South Africa ministry OKs AngloGold asset sale but blocks delisting

South Africa’s mines ministry has approved AngloGold Ashanti’s (JSE: ANG) (NYSE: AU) sale of its last remaining assets in the country to rival Harmony Gold (JSE: HAR) (NYSE: HMY), on the condition that it does not delist from the Johannesburg stock Exchange.

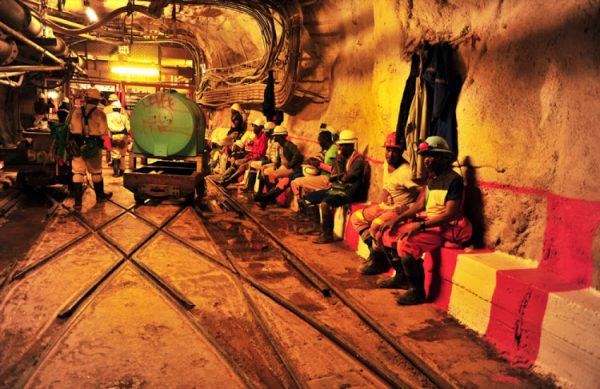

AngloGold announced the sale of its remaining asset in the home country earlier this year for $300 million. The portfolio included Mponeng, the world’s deepest gold mine, and the company’s last underground operation in South Africa.

The company said at the time it would consider moving its primary listing on the JSE after leaving the country. Earlier this month, however, it said that was no longer a priority amid the covid-19 pandemic.

Harmony’s acquisition of AngloGold’s operations in South Africa is expected to help the miner sustain growth and replace capacity. Most of Harmony’s output in the country currently comes from its Masimong and Unisel mines, which are running out of ore.

The Department of Mineral Resources and Energy (DMRE) corroborated on Wednesday the approval of the proposed transaction.

“The Department can confirm that an application in terms of Section 11 of the MPRDA has been received and was approved on 24 July,” the DMRE told Reuters via email.

AngloGold said on Wednesday it had not yet received all necessary approvals, adding it was still in talks with the government.

The sale would mark the miner’s exit from South Africa to focus on more profitable mines in Ghana, Australia and the Americas.

The company, which recently lost Kelvin Dushnisky as chief executive, was born out of the mines bought and built by Anglo American (LON: AAL), the mining giant founded by the Oppenheimer family more than a century ago.

End of an era

The company was the dominant gold miner for decades but progressively became weaker as it closed and sold old mines in South Africa, in favour of offshore investments.

Harmony’s chief executive officer, Peter Steenkamp, has repeatedly said that South Africa is its main investment target.

South Africa’s gold industry, however, continues to face mounting challenges, including geological and safety aspects of extracting ore from the world’s deepest mines.

Harmony is betting on recreating the successful strategy applied after it bought Anglo’s Moab Khotsong mine in 2017. Half of that money has already been paid back, Steenkamp said.