Tharisa, the South African company developing a platinum mine in Zimbabwe, plans to sell US$50 million of bonds on the Victoria Falls Stock Exchange to help finance the project.

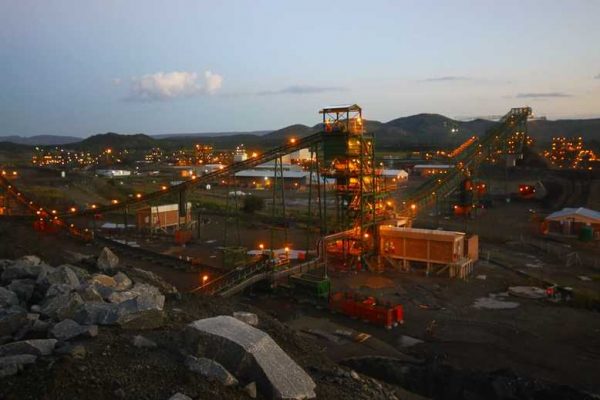

The miner last month announced a US$250 million first phase investment in Karo mine, expected to begin development later this year.

“While the financing solution for the development of the Karo Platinum project is well advanced, Karo Platinum is seeking to tap the capital markets in Zimbabwe to part finance this impactful development,” Ilja Graulich, Tharisa’s head of investor relations, said Wednesday.

The miner plans to offer the bond by the second half of this year. It would be the first debt listing on the exchange.

The bourse in Victoria Falls opened in October 2020. It has just four listings: SeedCo, Caledonia Mining Corporation, Bindura Nickel Corporation, and Padenga Holdings. Known as VFEX, it offers tax exemptions on capital gains and promises investors the ability to repatriate funds from a country where foreign exchange is typically in short supply.

A VFEX-listed exporter is allowed to keep 100% of what they earn from any incremental output above its monthly average.

Tharisa’s planned sale adds to similar proposals by the government to begin trading debt on the VFEX, said Justin Bgoni, the chief executive officer of the exchange.

“It will allow a creation of a yield curve on VFEX, provide alternative investment and more importantly show that VFEX is a credible capital raising platform,” he said.

Zimbabwe’s Great Dyke holds the world’s second-largest PGM deposits, and gives producers the lowest-cost platinum and good skills, Tharisa CEO CEO Phoevos Pouroulis said in April as he announced development plans for Karo.

Karo will produce 150,000 ounces of platinum group metals in its first phase and will have a 20-year life. It joins other mines on the Great Dyke. Zimplats produces 580,000 ounces per year, Unki 190,000 ounces and Mimosa 120,000 ounces. Great Dyke Investments’ delayed Darwendale project will, on completion, be the largest producer, at 860,000oz per year.