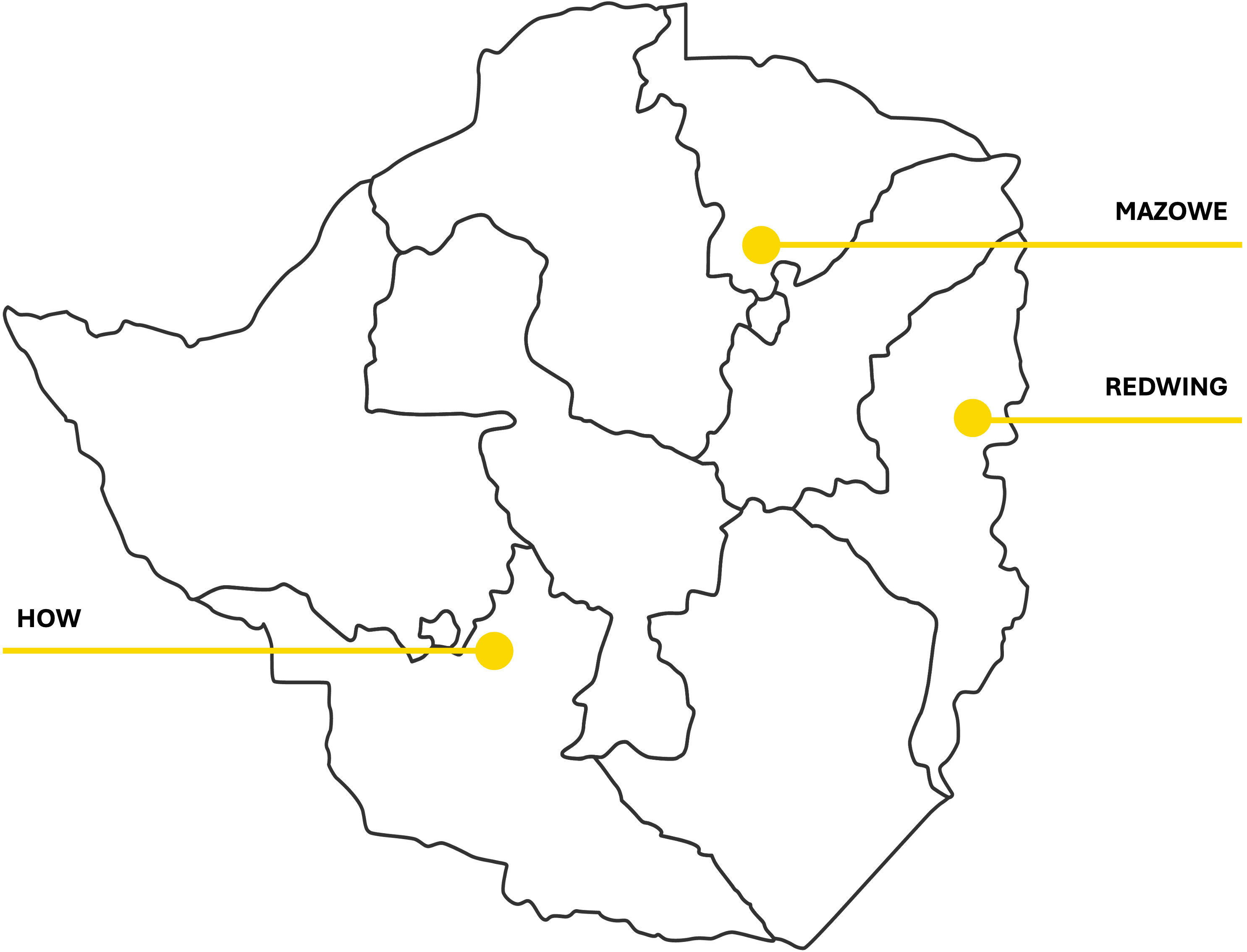

Namib Minerals is poised to join the Nasdaq stock exchange following Africa’s largest-ever shell company acquisition, which includes a producing mine, How Mine, and former top gold mines Redwing and Mazowe mines.

The proposed US$500-million merger with special purpose acquisition company (SPAC) Hennessy Capital Investment Corp. VI (Nasdaq: HCVI) is expected to close in the first quarter of 2025. The deal values the combined enterprise at approximately US$609 million. Namib Minerals’ management team will continue to lead the company following the transaction.

The proposed US$500-million merger with special purpose acquisition company (SPAC) Hennessy Capital Investment Corp. VI (Nasdaq: HCVI) is expected to close in the first quarter of 2025. The deal values the combined enterprise at approximately US$609 million. Namib Minerals’ management team will continue to lead the company following the transaction.

“As Namib Minerals takes this significant step toward becoming a publicly traded company, we remain dedicated to our mission of creating safe, sustainable, and profitable mining operations,” said Namib CEO Ibrahima Tall in a news release.

Strategic Assets in Zimbabwe

Namib Minerals’ portfolio includes the award-winning How Mine and the past-producing Mazowe and Redwing mines, all located within Zimbabwe’s greenstone belt. Proceeds from the merger will be allocated to enhancing operations at the How Mine and funding the restart of Mazowe and Redwing.

The How Mine is a high-grade, cash-generating gold asset that has produced 1.8 million ounces of gold between 1941 and 2023. In 2023, the mine generated US$65 million in revenues, with an additional US$42 million earned in the first half of 2024.

Mazowe and Redwing have substantial gold resource estimates. Mazowe’s measured and indicated resources are 291,000 ounces, with an additional inferred estimate of 915,000 ounces. Redwing’s measured and indicated resources total 1.19 million ounces, while inferred resources stand at 1.33 million ounces.

Merger Details and SEC Filings

The merger, announced in June, involves the issuance of 50 million Namib ordinary shares, with an additional 30 million shares (valued at US$300 million) tied to operational milestones. Namib filed registration documents with the U.S. Securities and Exchange Commission (SEC) on Monday.

The transaction is contingent on shareholder approvals from HCVI and Greenstone Corp., an affiliate of Namib Minerals and co-registrant with the SEC. Upon closing, Greenstone’s existing shareholders will own nearly 75% of the newly formed company.

The combined entity will operate under the Namib Minerals name with the ticker symbol NAMM and will incorporate all Greenstone’s mining and exploration assets.

Expanding Into Battery Metals

In addition to its Zimbabwean gold projects, Greenstone holds interests in 13 battery metals exploration permits in the Democratic Republic of the Congo. Early-stage diamond drilling in the Haut Katanga and Lualaba provinces has shown significant potential for copper and cobalt, diversifying the company’s asset base.

This merger positions Namib Minerals for significant growth as a publicly traded company, leveraging its diverse portfolio of gold and battery metals assets.

.png)