefit of the Zimbabwean citizenry.

Therefore, the results from this venture have made a huge impact to the said constituencies.

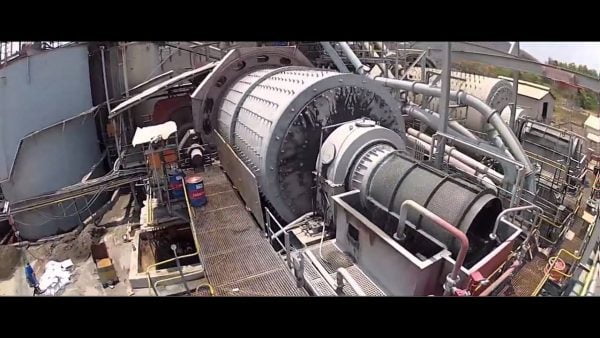

Kuvimba owns and manages three operating gold mines, three non-operating gold mines, chrome operations, an operating nickel mine and an investment in a platinum project.

“It is envisioned that this entity will help in unlocking the inherent richness and value of our country’s mineral deposits through deploying appropriate mining technologies and skills. I thus commend the company for showing confidence in our economy in response to our mantra, ‘Zimbabwe is open for Business,” said President Mnangagwa recently.

The Karo Resources project, a $4,2 billion venture, is expected to be one of the largest mining ventures to date in Zimbabwe as it will include platinum production, a PGMs refinery, 300MW power plant and coal mining operations. The project will lead to the creation of thousands of jobs.

The Tsingshan Holdings venture being financed by Chinese mining in Mvuma, has taken off on the back of President Mnangagwa’s “Zimbabwe is Open for Business”.

Tsingshan is one of the largest steel making giants globally, employing 80 000 people and has an annual output of 10 million tonnes of stainless steel with a turnover of $30 billion.

The group has already transformed the lives of many Chegutu youths through its subsidiary, Afrochine Smelting Plant located in Selous.

It is expected to contribute at least US$1,2 billion towards the US$12 billion mining industry by 2023.

Australian listed mining concern, Prospect Resources is another which recently took delivery of the pre-assembled pilot plant crushing equipment.

Arcadia represents a globally significant hard rock lithium resource. It is one of the most advanced lithium projects globally, with a definitive feasibility study, off take partners secured and a clear pathway to production.

Caledonia Mining Corporation, which has a major gold belt in Gwanda, has already made huge capital investments in both underground and surface mining, and rural infrastructure, in line with the devolution agenda. The firm is keen on investing in other Government-owned projects.

In the gold subsector, Dallaglio Investments (Pvt) Limited (in 2020), began a gold mining expansion drive at two of its gold mining assets — Pickstone Peerless Mine and Eureka Gold Mine. Pickstone Peerless, is currently producing about 65kg of gold per month and in terms of their expansion plans is expected to grow to about 100kg per month. At Eureka, which is currently under reconstruction, Dallaglio expects to haul two tonnes per annum of the yellow metal. Other massive projects are already in the cooking pot.

Mining contributes at least 12 percent to Zimbabwe’s Gross Domestic Product and more than 60 percent of exports. It employs thousands of people and impacts respective communities in a big way.

Many families depend on this sector for their livelihoods, either directly or through downstream industries.

The projects under implementation can only mean better lives for the communities and the nation at large.

The sector is expected to grow by 7 percent with reports that it will increase at levels above the GDP growth rate going forward.

Zimbabwe is blessed with at least 49 known minerals. This implies that we have barely scratched the surface. The potential is huge.

A major plus has been the country’s ability to attract interest from foreign investors into the capital-intensive sector in response to the “Zimbabwe is Open for Business” mantra.

Small mining firms have come to the party. We report in our business section that one of the gold buying agents Mr Pedzisayi Sakupwanya has delivered 1 400kg to Fidelity Printers and Refiners since the beginning of the year and promises to double the figure by the end of this year. The figure was an increase from last year’s 850kg.

Mines Minister Winston Chitando has stated that artisanal miners and National Gold Buyers Association are key in reaching a target of 100 tonnes per year by 2023.

However, the sector is still performing below capacity given available resources. Much more needs to be done to ensure the economy realises the sector’s full potential.

Mining is considered one of the best three areas to invest in, the other two being food security and education. In that regard too, we need to value add and beneficiate our minerals. Zimbabwe and the rest of the continent export minerals in their raw form, prejudicing the economies of billions of dollars annually.

Much more is being lost through smuggling, prompting the need for tighter supervision and the adoption of good corporate governance systems.

High volumes of minerals that are being clandestinely siphoned out of the country for the benefit of a few rogue individuals, at the expense of most who deserve nothing short of what they have been blessed with by the Almighty in terms of assets and resources.

Losing at least $1 billion a year from gold alone is no small issue. We need good corporate citizens that channel all output through formal channels to benefit the nation.

Zimbabwe is replete with some of the world’s best and most lucrative minerals in its belly: gold, diamonds, platinum, coal and all. It must, therefore, perform better, in terms of output regardless of the fact that our performance has been commendable in recent years.

I have always believed that we are one of, if not the most endowed of nations, on the planet, which probably explains the size of the fights that come our way.

But that notwithstanding, we need to put results on the table and attach value, rather extract value, real value from the assets that we have as a nation.

Parallel to agriculture, mining forms the backbone of our beloved economy and we can ill afford to hit anything less than 100 percent in terms of capacity utilisation in this sector.

With projections estimating a higher output in 2021, on the back of a better operating environment.

In a recent survey, 90 percent of respondents said they would up the ante in terms of mineral extraction and related activities as prospects within the sector for the year 2021 have been positive. No one player would want to be caught flat-footed when the tide hits.

Capacity utilisation is projected to grow to +/- 80 percent this year from 61 percent last year and everyone ought to come to the party as the Government, the single most important factor in this game, has intervened favourably for maximum results and output.

The extractive sector, along with other sectors of the economy, is expecting a major boost in 2021 and all is looking up with massive production expected in the mining sector.

Therefore, when the President says he envisages a $12 billion mining industry, he knows what he is talking about. He knows the potential, he knows the right policies that have to be in place.

Earning money from mining is one thing, making sure it has inclusive growth concepts, quite another. It is an issue which preoccupies the Presidency.

May we not forget too, that minerals are a finite resource. We derive optimum national benefits while it lasts, as we look at other options with longevity, sponsored by what we would have earned.

Twitter handle: @VictoriaRuzvid2; Email: [email protected]; [email protected]; WhatsApp number: 0772 129 992.