Multi-listed, gold-focused miner Caledonia Mining Corporation Plc has confirmed that the enacted Zimbabwe Finance Act of 2025 has formally cemented a favourable revision to the gold royalty regime, providing critical fiscal certainty for its flagship US$484 million Bilboes Gold Project, Mining Zimbabwe can report.

By Rudairo Mapuranga

The new law confirms the withdrawal of earlier, more punitive budget proposals that had threatened the project’s economics.

The key change, now signed into law, is the structure of a sliding-scale royalty for large-scale miners. The 10% top rate will now only apply when the gold price exceeds US$5,000 per ounce, a threshold far above current and historical market levels. This marks a significant retreat from the original 2026 budget statement in late November, which proposed the 10% rate kicking in at a price of just US$2,501 per ounce.

In its announcement, Caledonia stated that “no amendments are therefore required” to the Bilboes Project’s Technical Report Summary, which was published on November 25, 2025. This confirms that the project’s financial model and projected returns remain intact under the new fiscal terms.

“The enacted provisions confirm the position outlined in the announcement of December 19, 2025,” Caledonia stated. “Specifically, the higher royalty rate of 10% will only apply if the gold price exceeds US$5,000 per ounce, and the other proposed changes to the tax and royalty regime that were highlighted in the announcement of December 1, 2025 have been withdrawn.”

This finality removes a major investment risk that had clouded the project since the initial budget announcement.

The government’s policy shift is a direct result of concerted advocacy from the mining industry. The original proposal triggered immediate warnings from the Chamber of Mines and the Zimbabwe Miners Federation (ZMF), who argued it would render large-scale projects marginal and deter future investment.

By raising the 10% threshold to US$5,000—a price gold has never reached—the government has effectively created a royalty system that provides revenue upside only in an extreme bullion scenario, while maintaining a competitive base for investment. The 5% rate for prices between US$1,200 and US$5,000 aligns with regional norms and ensures project viability.

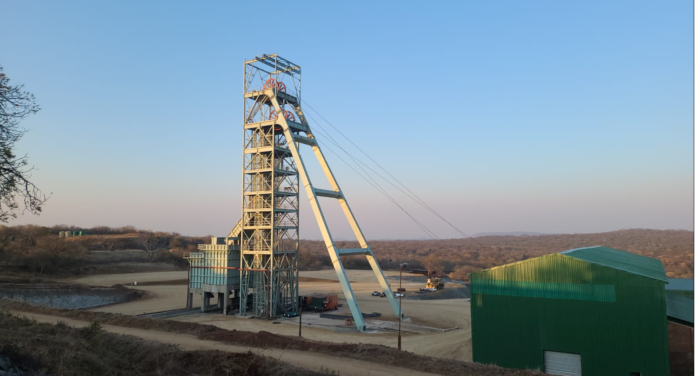

For Bilboes, a project designed to produce over 170,000 ounces of gold annually, the difference between a 10% royalty at US$2,500/oz and at US$5,000/oz is profound. It preserves the projected cash flows that underpin the project’s half-billion-dollar valuation and its potential to become one of Zimbabwe’s largest gold mines.

The swift government response to industry feedback and its decision to enact the more moderate regime is being viewed as a positive signal to foreign investors. It demonstrates a pragmatic approach to resource nationalism, seeking to balance fiscal needs with the capital-intensive nature of major mining projects.

With the fiscal framework now settled, Caledonia can accelerate its funding and development plans for Bilboes, moving the project closer to a construction decision. The project represents one of the single largest potential investments in Zimbabwe’s mining sector and is a cornerstone of the government’s ambition to grow gold output to 100 tonnes annually.

The resolution underscores a fundamental principle in resource economics: stability and competitiveness in fiscal policy are paramount to unlocking long-term, capital-intensive investments that ultimately deliver greater and more sustainable value to both shareholders and the nation.