Investors have been advised to ensure the viability of their projects before committing resources, avoiding excessive reliance on tax rebates or government concessions, Mining Zimbabwe can report.

By Ryan Chigoche

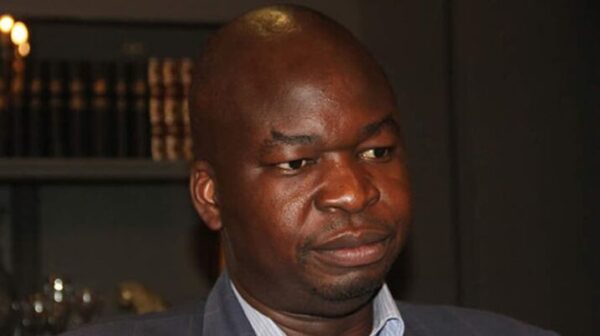

This guidance was provided by George Guvamatanga, PPP Committee Chairperson and Permanent Secretary in the Ministry of Finance and Investment Promotion, during the Northern Region Capacity Building Workshop held recently.

In Zimbabwe, investors, particularly in the mining sector, have frequently expressed frustration over the numerous taxes and royalties imposed on them. These concerns highlight how financial obligations impact their operations and overall profitability.

At the meeting, Guvamatanga emphasized, “Any project should be viable without relying on massive government concessions and rebates. While we offer incentives, the foundation of a project’s viability should not depend on them.”

His statement underscores a broader government stance: projects must be economically viable on their own merits, without excessive dependence on state support.

He argued that projects should not rely heavily on government rebates or concessions to ensure their viability. This approach reflects a push for self-sufficiency within the sector, reinforcing the idea that mining enterprises should be robust enough to thrive independently.

This perspective, however, comes amid ongoing concerns from miners about the heavy tax burden and high royalty rates imposed on the industry. Zimbabwean miners have often criticized the complex regulatory environment and financial pressures stemming from corporate tax rates, significant mining royalties, VAT, and other levies.

In June, the Chamber of Mines Zimbabwe called on the Treasury to review the special capital gains tax on the transfer of mining titles and royalties, which they argued was a major concern for investors.

The Chamber added that the royalties were negatively impacting the sector’s viability.

Royalties, a key form of government revenue, are calculated as a percentage of the gross market value of mineral revenue. In Zimbabwe, different minerals attract different rates: diamonds and precious stones at 10%, platinum at 5%, base and industrial metals at 2%, and coal at 1%. Gold has a flexible royalty rate of 5% if the international market price is above US$1,200 per ounce, and 3% if it falls below that threshold. Artisanal and small-scale mining operations benefit from a fixed 1% preferential rate.

Miners argue that these financial demands, coupled with economic instability and high operational costs, present significant challenges to maintaining and expanding their operations. The government’s stance suggests a shift toward reinforcing the expectation that projects must stand on their own, sparking a debate about balancing regulatory demands with industry sustainability.