Rhodium price on track for new record as mine output plummets

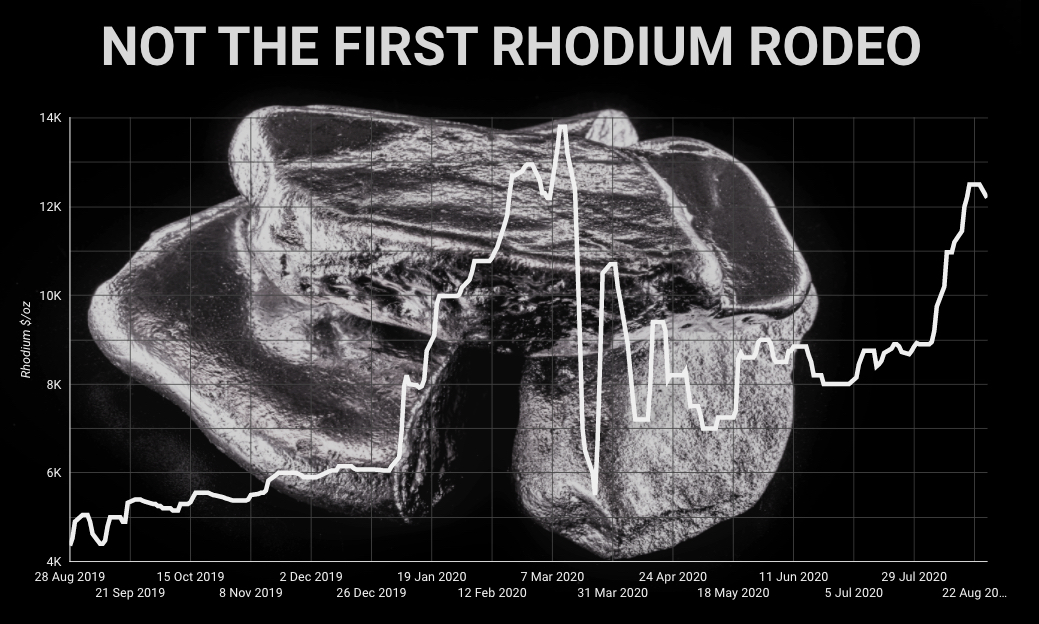

The price of rhodium has been on a stomach-churning ride this year, rocketing from $6,050 an ounce at the start 2020 to a record high of $13,800 an ounce by March 10, only to plummet to $7,800 an ounce before the end of that month as covid-19 spread around the world.

Like its sister metals palladium and platinum, rhodium’s main application is to clean vehicle emissions and the price quoted by Johnson Matthey, the world’s number one manufacturer of autocatalysts, showed the metal has clawed back much of its covid-19 losses to trade at $12,200 an ounce.

The fall in ounces leaving mine gates has forced producers to enter the open market as buyers to meet contracted volumes, says BMO:

The recovery in auto sales is boosting demand, particularly given the lack of alternatives in catalyst chemistry given rhodium’s role in reducing NOx (nitrogen oxide) emissions.

Given this, it is possible to see further new highs over the coming weeks.

South African PGM producers extract a mix of metals comprising roughly 60% platinum, 30% palladium and 10% rhodium.

Rhodium is also alloyed with platinum to make reinforcement fibre for the high-tech glass on consumer electronics, and used as a catalyst to make certain chemicals.

Due to rarity, the small size of the market (all of which is over the counter) and concentrated supply, prices are typically volatile.

Rhodium had a stunning run in 2019, rewarding investors with steady gains ending in 150% in annual returns.

But 2020 trading more resembles 2008, when rhodium touched $10,025 an ounce just before the global financial crisis hit – the metal would drop 90% before the end of that tumultuous year.