The Zimbabwe Investment and Development Agency (ZIDA) expressed reservations over the eight percent management fees from gross revenue proposed by Kuvimba Mining House (KMH), a company selected to revive the Zimbabwe Iron and Steel Company (ZISCO), Business Weekly has established.

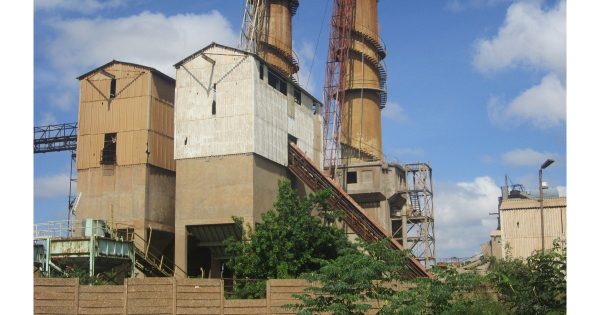

The Government selected Kuvimba to revive ZISCO, once Africa’s largest steel mills after ZIDA recommended three investors from six that had initially shown interest in the Kwekwe- based integrated steel works.

Kuvimba, which is owned 65 percent by the Government, has proposed to enter into a threeyear management contract with ZISCO and inject US$1,3 billion into the business to revive mining and steel processing operations, according to a due diligence report submitted to Government in November 2021.

The contract, ZIDA described as “too rich” would be for three years, after which ZISCO may choose to extend or assume full responsibility of operations. It is targeting to reach annual output of one million tonnes of steel in three years from the date of signing the contracts.

The Cabinet selected Kuvimba among three shortlisted potential investors, paving way for negotiations and signing of binding agreements.

Industry and Commerce Minister Dr Sekai Nzenza said negotiations for binding contracts would commence soon.

Kuvimba proposed a management fee of 8 percent but ZIDA, which conducted a due diligence on ZISCO’s potential investors, said a flat management fee “seems loosely structured and may be lopsided” to the advantage of Kuvimba.

Kuvimba owns various mining assets in Zimbabwe including gold, platinum, nickel and chrome.

Eight percent management appears too rich, there is need for revenue split to be equitable. We would…propose that the management fees be structured differently,” ZIDA said.

“A lower base management fee of say 5 percent plus an incentive above an agreed IRR hurdle of say 15 percent would align parties’ interests.

“We are happy to elaborate and debate this matter,” said ZIDA in its November 22 due diligence report.

ZISCO stopped operations in 2008 due to mismanagement and lack of funding to retool.

Since then, the Government engaged various potential investors in a bid to re-open the company but with limited success. Kuvimba won the tender ahead of other two final bidders who had expressed interest in ZISCO, which used to employ 5 000 people.

However, ZIDA said Kuvimba was already involved in mining in the country and expert knowledge in the extractive sector, giving an edge over other potential bidder. ZIDA said

Kuvimba has managed to revive distressed companies such as Shamva Gold Mine, Freda Rebecca, Sandawana and Jena.

“Funding will be through debt and quasi-equity facility,” said ZIDA, adding Kuvimba “has existing relationships with funders and mobilization will be easier.” Who else was in the race

PAI International, incorporated in England and Wales submitted its unaudited financial results for the period ended 30 November 2020, showing an asset base of 27 000 pounds.

It proposed to partner with AEEPL, Anglo American, CMS, Blue International and other local firms. Anglo American would undertake mining operations with AEEPL being a technical partner for steel manufacturing. PAI and its partners would work with the ZISCO and take joint decisions on the revival of the company.

PAI had also proposed share ownership and options schemes to incentivise workers.

In addition, it had proposed technical partners to be off takers of the steel products, so share agreements would be part of the strategy of financing the operations.

Further, it proposed to attract financing through an Initial Public Offering on the Johannesburg Stock Exchange, where it hoped to attract enough financial resources to further develop the company’s operations.

ZIDA recommended that PAI was a small company, which was established in 2019 and had not been involved in any mining venture.

On its proposal to extinguish the debt, through offering shares to the public in a new stock issuance, ZIDA noted that PAI did not guarantee that the company would garner positive attention since companies that offer IPO lacked a proven record of operating publicly.

Epikaizo and Sebeuzani

Epikaizo and Sebeuzani submitted a joint proposal where the former would mobilise funds from the United States in the form of US Treasury bonds to the tune of US$3 billion while the later would coordinate technical partners for the project.

The directors for the joint venture company are Engineers M Chivaura and T Revanewako, who once worked for ZISCO, and Dr R Chamba.

The joint venture indicated it would mobilise US$3 billion through US Treasury bonds upon submission of an evaluation report on ZISCO.

The company sought to determine the value of ZISCO assets from a valuation exercise and geological reports to raise capital.

If the outcome was favourable, it would engage technical partners with expertise in mining and steel production.

Government shareholding would be negotiated, taking into consideration the equity brought by other parties to the project.

Its technical partner in the bid was SMS Group, a Germany family-owned business established in 1817 and has branches in 90 countries including in South Africa.

SMS has more than 100 years of experience in ferrous and nonferrous plant technology.

The resuscitation strategy sought to do away with blast furnace operations and introduce new ultra-low-cost technologies which eliminate the expensive and highly polluting coke making processes for use of coking coal.

Epikaizo would also seek to invest in a 600MW power plant using environmentally compatible coal technologies and incorporate new mineral beneficiation processes.

In its recommendation, Epikaizo-Sebeuzani joint bid has failed to satisfactorily explain its investment of US$3 billion.