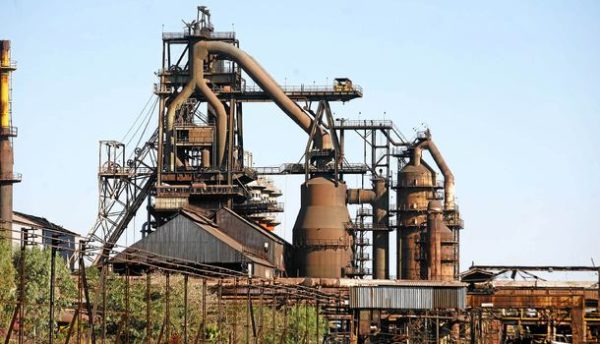

Net worth evaluation for defunct Zisco

Kwekwe defunct miner Zimbabwe Iron and Steel Company (Ziscosteel) board has approached the Government seeking approval to engage a German consultant to evaluate the net worth of the steel producer before seeking an investor to resuscitate operations.

Zimbabwe’s integrated steel manufacturer closed down in 2008 at the height of hyperinflation. Between 2011 and 2017, two attempts to resuscitate operations at Zisco by Essar Global and R and F, failed to materialise.

In an interview last week, Zisco acting board chairman, Dr Gift Mugano, said in the past there have been many conflicting figures thrown out concerning the net worth of Zisco. He said before an investor is secured, it was critical to do a proper evaluation of the firm’s assets.

“We are very open minded in terms of the company to do the evaluation of Zisco and we can go as far as Germany because most of the technology, which is there came from Germany.

“So, we are not going to be looking at the mediocrity to do the evaluation exercise. We want the correct position from a technical point of view. If there is going to be any local person it will be someone supporting from the local knowledge, but we think we can get the technical expertise from Germany,” he said.

“We have engaged our Minister (Dr Sekai Nzenza) for approval and she is happy with that, what we now need to do is to do the normal procurement processes.”

In 2011, Zimbabwe and Essar Global signed a US$750 million deal to resuscitate operations at the Redcliff-based steel plant but the deal fell by the way side because of among other reasons, political bickering in the inclusive Government as well as numerous squabbles over mineral rights and other technicalities. Again in 2017, it was reported that the Government had secured US$1 billion investment for the revival of Zisco from a Chinese firm, R and F.

Last year R and F advised the Government that it was pulling out of the deal amid reports that efforts to renegotiate the deal agreed on under the previous administration led by former President Mr Robert Mugabe were unsuccessful.

The arrangement entailed the acquisition of Zisco’s majority shareholding by the Chinese investor to pave way for the revitalisation of the steel plant.

Dr Mugano said it was imperative for them to engage a foreign company with technical expertise to do the valuation of Zisco assets to eliminate the possibilities of mortgaging the country given the fact that the steel manufacturer’s assets go beyond plant and equipment.

“That is why you hear sentiments that the R and F deal was like mortgaging the country because you don’t know what you are giving by giving concessions that you don’t know.

“We want to do proper evaluation to understand the net worth of Zisco because when we go out to look for investors, we need to know what we are holding in our hand. So far, I don’t know exactly the net worth of Zisco and we are engaging a company through the normal procurement processes so that we can be able to know,” he said.

“But what I know, it’s in millions of US dollars but we need to know the exact number and then we break down to say what is this section costing. Zisco is just beyond the Zisco plant, there are properties . . . and that will be a process that will take a couple of months to do proper evaluation,” said Dr Mugano.

He said their role as the board was to render strategic guidance and direction on how things should be done to resuscitate Zisco.

“We can only do that once we have agreed. First we have to do the feasibility study and then come up with a decision on which route we are taking in terms of selling all the scrap or are we resizing it (Zisco) and if we are resizing it, what can we do from a domestic resource mobilisation, or international investment,” said Dr Mugano.

He said it was also critical to take into account that the world was now in the 4th industrial revolution and it should be well-thought on what can come out of Zisco looking at the existing plant technology and modern-day equipment.

“Those are questions to be answered when we do proper feasibility study of what is Zisco of today against Zisco of 1980. Or should we start a new right size company, which should be able to fit the modern demand taking into account the pressure of green economy and the need to align with modern trends in terms of demand for steel,” said Dr Mugano.

Source: The Chronicle