Incessant power cuts being experienced in the country weighed down on diversified resources group RioZim’s operations during the half year to June 30, despite arrangements to be exempt from power cuts. This, together with other economic challenges resulted in an 8 percent decline in gold output.

Industry wide, erratic power supplies have been blamed for low production as production time is severely lost to load shedding, a phenomenon also affecting the domestic consumers.

According to RioZim, its mining operations were severely affected by power cuts although the group is paying for electricity in foreign currency to guarantee uninterrupted supplies.

As a result, total gold output went down 8 percent to 962kg from 1 050kg achieved in the same period last year.

“Incessant power cuts, which commenced in the second quarter of the year significantly affected production. As a direct result of these power cuts, the Group, recorded a decrease in production,” said group chairman Saleem Rashid Beebeejaun in a statement accompanying financial results for the half year period under review.

At Dalny Mine acute power cuts were the order of the day in the second quarter of the year, which worsened during the month of June with the mine only afforded an average of four to six hours of plant running time per day.

As a result, production went down 7 percent to 215kg from 232kg recorded in the same period in 2018.

Renco Mine recorded a 28 percent decrease in gold production to 259kg on the back of severe power cuts in the second quarter of the year as well as plant breakdowns which reduced production processing time.

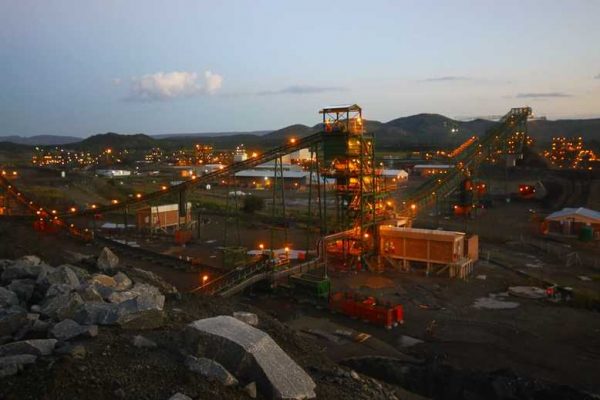

Its flagship, Cam & Motor Mine, however, recorded a 7 percent growth in gold production to 489kg, from 458kg achieved in the same period in 2018 on the back of processing of pure oxide ores with good grades and higher recoveries.

Apart from the power challenges, RioZim has indicated the company has now reverted to paying for almost everything in US dollars which is unsustainable in an economy already experiencing severe foreign currency shortages.

“This is impacting working capital, maintenance and expansion capital expenditure. In the absence of either being allowed to retain and use 100 percent of its export proceeds or raise and use US Dollars from shareholders, the company’s position will continue to be extremely challenging,” said Mr Beebeejaun.

Meanwhile, RioZim is in the process of constructing its Biological Oxidation (BIOX) plant to treat refractory ore at Cam & Motor Mine. Civil works for the project are in full swing and structural steel fabrications are in progress.

According to the group, key suppliers and contractors have also been appointed for the project whose commissioning is expected in the fourth quarter of 2020, depending on availability of foreign currency_Business Weekly